FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ipunys supervisors and managers dur-

pany received an order on December 29 that was boxed and was sitting o

the ioading dock awaiting pick-up on December 31. The shipper picked up the

on January 1 and delivered them on January 6. The shipping terms were FOB ship-

g Foint. The goods had a selling price of $40.000 and a cost of $29,000. The goods

*ere not included in the count because they were sitting on the doCk.

uded in the count was $50,000 of goods that were parts for a machine that the

ny no longer made. Given the high-tech nature of Ryder's products, it wa

ikely that these obsolete parts had any other use. However, management would

Breier to keep them on the books at cost, "since that is what we paid for them, after all."

RN tions

*repare a schedule to determine the correct inventory amount. Provide explanations to

each item above, stating why you did or did not make an adjustment for eacn nem.

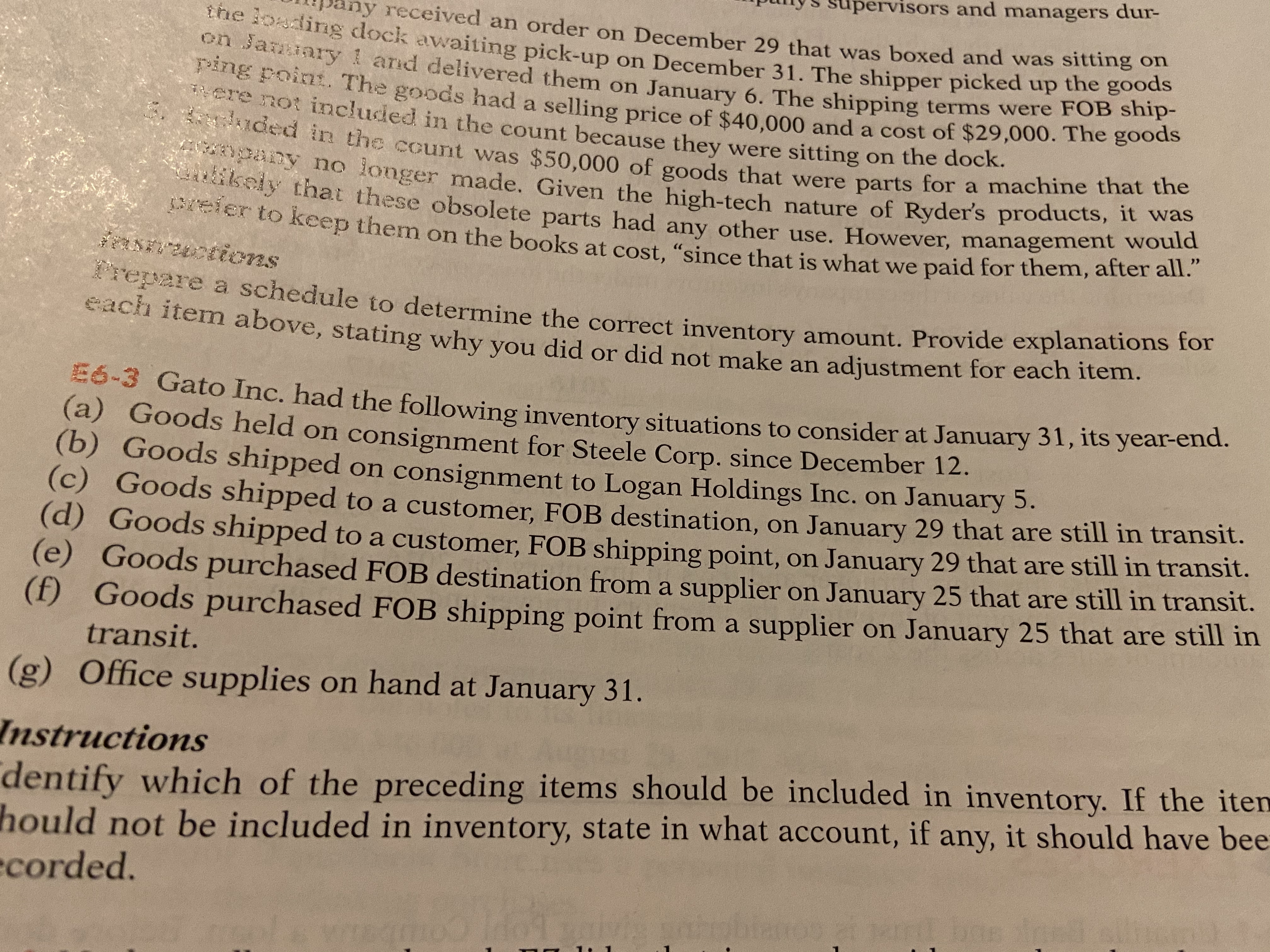

-3 Gato Inc. had the following inventory situations to consider at January 31, its year-end.

