FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

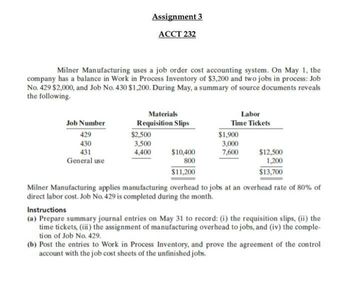

Transcribed Image Text:Milner Manufacturing uses a job order cost accounting system. On May 1, the

company has a balance in Work in Process Inventory of $3,200 and two jobs in process: Job

No. 429 $2,000, and Job No. 430 $1,200. During May, a summary of source documents reveals

the following.

Job Number

429

430

431

General use

Assignment 3

ACCT 232

Materials

Requisition Slips

$2,500

3,500

4,400

$10,400

800

$11,200

Labor

Time Tickets

$1,900

3,000

7,600

$12,500

1,200

$13,700

Milner Manufacturing applies manufacturing overhead to jobs at an overhead rate of 80% of

direct labor cost. Job No. 429 is completed during the month.

Instructions

(a) Prepare summary journal entries on May 31 to record: (i) the requisition slips, (ii) the

time tickets, (iii) the assignment of manufacturing overhead to jobs, and (iv) the comple-

tion of Job No. 429.

(b) Post the entries to Work in Process Inventory, and prove the agreement of the control

account with the job cost sheets of the unfinished jobs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the job cost related accounts for the law firm of Cullumber Associates and their manufacturing equivalents: Law Firm Accounts Supplies Salaries and Wages Payable Operating Overhead Service Contracts in Process Cost of Completed Service Contracts Cost data for the month of March follow. 1. Purchased supplies on account $2,400. 2. 3. 4. 5. 6. (a) 1. Journalize the transactions for March. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually) 2. No. Account Titles and Explanation 3. 5. Issued supplies $1,680 (60% direct and 40% indirect). Assigned labor costs based on time cards for the month which indicated labor costs of $89,600 (80% direct and 20% indirect). 6. Operating overhead costs incurred for cash totaled $51,200. Operating overhead is applied at a rate of 90% of direct labor cost. Work completed totaled $96,000. Supplies Accounts Payable Manufacturing Firm Accounts Raw…arrow_forwardEntry for Jobs Completed; Cost of Unfinished Jobs The following account appears in the ledger prior to recognizing the jobs completed in January: Work in Process Balance, January 1 $11,420 Direct materials 92,840 Direct labor 100,150 Factory overhead 52,650 Jobs finished during January are summarized as follows: Job 210 $46,270 Job 224 $53,980 Job 216 28,280 Job 230 97,680 a. Journalize the entry to record the jobs completed. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - b. Determine the cost of the unfinished jobs at January 31.$fill in the blank 14d786ff9fe8ffc_1arrow_forwardUse the following information to calculate the cost of goods manufactured during July. Work in process inventory, 1 July Manufacturing overhead applied during the month Work in process inventory, 31 July Finished goods inventory, 1 July Finished goods inventory, 31 July Cost of goods sold during July 9,000 20,000 14,000 7,500 5,000 75,000arrow_forward

- Michael Jones and Associates, a CPA firm, uses job order costing to capture the costs of its audit jobs. There were no audit jobs in process at the beginning of November. Listed below are data concerning the three audit jobs conducted during November. Direct materials Auditor labor costs Auditor hours Ivanhoe Inc. $700 $5,700 76 Oriole Inc. $440 $7,500 89 Pharoah Inc. $250 $4,475 49 Overhead costs are applied to jobs on the basis of auditor hours, and the predetermined overhead rate is $51 per auditor hour. The Ivanhoe Inc. job is the only incomplete job at the end of November. Actual overhead for the month was $12.900arrow_forwardEntry for Jobs Completed; Cost of Unfinished Jobs The following account appears in the ledger prior to recognizing the jobs completed in January: Work in Process Balance, January 1 Direct materials Direct labor Factory overhead Jobs finished during January are summarized as follows: Job 210 $69,290 Job 224 $80,830 42,340 Job 230 142,420 Job 216 a. Journalize the entry to record the jobs completed. If an amount box does not require an entry, leave it blank. Finished Goods Work in Process $17,100 139,020 149,970 78,830 Feedback LA Check My Work a. Move the cost of completed jobs out of work in process and into finished goods. b. Determine the cost of the unfinished jobs at January 31.arrow_forwardXYZ Company uses a job costing system. The direct materials for Job Y were purchased in September and put into production in October. The job was not completed by the end of October. At the end of October, in what account would the direct materials cost assigned to Job Y be located? Select one: O a Work-in-Process Inventory. Ob. None of the given is correct. ON Finished Goods Inventory. Od. Raw Materials Inventory. O e. Cost of Goods Sold.arrow_forward

- Jensen Fences uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company's Work in Process Inventory account for the month of June: Debits to account: Balance, June 1 Direct materials Direct labor Manufacturing overhead (applied to jobs as 125% of direct labor cost) Total debits to account Credits to account: Transferred to Finished Goods Inventory account Balance, June 30 Required: $ 5,000 18,000 12,100 15,125 $ 50,225 44,000 $ 6,225 a. Assuming that the direct labor charged to the jobs still in process at June 30 amounts to $1,500, compute the amount of manufacturing overhead and the amount of direct materials that have been charged to these jobs as of June 30. b. Prepare general journal entries to summarize: 1. The manufacturing costs (direct materials, direct labor, and overhead) charged to production during June. 2. The transfer of…arrow_forwardLouisiana Metals uses a job costing system. The company applies manufacturing overhead using a predetermined rate based on direct labor cost. The following debits (credits) appeared in the Work-in-Process Inventory for June. June 1 For the month For the month For the month For the month Balance Direct labor Direct materials Manufacturing overhead To finished goods Beginning inventory ??? $ 33,000 43, 200 19,800 (78,700) Job LM-12, the only job still in production at the end of June, has been charged $13,200 in direct materials cost and $12,400 in direct labor cost. Required: What was the beginning balance in Work-in-Process Inventory?arrow_forwardKurtz Fencing Inc. uses a job order cost system. The following data summarize the operations related to production for March, the first month of operations: a. Materials purchased on account, $28,790. b. Materials requisitioned and factory labor used: Job Materials Factory Labor 301 $2,880 $2,910 302 3,690 3,860 303 2,300 1,780 304 7,820 6,990 305 5,310 5,050 306 3,700 3,280 For general factory use 1,070 4,180 c. Factory overhead costs incurred on account, $5,600. d. Depreciation of machinery and equipment, $1,970. e. The factory overhead rate is $53 per machine hour. Machine hours used: Job Machine Hours 301 25 302 34 303 30 304 71 305 42 306 26 Total 228 f. Jobs completed: 301, 302, 303 and 305. g. Jobs were shipped and customers were billed as follows: Job 301, $8,270; Job 302, $11,720; Job 303, $15,730. Required: 1. Journalize the entries to record the summarized…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education