FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

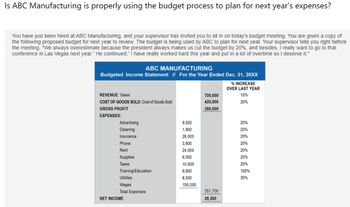

Transcribed Image Text:Is ABC Manufacturing is properly using the budget process to plan for next year's expenses?

You have just been hired at ABC Manufacturing, and your supervisor has invited you to sit in on today's budget meeting. You are given a copy of

the following proposed budget for next year to review. The budget is being used by ABC to plan for next year. Your supervisor tells you right before

the meeting, "We always overestimate because the president always makes us cut the budget by 20%, and besides, I really want to go to that

conference in Las Vegas next year." He continued," I have really worked hard this year and put in a lot of overtime so I deserve it."

ABC MANUFACTURING

Budgeted Income Statement // For the Year Ended Dec. 31, 20XX

REVENUE: Sales

COST OF GOODS SOLD: Cost of Goods Sold

GROSS PROFIT

EXPENSES:

Advertising

Cleaning

Insurance

Phone

Rent

Supplies

Taxes

Training/Education

Utilities

Wages

Total Expenses

NET INCOME

9,500

1,800

28,000

3,600

24,000

6,500

10,000

9,800

8,500

150,000

700,000

420,000

280,000

251,700

28,300

% INCREASE

OVER LAST YEAR

15%

20%

20%

20%

20%

20%

20%

20%

20%

100%

35%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- arrow_forward Question .(iii) To help achieve the budgeted sales for the year, Sampson is about to introduce bonuses for itssales staff. The bonuses will be an increasing percentage of the gross sales made, by eachsalesperson, above certain monthly targets.(iv) The company is using a new general ledger software package. The financial controller is impressedwith the new system, because management accounts are easily produced and allow detailedcomparisons with budgets and prior-period figures across product lines and geographical areas.The conversion to the new system occurred with a minimum of fuss. As it is a popular computerpackage, it required only minor modifications.(v) As part of the conversion, the position of systems administrator was created. This position isresponsible for all systems maintenance, including data backups and modifications. These taskswere the responsibility of the accountant.Required:For each of the scenarios above, explain how the components of…arrow_forwardYou recently began a job as an accounting intern at Rockwall Adventures. Your first task was to help prepare the cash budget for February and March. Unfortunately, the computer with the budget file crashed, and you did not have a backup or even a hard copy. You ran a program to salvage bits of data from the budget file. After entering the following data in the budget, you may have just enough information to reconstruct the budget. Rockwall Adventures eliminates any cash deficiency by borrowing the exact amount needed from State Street Bank, where the current interest rate is 6%. Rockwall Adventures pays interest on its outstanding debt at the end of each month. The company also repays all borrowed amounts at the end of the month as cash becomes available. Requirement: Complete the following cash budget:arrow_forwardDuring lunch, the director of the Streets and Parkways Department of the city Torrance made the following comment: “For the past 10 years, I have deliberately overstated my labor and equipment needs by 20 percent when preparing my budget request. I figure that the city council will cut it by 10 percent, and I can use the other 10 percent as slack. If there is money left over, I can always find a way to spend it.” Do you consider this behavior to be ethical? If not, what steps might you, as budget director, take to cut down on this “padding”?arrow_forward

- Prepare a 12-month Master Budget for a company of your choosing. It can be a company that you are closely connect too or one randomly selected. COMPLETED IN EXCEL. As you are preparing the Master Budget, some information is NOT provided. You are required to decide or predict or forecast this information. Provide an introduction for the company you have chosen. The introduction should include the following: Name of company Location of company Name of owner Nature of the business. Type of product Fiscal period For the company that you have selected - Prepare a 12-month Master Budget. Your submission must show each month’s activities. Here are some considerations to include in preparing the budget: You must forecast your sales, purchases, direct labour and manufacturing overhead for each month and any other information as required All sales are on accounts Expected collections are to be 50% in the month of the sale, 30 % in the first month following the sale, and 20% in the second…arrow_forwardBank Assistant Printers, Inc., produces luxury checkbooks with three checks and stubs per page. Each checkbook is designed for an individual customer and is ordered through the customer's bank. The company's operating budget for September 2020 included these data: LOADING... (Click the icon to view the operating budget and actual results.) The executive vice president of the company observed that the operating income for September was much lower than anticipated, despite a higher-than-budgeted selling price and a lower-than-budgeted variable cost per unit. As the company's management accountant, you have been asked to provide explanations for the disappointing September results. Bank Assistant develops its flexible budget on the basis of budgeted per-output-unit revenue and per-output-unit variable costs without detailed analysis of budgeted inputs. The budgeted amounts for September 2020 were: Number of checkbooks 20,000 Selling price per book $25…arrow_forwardYou have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below. The company sells many styles of earrings, but all are sold for the same price—$16 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings): January (actual) 21,200 June (budget) 51,200 February (actual) 27,200 July (budget) 31,200 March (actual) 41,200 August (budget) 29,200 April (budget) 66,200 September (budget) 26,200 May (budget)…arrow_forward

- As a consultant to President James Davis at Red Lake State University, you are assigned to assist in performing a 5% across–the-board cut to reduce the budget deficit. He asks you to write a paragraph narrative as to why a budget cut should be implemented. Please prepare your narrative with a clear justification that is supported with examples.arrow_forwardHappy Habanero Inc. has decided to purchase new capital equipment costing $540,000 cash in the next fiscal year. They also intend on selling their old equipment for $31,000 cash. Prepare the capital budget for Happy Habanero Inc. for their upcoming year-end (June 30, 2019). Do not enter dollar signs or commas in the input boxes. Use the negative sign for values that must be subtracted. Happy Habanero Inc. Capital Budget for year-ending June 30, 2019 Capital Expenditures $Answer Sale of Capital Assets $Answer Total Capital Expenditures $Answerarrow_forwardYou have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below. The company sells many styles of earrings, but all are sold for the same price—$17 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings): January (actual) 22,600 June (budget) 52,600 February (actual) 28,600 July (budget) 32,600 March (actual) 42,600 August (budget) 30,600 April (budget) 67,600 September (budget) 27,600 May (budget) 102,600 The concentration…arrow_forward

- At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: \table[[Cash balance, September 1 (from a summer job), $8, 430 At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: \table[[Cash balance, September 1 (from a summer job), $8,430arrow_forwardYou recently began a job as an accounting intern at Regis Adventures. Your first task was to help prepare the cash budget for February and March. Unfortunately, the computer with the budget ile crashed, and you did not have a backup or even a hard copy. You ran a program to salvage bits of data from the budget file. After entering the following data in the budget, you may have just enough information to reconstruct the budget. (Click the icon to view information on borrowing cash.) Requirements Complete the following cash budget. (For amounts with a $0 balance, make sure to enter "0" in the appropriate input field. Enter cash deficiencies with a minus sign or parentheses. Enter the net total effects of financing with a minus sign when the amount is a net outflow. Round interest expense to the nearest whole dollar.) Regis Adventures eliminates any cash deficiency by borrowing the exact amount needed from State Street Bank, where the current interest rate is 6%. Regis Adventures pays…arrow_forwardPlease do not give solution in image format ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education