EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

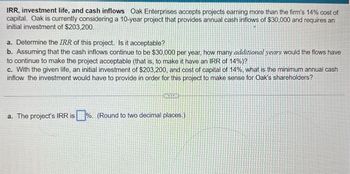

Transcribed Image Text:IRR, investment life, and cash inflows Oak Enterprises accepts projects earning more than the firm's 14% cost of

capital. Oak is currently considering a 10-year project that provides annual cash inflows of $30,000 and requires an

initial investment of $203,200.

a. Determine the IRR of this project. Is it acceptable?

b. Assuming that the cash inflows continue to be $30,000 per year, how many additional years would the flows have

to continue to make the project acceptable (that is, to make it have an IRR of 14%)?

c. With the given life, an initial investment of $203,200, and cost of capital of 14%, what is the minimum annual cash

inflow the investment would have to provide in order for this project to make sense for Oak's shareholders?

a. The project's IRR is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cash payback period for a service company Janes Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of 975,000 and each with a seven-year life and expected total net cash flows of 1,050,000. Location 1 is expected to provide equal annual net cash flows of 150,000, and Location 2 is expected to have the following unequal annual net cash flows: Determine the cash payback period for both location proposals.arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forwardYour company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forward

- Net present value method, internal rate of return method, and analysis for a service company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: The wind turbines require an investment of 887,600, while the biofuel equipment requires an investment of 911,100. No residual value is expected from either project. Instructions 1. Compute the following for each project: A. The net present value. Use a rate of 6% and the present value of an annuity table appearing in Exhibit 5 of this chapter. B. A present value index. (Round to two decimal places.) 2. Determine the internal rate of return for each project by (A) computing a present value factor for an annuity of 1 and (B) using the present value of an annuity of 1 table appearing in Exhibit 5 of this chapter. 3. What advantage does the internal rate of return method have over the net present value method in comparing projects?arrow_forwardBuena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forwardInternal rate of return A project is estimated to cost 463,565 and provide annual net cash flows of 115,000 for nine years. Determine the internal rate of return for this project, using the present value of an annuity table appearing in Exhibit 5 of this chapter.arrow_forward

- Gallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forwardCAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS Project S requires an initial outlay at t = 0 of 17,000, and its expected cash flows would be 5,000 per year for 5 years. Mutually exclusive Project L requires an initial outlay at t = 0 of 30,000, and its expected cash flows would be 8,750 per year for 5 years. If both projects have a WACC of 12%, which project would you recommend? Explain.arrow_forward

- Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardIf a copy center is considering the purchase of a new copy machine with an initial investment cost of $150,000 and the center expects an annual net cash flow of $20,000 per year, what is the payback period?arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning