ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need all three MCQ answer . I will give you thumbs up please solve ASAP. Thank you

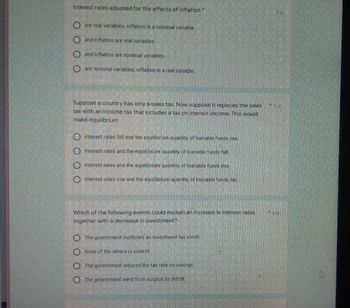

Transcribed Image Text:Interest rates adjusted for the effects of inflation

are real variables, inflation is a nominal variable.

and inflation are real variables.

and inflation are nominal variables

are nominal variables, inflation is a real variable.

Suppose a country has only a sales tax. Now suppose it replaces the sales

tax with an income tax that includes a tax on interest income. This would

make equilibrium

Interest rates fall and the equilibrium quantity of loanable Funds rise.

interest rates and the equilibrium quantity of loanable funds fall.

interest rates and the equilibrium quantity of loanable funds rise.

interest rates rise and the equilibrium quantity of loanable funds fall

Which of the following events could explain an increase in interest rates

together with a decrease in investment?

The government instituted an investment tax credit.

None of the others is correct

The government reduced the tax rate on savings.

The government went from surplus to deficit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please don't use excel and show equations used.arrow_forwardPlease see attachment and type out step by step the correct answer within 40 minutes , n give explanation of each option given below . Will give thumbs up only for the correct answer. Thank youarrow_forwardPlease see attachment and type out the correct answer ASAP with proper explanation of it. Answer neatly. Will give you thumbs up only for the correct answer ASAP. Thank youarrow_forward

- can you solve it with formulas?please make your text readable.arrow_forwardSo what really happens if we don't raise the debit limit? Hmmmm? Good question we have never not done that before... Verbatum question formulated by Eric Kortenhoven. Comment on the question then reply to a fellow student this will be an extra credit and points can be used wherever you would like just let me know where to apply themarrow_forwardAutomobile repair shops typically recommend that their customers change their oil and oll filter every 4.500 miles. Your automobile user's manual suggests changing your oil every 6,500-8,000 miles. If you drive your car 87,750 miles each year and an oil and filter change costs S34, how much money would you save each year if you had this service performed every 6.500 miles? Your savings will be $ per year. (Round to the nearest cent.Y Enter your answer in the answer boxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education