ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

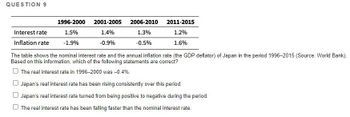

Transcribed Image Text:QUESTION 9

Interest rate

Inflation rate

1996-2000 2001-2005

1.5%

1.4%

-1.9%

-0.9%

2006-2010

1.3%

-0.5%

2011-2015

1.2%

1.6%

The table shows the nominal interest rate and the annual inflation rate (the GDP deflator) of Japan in the period 1996-2015 (Source: World Bank).

Based on this information, which of the following statements are correct?

The real interest rate in 1996-2000 was -0.4%.

Japan's real interest rate has been rising consistently over this period.

Japan's real interest rate turned from being positive to negative during the period.

The real interest rate has been falling faster than the nominal interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- This table indicates the historical level of the Consumer Price Index (CPI) for the United States for 1921, 1922, and 1923. Complete the table by (1) selecting the inflation rates for 1922 and 1923, and (2) indicating for each year whether there has been inflation, deflation, or hyperinflation. Year CPI Inflation Rate Change in Price Level 1921 17.9 — — 1922 16.8 1923 17.1 What rates of inflation for 1924 would be consistent with disinflation between 1923 and 1924? Check all that apply. 1.7% 11.8% 51.8% 1.8% What rates of inflation for 1924 would be consistent with hyperinflation? Check all that apply. 15.0% -1.8% 100.0% 120.0%arrow_forwardInflation in Mexico (using the CPI method) rose from 4.01% in August 2020 to 4.09% in October 2020. By how many percentage points should real interest rates have changed over the same period, assuming that nominal interest rates have remained fixed during this time? (Round your answer to twodecimal places. If real interest rates fell, be sure to include a negative sign. Do not include a percentage sign.)arrow_forwardThe following table shows a person's nominal and real wages for three years, as well as the price level (price index) for each year, using the first year as the base year. Fill in the blanks in the table. Then calculate the annual inflation rate for each year (not including the base year). Instructions: Round your answers to 2 decimal places. Nominal Wage ($) Real Wage ($) Inflation Rate (%) Year Price Level 1 7.00 140 5.00 2. 9.00 7.00 150.00 3 11 160.00 7.50arrow_forward

- because most businesses do not experience inflation as reflected by the market basket used to measure the CPI, a different index is used for provider of goods and services. which price index generally provides a better measurement of the inflation effects for particular business or for the purchase of particular equipment than the CPI? A) Business B) distributor C) manufacturer D) producer E) provider F) purchaser G) retail H) seller I) supplier J) vendor K) none of thesearrow_forwardSuppose, in the base year, a typical market basket purchased by an urban family costs $250. In Year 1, the same market basket cost $950. What is the consumer price index (CPI) for Year 1? If the same market basket costs $1000 in Year 2, what is the CPI for Year 2? What was the Year 2 rate of inflation?arrow_forwardUse the information in the table to calculate the %change in prices (inflation rate), using a chain-weighted methodology. Q1=2 Q2=3 Year (t) P1 E1 P2 E2 E(t) 2017 $1.05 $2.00 2018 $1.10 $2.10 2019 $1.10 $2.15 2020 $1.15 $2.15 Price Index Inflation Rate 2017 2018 2019 2020 Question 1: What is the inflation rate for 2019? a) 1.76% b) 1.16% c) -0.60% d) -3.02arrow_forward

- Two countries, Country N in North America and Country S in South America, have the same CPI basket. Year 2000 is the CPI base year for both countries. In that year, the cost of CPI basket in Country N is $N100, and in country S is $s1000, where $N and $s are their respective currencies. Twenty years later, in 2020, the CPI in Country N rose to 240, and in Country S to 360. a) In the ideal world in which the purchasing power parity (PPP) holds true, what should be the nominal exchange between $s and $N in Year 2000 and in Year 2020. Show calculations and explain the change in nominal exchange rate. b) Suppose in reality, the nominal exchange rage between the two currencies is 18 $s per $N in Year 2020. First, explain why the nominal exchange rate differs from your calculation above. Second, calculate the real exchange rate between the two countries, and explain the meaning of your calculated result. c) During Year 2021, the growth of the real GDP in the two countries are, 0% in country…arrow_forwardAssume that this economy produces only two goods Good X and Good Y. If year 2 is the base year, the value for this economy's GDP deflator in year 3 is: A- = 120 B- = 123 C- = 135 D- = 140 Assume that this economy produces only two goods Good X and Good Y. If year 2 is the base year, the value for this economy's inflation rate between year 2 and year 3 is: A- = 1,8 ./. B- = 1,2./. C- = 1,65 ./. D- =2./.arrow_forwardThe following table shows the average nominal interest rates on six-month Treasury bills between 2014 and 2018, which determined the nominal interest rate that the U.S. government paid when it issued debt in those years. The table also shows the inflation rate for the years 2014 to 2018. (All rates are rounded to the nearest tenth of a percent.) Year Nominal Interest Rate Inflation Rate (Percent) (Percent) 2014 0.1 1. 6 2015 0.2 0.1 2016 0.5 1.3 2017 1.1 2.1 2018 2.1 2.4 On the following graph, use the orange points (square symbol) to plot the nominal interest rates for the years 2014 to 2018. Next, use the green points (triangle symbol) to plot the real interest rates for those years. According to the table, in which year did buyers of six-month Treasury…arrow_forward

- Here are some recent data on the US consumer price index: Year CPI Year CPI Year CPI 2016 240.0 2011 224.9 2006 201.6 2015 237.0 2010 218.1 2005 195.3 2014 236.7 2009 214.5 2004 188.9 2013 233.0 2008 215.3 2003 184.0 2012 229.6 2007 207.3 2002 179.9 Compute the inflation rate of each year 2003-2016 and determine which were years of inflation. In which years did deflation occur? In which years did disinflation occur? Was there hyperinflation in any year?arrow_forwardNonearrow_forwardQuestion 1: In an economy, there are only two goods (Cars and cycles) produced. The data for last three years is given in the below table. Calculate the nominal and real GDP of three years and then find the GDP deflator for all the three years. Find year on year (YoY) inflation for 2018 and 2019. Note: the base year for this economy is given as 2017. year Price of Car (AED) Number of Car Price of cycle (AED) Number of cycle 2017 1000 10 200 900 2018 1200 15 210 1000 2019 1500 25 250 1500 Question 2: Explain the role of fiscal and monetary policy in an economy facing a recession. Use appropriate graph to justify your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education