(a) Goods held on consignment for Steele Corp. since December 12.

(b) Goods shipped on consignment to Logan Holdings Inc. on January 5.

(c) Goods shipped to a customer, FOB destination, on January 29 that are still in transit.

(d) Goods shipped to a customer, FOB shipping point, on January 29 that are still in transit.

(e) Goods purchased FOB destination from a supplier on January 25 that are still in transit.

(f) Goods purchased FOB shipping point from a supplier on January 25 that are still in

transit.

(g) Office supplies on hand at January 31.

dentify which of the preceding items should be included in inventory. If the iten

hould not be included in inventory, state in what account, if any, it should have bee

ecorded.

Instructions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- assume the selling cost was 7000$ and it was shipping FOB shipping point. We received the goods on 2/30. Terms of the sale were 2/10. n/45. Shipping costs covered by the suppliers, were 500$. we chose to insure the goods while in transit for 80$. While in transit, the driver of the truck was issued a speeding ticket for $120. To unload the goods and get them out onto our sales floor cos an additional $200. We paid for the goods on 12/31. As of 12/31/2020. what is the value of this particular inventory on our balance sheet?arrow_forward8. On 12/30/20, Redding Corporation sold merchandise for $75,000 to Norbert Company. The terms of the sale were net 30, FOB shipping point. The merchandise was shipped on 12/31/20, and arrived at Norbert on 1/5/21. Because of a clerical error, Redding did not record the sale until 1/7/21, and the merchandise (before Redding's 25% markup on cost) was included in Redding's inventory at 12/31/20. As a result, Redding's net income for the year ended 12/31/20 was: a. Overstated by $75,000. b. Understated by $60,000. c. Understated by $15,000. d. Correctly stated; not impacted by inventory.arrow_forwardi have rows 1-24 filled out but don't know what to put for the remaining rows?arrow_forward

- This information relates to Swifty Corporation. 1. 2. 3. 4. 5. On April 5, purchased merchandise from Blue Spruce Inc. for $30,500, terms 2/10, n/30. On April 6, paid freight costs of $1,140 on merchandise purchased from Blue Spruce. On April 7, purchased equipment on account for $36,600. On April 8, returned some of April 5 merchandise to Blue Spruce that cost $4,900. On April 15, paid the amount due to Blue Spruce in full. Swifty uses a periodic inventory system. Prepare the journal entries to record the transactions listed above on the books of Swifty Corporation. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to the nearest whole dollar, e.g. 5,725. List all debit entries before credit entries.) Date Account Titles and Explanation Debit DOOT Creditarrow_forwardResgan Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Reagan's records are as follows: Inventory at Decenber 31 (based on a physical count of goods in Reagan's warchouse on December 31) $1,400,e0e Accounts payable at December 31: Vendor Baker Corpany Charlie Corpany Dolly Corpany Еagler Companу Full Company Amount $ 295,000 248, 000 Terms 28, 10 days, пet 38 Net 30 Net 30 330,eee Net 30 255, 0ee Net 30 Greg Company Net 30 Accounts payable, December 31 $1,120,000 Sales for the year $9,750,eee Additional Information: 1. Parts held by Reagan on consignment from Charlie, amounting to $230,000, were included in the physical count of goods in Reagan's warehouse and in accounts payable at December 31. 2 Parts totaling $37,000, which were purchased from Full and paid for in December, were sold in the last week of the year and appropriately recorded as sales of $43,000. The parts were included in the physical count of goods in Reagan's worehouse on…arrow_forwardInformation related to Splish Brothers Inc. is presented below. rch On April 5, purchased merchandise on account from Sheffield Company for $26,400, terms 4/10, net/30, FOB shipping point. On April 6, paid freight costs of $930 on merchandise purchased from Sheffield. On April 7, purchased equipment on account for $41,900. On April 8, returned damaged merchandise to Sheffield Company and was granted a $4,100 credit for returned merchandise. 5. On April 15, paid the amount due to Sheffield Company in full. 1. 2. 3. 4. Prepare the journal entries to record these transactions on the books of Splish Brothers Inc. under a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. 1. 2. Date Account Titles and Explanation norcal_archives_20....zip O i Ei W QCA 5.docx C ((( W response essay.docx Debit < 76°F_^ Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education