FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer within the format by providing formula the detailed working

Please provide answer in text (Without image)

Please provide answer in text (Without image)

Please provide answer in text (Without image)

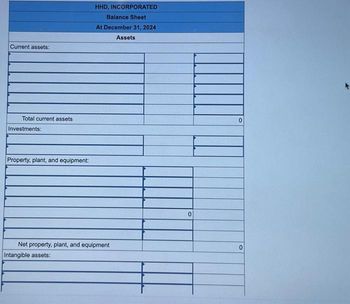

Transcribed Image Text:Current assets:

Total current assets

Investments:

Property, plant, and equipment:

HHD, INCORPORATED

Balance Sheet

At December 31, 2024

Assets

Net property, plant, and equipment

Intangible assets:

0

0

0

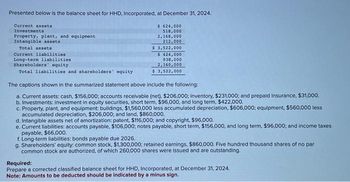

Transcribed Image Text:Presented below is the balance sheet for HHD, Incorporated, at December 31, 2024.

$ 624,000

518,000

2,168,000

212,000

Current assets

Investments

Property, plant, and equipment

Intangible assets

Total assets

Current liabilities

Long-term liabilities.

Shareholders' equity

Total liabilities and shareholders' equity

$ 3,522,000

$ 424,000

938,000

2,160,000

$ 3,522,000

The captions shown in the summarized statement above include the following:

a. Current assets: cash, $156,000; accounts receivable (net), $206,000; inventory, $231,000; and prepaid insurance, $31,000.

b. Investments: investment in equity securities, short term, $96,000, and long term, $422,000.

c. Property, plant, and equipment: buildings, $1,560,000 less accumulated depreciation, $606,000; equipment, $560,000 less

accumulated depreciation, $206,000; and land, $860,000.

d. Intangible assets net of amortization: patent, $116,000; and copyright, $96,000.

e. Current liabilities: accounts payable, $106,000; notes payable, short term, $156,000, and long term, $96,000; and income taxes

payable, $66,000.

f. Long-term liabilities: bonds payable due 2026.

g. Shareholders' equity: common stock, $1,300,000; retained earnings, $860,000. Five hundred thousand shares of no par

common stock are authorized, of which 260,000 shares were issued and are outstanding.

Required:

Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024.

Note: Amounts to be deducted should be indicated by a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Fill out the missing columns and show the calculation and formulasarrow_forwardWill you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardWhat information is provided by this statement? Describe the steps to create the statement - choose either the direct or indirect method in your response.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education