FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

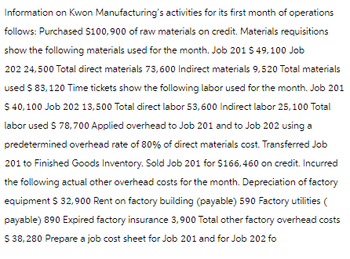

Transcribed Image Text:Information on Kwon Manufacturing's activities for its first month of operations

follows: Purchased $100,900 of raw materials on credit. Materials requisitions

show the following materials used for the month. Job 201 $ 49,100 Job

202 24,500 Total direct materials 73,600 Indirect materials 9,520 Total materials

used $ 83,120 Time tickets show the following labor used for the month. Job 201

$ 40,100 Job 202 13,500 Total direct labor 53,600 Indirect labor 25,100 Total

labor used $ 78,700 Applied overhead to Job 201 and to Job 202 using a

predetermined overhead rate of 80% of direct materials cost. Transferred Job

201 to Finished Goods Inventory. Sold Job 201 for $166,460 on credit. Incurred

the following actual other overhead costs for the month. Depreciation of factory

equipment $ 32,900 Rent on factory building (payable) 590 Factory utilities (

payable) 890 Expired factory insurance 3,900 Total other factory overhead costs

$ 38,280 Prepare a job cost sheet for Job 201 and for Job 202 fo

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Quite often, people may face situations that put them in an ethical conflict. The best way to cope with this is ________. Question 22 options: A) to develop a personal code of ethical conduct about what is right and wrong B) to use the "golden rule" C) to do what makes the largest number of people happy in the situation D) to do nothing and ignore the situation E) to act the same way you have seen others act in similar situationsarrow_forwardSome accountants argue that the receiving department should be eliminated. Discuss the objective of eliminating the receiving function. What accounting/audit problems need to be resolved.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education