ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Typed plz and Asap thanks

You are giving me my answer 3 to 4 hours I need it asap thanks

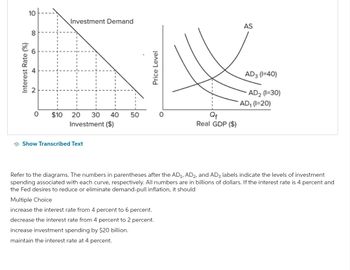

Transcribed Image Text:10

8

09

Interest Rate (%)

0

$10

Investment Demand

20 30 40 50

Investment ($)

Show Transcribed Text

Price Level

Multiple Choice

increase the interest rate from 4 percent to 6 percent.

decrease the interest rate from 4 percent to 2 percent.

increase investment spending by $20 billion.

maintain the interest rate at 4 percent.

0

Qf

Real GDP ($)

AS

AD3 (1=40)

AD₂ (1=30)

Refer to the diagrams. The numbers in parentheses after the AD₁, AD2, and AD3 labels indicate the levels of investment

spending associated with each curve, respectively. All numbers are in billions of dollars. If the interest rate is 4 percent and

the Fed desires to reduce or eliminate demand-pull inflation, it should

AD₁ (1=20)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Typed plz and Asap Please give me a quality solution thanksarrow_forwardDon’t do question 9, just look at the info and chart on question 9 and apply it to question 10 in the next image.arrow_forwardFill in the table below, giving a numerical value for letters A, B, C, and D. TC AFC AVC 50 1 90 A B D 30 2.arrow_forward

- I cannot read the hand writing can someone tyoe this out for mr please ?arrow_forwardWhat cultural aspects (language, religion, customs) a company must have in the area of technologyarrow_forwardQuestion 32 Which points represent a production level that could lead to unemployment? 12 10 Thousands of sedans 8 9 4 A 2 D B C 0- 0 2 4 6 8 10 12 Thousands of convertibles Full text description Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. Q Searcharrow_forward

- What benefits are their in operating a business to consumer online business model for consumers and the owner?arrow_forwardTyped plzzarrow_forwardImagine you are the mayor of a town and you are trying to decide if you should pay for a fireworks show. Your staff survey your 400 citizens who say that they each value a fireworks show at $10. The fireworks show only costs $3,000 so you put on the show but when you ask for donations to pay for the fireworks you only receive $25 total. What does this result show? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. You staff's survey must have overestimated the value of a fireworks show. b The fireworks cost must have been greater than their economic benefit. The firework show suffered from the Tragedy of the Commons problems d The town's citizens were free-riders.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education