FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

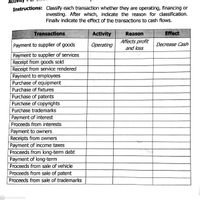

Transcribed Image Text:Instructions: Classify each transaction whether they are operating, financing or

investing. After which, indicate the reason for classification.

Finally indicate the effect of the transactions to cash flows.

Transactions

Activity

Reason

Effect

Affects profit

Payment to supplier of goods

Operating

Decrease Cash

and loss

Payment to supplier of services

Receipt from goods sold

Receipt from service rendered

Payment to employees

Purchase of equipment

Purchase of fixtures

Purchase of patents

Purchase of copyrights

Purchase trademarks

Payment of interest

Proceeds from interests

Payment to owners

Receipts from owners

Pay

Proceeds from long-term debt

ent of income taxes

Payment of long-term

Proceeds from sale of vehicle

Proceeds from sale of patent

Proceeds from sale of trademarks

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following has a different effect on net profit than it does on cashflow? A.Cash sale to customer B.Payment for wages C.Payment for rent D.Depreciation of equipmentarrow_forwardUnder the accrual basis of accounting - if cash has been received before the revenue has been earned, which of the following journal entries should be recorded? A) Debit Cash, Credit Unearned Revenue. B) Debit Cash, Credit Sales Revenue. C) Debit Unearned Revenue, Credit Cash. D) Debit Cash, Credit Accounts Receivable.arrow_forwardRecording cost of goods sold is a/an A. cash entry B. deferral entry C. accrual entry D. adjusting entry E. paid bill entryarrow_forward

- Which one of the following statements about revenue is not correct?A. Revenue can result in increases in accounts receivableB. Revenue can result in increases in liabilitiesC. Revenue is earned whenever cash is received from a customerD. Revenue is earned when a service is provided to a customerarrow_forwardFASB suggest that revenues are considered to be earned: a. at the point of sale b. throughout the earnings process c. when the company is entitled to its benefits d. when cash is receivedarrow_forwardA business provider services to a customer on credit.Which of the following is correct: A.Assets increase and liabilities decrease at the time the cash is collected B.Assets increase and liabilities increase at the time of the sale C.Assets increase and the owner's equity increases at the time the cash is collected D.Assets increase and the owner's equity increases at the time of the salearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education