FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

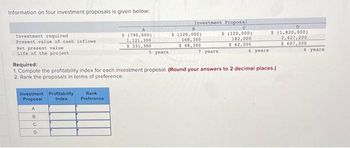

Transcribed Image Text:Information on four investment proposals is given below:

Investment required.

Present value of cash inflows

Net present value.

Life of the project

Investment Profitability.

Index

Proposal

A

8

C

D

A

$ (790,000)

1,121,300

$ 331,300

Rank

Preference

5 years

Required:

1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.)

2. Rank the proposals in terms of preference.

Investment Proposal

$ (120,000)

182,000

$ 62,000

B

$ (120,000)

168,300

$ 48,300

7 years

6 years

D

$ (1,820,000)

2,427,200

$ 607,200

6 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the MIRR statistic for Project I if the appropriate cost of capital is 12 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project I Time: 0 1 2 3 4 Cash flow: −$11,000 $5,330 $4,180 $1,520 $2,000 What is the MIRR %arrow_forwardInternal rate of return and modified Internal rate of return. Quark Industries has three potential projects, all with an initial cost of $2,200,000. Given the discount rate and the future cash flow of each project in the following table, what are the IRRs and MIRRs of the three projects for Quark Industries? What is the IRR for project M7 % (Round to two decimal places.) GITEarrow_forwardInformation on four investment proposals is given below: Investment required Present value of cash inflows Net present value Life of the project 4 Required: 1. Compute the project profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. Investment Proposal A BUD C Project Profitability Index Investment Proposal A D $(106,000) $(116,000) $(86,000) $(144,000) 142,040 178,640 118,680 213,120 $36,048 $ 62,640 $ 32,680 $ 69,120 5 years 7 years years 6 years Rank Preference:arrow_forward

- Moates Corporation has provided the following data concerning an investment project that it is considering: Initial investnent Annual cash flow Expected life of the project Discount rate $380,000 $124,000 per year 4 years 10% Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to: Multiple Cholce $12.956 $380,000 $/256,000) K 69°F Mostly cloudy A E W 10 re to search DELL 近 ...arrow_forwardiarrow_forwardCompute the IRR statistic for Project F. The appropriate cost of capital is 12 percent. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Project F Time: 0 Cash flow: -$ 11,000 1 $ 4,100 2 $ 4,930 3 4 $ 2,270 $ 2,900 IRR % Should the project be accepted or rejected? (Click to select) ✓arrow_forward

- A project has cash flows of –$148,000, $43,000, $87,000, and $51,500 for Years 0 to 3, respectively. The required rate of return is 11 percent. Based on the internal rate of return of Blank 1 percent for this project, you should Blank 2 the project. Enter your answer in the first blank as a percent rounded to 2 decimal places, e.g., 32.16. Also enter either "accept" or "reject" in the second blank.arrow_forward1.Assuming you are facing with making a decision on a large capital investment proposal. the capital investment amount is $ Estimated the study period is years .The annual revenue at the end of each year is $ and the estimated annual year-end expense is $ starting in year Assuming a market value at the end year is $ and the benchmark rate is 10%, please answer the following questions: 1.Please design this investment project to fill the proper number in blank space to let the project is feasible in economics( 2.To give the cash flow chart of the project(arrow_forwardInformation on four investment proposals is given below. Investment required Present value of cash inflows Net present value Life of the project Required: 1 Compute the profitability index for each investment proposal. Note: Round your answers to 2 decimal places. 2. Rank the proposals in terms of preference Investment Profitability Proposal Index A B C D S (150,000) 211,800 $61,500 Rank Preference 5 years Investment Proposal $(80,000) 110,400 $ 30,400 7 years $ (160,000) 241,600 $ 81,600 6 years D $ (910,000) 1.214,500 $ 304,500 6 yearsarrow_forward

- Find internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 9.35%. Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. A. 15.64% B. 14.90% C. 13.70% D. 14.75% E. 11.17%arrow_forwardThe management of Riker Inc. is exploring five different investment opportunities. Information on the five projects under study follow Project Number Investment required Present value of cash inflows at a 10% discount rate Net present value Life of the project Project 1 2 3 4 5 Profitability Index 1 2 3 $(390,000) $(330,000) $(350,000) 478,490 396,950 $ 88,490 $ 66,950 6 years 3 years First preference Second preference 433,190 $ (83,190) 5 years The company's required rate of return is 10%; thus, a 10% discount rate has been used in the preceding present value computations. Limited funds are available for investment, and so the company cannot accept all of the available projects. Third preference Fourth preference Fifth preference 4 $(330,000) Required: 1. Compute the profitability Index for each investment project. (Round your answers to 2 decimal places.) 300, 100 $ 29,900 12 years 5 $(480,000) 562,860 $82,860 6 years 2. Rank the five projects according to preference, in terms of (a)…arrow_forwardThe Michner Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow (I) Cash Flow (II) 0 -$ 76,000 -$ 34,000 1 29,000 11,000 23,500 17,500 2 3 36,000 42,000 a-1. If the required return is 12 percent, what is the profitability index for each project? Note: Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161. a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 12 percent, what is the NPV for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b-2. If the company applies the net present value decision rule, which project should it take? a-1. Project I a-2. Project II b-1. Project I b-2. Project IIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education