Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Use the

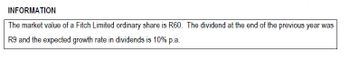

Transcribed Image Text:INFORMATION

The market value of a Fitch Limited ordinary share is R60. The dividend at the end of the previous year was

R9 and the expected growth rate in dividends is 10% p.a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information in the table below, 1.Calculate the Price Earnings Ratio for both stocks. Share Price Per Share Stock X ($) 25 Earnings Per Share 2.00 Stock Y ($) 20 0.67 2. Interpret the results obtained in part above, by highlighting the implications for a firm of having a low P/E or a high P/E.arrow_forwardExplain how to find the value of a stock given itslast dividend, its expected growth rate, and itsrequired rate of return.arrow_forward(b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.)Average of the two rounded ratios in (a) aboveAnswer (Round to two decimal places.) Using the rounded average calculation above, calculate the following:Intrinsic valuearrow_forward

- Suppose a stock had an initial price of $84 per share, paid a dividend of $1.50 per share during the year, and had an ending share price of $71.50. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardIn computing Earnings per share when there are preference shares, the total net income after tax is reduced by the dividend in arrears of cumulative preference shares. a. TRUE b. FALSEarrow_forwardWhen it comes to the market value of a company, is it true or not that it equals the number of outstanding shares multiplied by the most recent transaction price per share.arrow_forward

- Define Diluted Earnings Per Share.arrow_forwardToday's dividend yield for standard supply is computed by utilizing the formula C = A/S where A is the most recent annual dividend (in dollars) and S is the current share expense (in dollars). Encounter the function C's domain.arrow_forwardthe ratio of dividends per share to earnings per share is known as the dividends yield (T/F)arrow_forward

- What are three ways to estimate the expected dividend growthrate?arrow_forwardWhich of the following best describes the market capitalization of a company? Select one: a. it represents the total value of the company b. it is the product of the numbers of shares and the price per share c. it represents the total wealth associated with the company's earnings d. it is the most someone would pay for the stockarrow_forwardA company’s comparative statements are given below. Please conduct the following analyses: a. Horizontal analysis (trend analysis) on the income statement b. Vertical analysis (common size financial statement analysis) on the income statement Note: When the dollar change is positive, it indicates that the value increased and therefore the % change should be positive. Therefore, when calculating % change involving a negative baseline value, use the absolute value of the baseline number in the denominator: % change = (new value - original baseline value)/|baseline value|. Otherwise the % change will be inconsistent with the real change. For example:Let's say item A changed from -10 to +10. Item A increased by 20 and thus should give rise to a positive % change. However, % change based on formula using the original value of -10 is -200% = [10-(-10)]/(-10).Let’s look at another example. Assume item B changed from -10…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education