FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

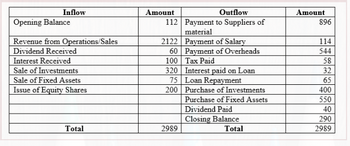

From the following cash summary for the year ended on 31st March, 2022, Prepare a

Transcribed Image Text:Inflow

Opening Balance

Revenue from Operations/Sales

Dividend Received

Interest Received

Sale of Investments

Sale of Fixed Assets

Issue of Equity Shares

Total

Outflow

112 Payment to Suppliers of

material

Amount

2122

60

100

Payment of Salary

Payment of Overheads

Tax Paid

Interest paid on Loan

Loan Repayment

200 Purchase of Investments

Purchase of Fixed Assets

320

75

2989

Dividend Paid

Closing Balance

Total

Amount

896

114

544

58

32

65

400

550

40

290

2989

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The term cash as used on the statement of cash flows includes all the following EXCEPT: A) cash due from customers within 30 days. B) cash on hand. C) cash equivalents. D) cash in bank 2. Which of the following statements accurately describes the statement of cash flows? A) It shows the relative proportion of debt and assets. B) It shows the link between accrual-based income and the cash reported on the balance sheet. C) It indicates when long-term debt will mature. D) It shows the link between book income and earnings per share. 3. Which of the following is NOT a true statement about the statement of cash flows? A) It shows where cash came from and how it was spent. B) It reports why cash increased or decreased. C) It covers a specific span of time the same as the income statement. D) It shows how the profits or losses of the company were generated. 4. . Which one of the following is a principal function of the statement of cash flows A) To predict future net income B) To…arrow_forwardWhich of the following statements provides a summary of cash receipts and cash payments for a specific period of time, such as a month or a year? O a. Balance sheet O b. Statement of cash flows O c. Income statement O d. Statement of stockholders' equityarrow_forwardSubject -account Please help me. Thankyou.arrow_forward

- 1. How much cash is received from sales to customers for year 2021? Assume all the sales were made on credit basis . 2. What is the net increase or decrease in the Cash account for year 2021?arrow_forwardWhat adjustment(s) should be made to reconcile net income to net cash flows from operating activities (indirect method) considering the following balances in current assets? For those boxes in which you must enter subtractive or negative numbers use a minus sign. Accounts receivable, beginning of year $23,000 Accounts receivable, end of year 29,000 Prepaid insurance, beginning of year 16,000 Prepaid insurance, end of year 13,000 Accounts Receivable $fill in the blank 1 Prepaid Insurance fill in the blank 2 Total $fill in the blank 3arrow_forwardFrontier Rare Coins (FRC) was formed on January 1, 2024. Additional data for the year follow: i (Click the icon to view the data.) Read the requirements. Requirement 1. What is the purpose of the statement of cash flows? The purpose of the statement of cash flows is to show where cash came from and how cash was spent during the period. Requirement 2. Prepare FRC's income statement for the year ended December 31, 2024. Use the single-step format, with all revenues listed together and all expenses listed together. Frontier Rare Coins Income Statement Year Ended December 31, 2024 Revenue: Expenses: Total Expenses Net Income More info (...) a. On January 1, 2024, FRC issued no par common stock for $550,000. b. Early in January, FRC made the following cash payments: 1. For store fixtures, $54,000 2. 3. For merchandise inventory, $240,000 For rent expense on a store building, $15,000 c. Later in the year, FRC purchased merchandise inventory on account for $242,000. Before year-end, FRC paid…arrow_forward

- Please answer correct ,, and provide answer in text formarrow_forwardWhen reporting cash on the balance sheet, companies: O A. combine cash and cash equivalents. B. show each bank account separately. C. combine cash with long - term investments. D. combine cash with accounts receivable.arrow_forwardPrepare a complete statement of cash flows using the indirect method for the current year. Note: Amounts to be deducted should be indicated with a minus sign. Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $ 667,500 Cost of goods sold 302,000 Gross profit 365,500 Operating expenses (excluding depreciation) $ 149,400 Depreciation expense 37,750 187,150 Other gains (losses) Loss on sale of equipment (22,125) Income before taxes 156,225 Income taxes expense 48,050 Net income $ 108,175 FORTEN COMPANY Comparative Balance Sheets December 31 Current Year…arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardFrom the attached image, which deferred revenue do we need to consider for calculations? I can see two of them one is current and the other one is net of the current portion.arrow_forwardUse the following information from Dubuque Company’s financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education