ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

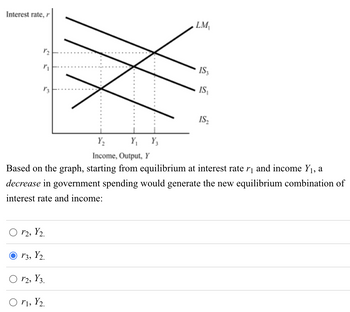

Transcribed Image Text:Interest rate, r

1₂

P₁

13

r2, Y₂.

Y₁ Y3

V3, Y₂.

r2, Y3.

r1, Y₂.

LM₁

Y₂2

Income, Output, Y

Based on the graph, starting from equilibrium at interest rate r₁ and income Y₁, a

decrease in government spending would generate the new equilibrium combination of

interest rate and income:

IS₂

IS₁

IS₂

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider an economy with the following situation: C = 50 +0.8 Yd I=100;T= 100 G =150 a. To eliminate the gap, the government decides to change its expenditure G. By how much should G change? Show that income AE or Ye is now 900 after the change in G. b. If the government decides to adopt balanced budget spending, by how much G and T will change to reach full employment output or income?arrow_forwardFigure 8-24. The figure represents the relationship between the size of a tax and the tax revenue raised by that tax. 9 Tax Revenue a∞rontm ~ - X 8 7 6 5 4 3 2 1 A B Refer to Figure 8-24. Tax revenue would [I B. All of the above are correct. A. decrease if the economy began at point C and then the tax rate was increased. Answer Key:B Tax Size OC. decrease if the economy began at point B and then the tax rate was decreased. D. increase if the economy began at point F and then the tax rate was decreased.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- please answer all thanks !arrow_forwardQuestion 5/ 25 If government spending decreased by $500. Given that c= 100+0.75y and the initial income is S5000, the new equilibrium income is: 1. O$7000 2. Os1600 3. O$3000 4. Os6600arrow_forwardAggregate expenditure (billions of 2007 dollars) 375 347 150 100 10 0 100 200 45° line AE C 300 375 Real GDP (billions of 2007 dollars) 6. Using the graph above, assume there are no taxes in this economy. Answer the following questions: a. MPC = b. MPM = C. MP to Spend = =Z= d. AE Function = e. Multiplier = f. Equilibrium level of Real GDP isarrow_forward

- A5arrow_forwardConsider the economy of Citronia, where citizens consume only oranges. Assume that oranges are priced at $1 each. The government has devised the following tax plans: Plan A • Consumption up to 1,000 oranges is taxed at 5%. • Consumption higher than 1,000 oranges is taxed at 50%. . Use the Plan A and Plan B tax schemes to complete the following table by deriving the marginal and average tax rates under each tax plan at the consumption levels of 500 oranges, 1,800 oranges, and 3,000 oranges, respectively. Consumption Level (Quantity of oranges) 88°F Sunny 500 1,800 3,000 F2 @ 2 Marginal Tax Rate (Percent) Complete the following table by indicating whether each plan is a progressive tax system, a proportional tax system, or a regressive tax system. F3 70 Q+ Plan A # 3 F4 Average Tax Rate (Percent) Plan B • Consumption up to 2,000 oranges is taxed at 45%. • Consumption higher than 2,000 oranges is taxed at 15%. $ 4 F5 Plan B Marginal Tax Rate (Percent) % 5 F6 F7 Average Tax Rate (Percent)…arrow_forwardproblems 2, 3, and 4 pleasearrow_forward

- 3arrow_forward29. Given this model, what is the equilibrium level of income?arrow_forwardConsider an economy that is described by the following: C = 500 + 0.75Yd I = 100 G = 100 T = 100 a. Derive the equilibrium level of income b. Derive the effects of a PhP 10 increase in government spending on equilibrium income c. Derive the effects of a PhP 10 increase in income taxes on equilibrium income.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education