FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The answer is not $158,425.

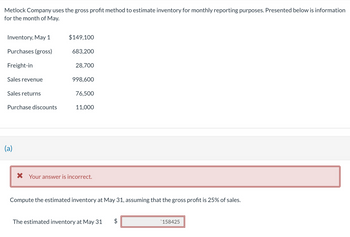

Transcribed Image Text:Metlock Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information

for the month of May.

Inventory, May 1

Purchases (gross)

Freight-in

Sales revenue

Sales returns

Purchase discounts

(a)

$149,100

683,200

28,700

998,600

76,500

11,000

* Your answer is incorrect.

Compute the estimated inventory at May 31, assuming that the gross profit is 25% of sales.

The estimated inventory at May 31

tA

$

158425

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why wasn't the $1,400,000 sale by samba to pamba subtracted from the net income of Pamba in 2018?arrow_forwardAn individual is a head of household. What is her standard deduction? a.$18,350 b.$24,800 c.$12,400 d.$18,650 e.None of these choices are correct.arrow_forwardRequired information Problem 8-64 (LO 8-3) (Static) [The following information applies to the questions displayed below.] Brooke, a single taxpayer, works for Company A for all of 2023, earning a salary of $50,000. Note: Round your intermediate and final answers to the nearest whole dollar amount. Problem 8-64 Part b (Static) b. Assume Brooke works for Company A for half of 2023, earning $75,000 in salary, and she works for Company B for the second half of 2023, earning $125,000 in salary. What is Brooke's FICA tax obligation for the year? FICA tax obligationarrow_forward

- H5.arrow_forwardFor 2020, Garden Corporation has 800.000 of gross profit from its sales and $410,000 of operating expenses. Garden makes $90,000 of cash charitable contributions during 2020 Inot inchuded in the other amounts). How much of these contributions can it deduct for 2020? (Note that this is for 2020, ie, 25%) O $75.000 O $97.500 $22.500 O $90.000arrow_forwardCould you please recalculate the gross profit for 2025, 2026, and 2027? 2025 amount of 228,000 is incorrect. 2026 amount of 186,920 is incorrect. 2027 amount of 142,080 is incorrect. Thank you.arrow_forward

- Assume that Helene E, who pays 35 percent in income taxes, plans to contribute $2,625,000 to not-for-profit Ravenswood Community Hospital. Without the contribution, his tax bill would be $7.500,000. What would be the tax bill if the contribution is made? Just enter a number, 5 instend of $5; the system will consider $5 as an alphanumeric entry and will consider it 0 which could result in a wrong answer if the answer is not 0.arrow_forward1. Which of the following must be included in the gross income of the recipient in 2021? a.Unemployment compensation b.Child support payments c.Welfare payments d.Gifts e.All of these choices are included in gross income. 2. All of the following must be included in gross income, except: a.Gambling winnings b.Jury duty fees c.Dividends d.Gifts e.Partnership income 3. All of the following amounts are excluded from gross income, except: a.Gifts b.Veterans' benefits c.Tips and gratuities d.Child support payments e.Scholarship grants for tuitionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education