Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

FINANCE

PLEASE ANSWER C & D

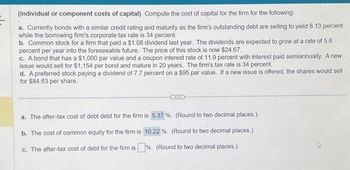

Transcribed Image Text:(Individual or component costs of capital) Compute the cost of capital for the firm for the following:

a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.13 percent

while the borrowing firm's corporate tax rate is 34 percent.

b. Common stock for a firm that paid a $1.08 dividend last year. The dividends are expected to grow at a rate of 5.6

percent per year into the foreseeable future. The price of this stock is now $24.67.

c. A bond that has a $1,000 par value and a coupon interest rate of 11.9 percent with interest paid semiannually. A new

issue would sell for $1,154 per bond and mature in 20 years. The firm's tax rate is 34 percent.

d. A preferred stock paying a dividend of 7.7 percent on a $95 par value. If a new issue is offered, the shares would sell

for $84.63 per share.

a. The after-tax cost of debt debt for the firm is 5.37 %. (Round to two decimal places.)

b. The cost of common equity for the firm is 10.22 %. (Round to two decimal places.)

c. The after-tax cost of debt for the firm is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forward(Individual or component costs of capital) Compute the cost of capital for the firm for the following a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.84 percent while the borrowing firm's corporate tax rate is 34 percent. b. Common stock for a firm that paid a $1.02 dividend last year. The dividends are expected to grow at a rate of 4 1 percent per year into the foreseeable future. The price of this stock is now $25 56, c. A bond that has a $1,000 par value and a coupon interest rate of 11.2 percent with interest paid semiannually. A new issue would sell for $1,151 per bond and mature in 20 years. The firm's tax rate is 34 percent d. A preferred stock paying a dividend of 7.7 percent on a $107 par value. If a new issue is offered, the shares would sell for $84 71 per share a. The after-tax cost of debt debit for the firm is (Round to two decimal places)arrow_forward(Individual or component costs of capital) Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.77 percent while the borrowing firm's corporate tax rate is 34 percent. b. Common stock for a firm that paid a $1.09 dividend last year. The dividends are expected to grow at a rate of 5.8 percent per year into the foreseeable future. The price of this stock is now $24.85. c. A bond that has a $1,000 par value and a coupon interest rate of 11.9 percent with interest paid semiannually. A new issue would sell for $1,151 per bond and mature in 20 years. The firm's tax rate is 34 percent. d. A preferred stock paying a dividend of 6.3 percent on a $93 par value. If a new issue is offered, the shares would sell for $83.65 per share. a. The after-tax cost of debt debt for the firm is %. (Round to two decimal places.)arrow_forward

- (Computing individual or component costs of capital) Compute the cost of capital for the firm for the following:a. Currently, new bond issues with a credit rating and maturity similar to those of the firm’s outstanding debt are selling to yield 8 percent, while the borrowing firm’s corporate tax rate is 34 percent.b. Common stock for a firm that paid a $2.05 dividend last year. The dividends are expected to grow at a rate of 5 percent per year into the foreseeable future. The price of this stock is now $25.c. A bond that has a $1,000 par value and a coupon interest rate of 12 percent with interest paid semiannually. A new issue would sell for $1,150 per bond and mature in 20 years. The firm’s tax rate is 34 percent.arrow_forwardA financial analyst wants to compute a company's weighted average cost of capital (WACC) using the dividend discount model. The company has a before-tax cost of new debt of 9%, tax rate of 37.5%, target debt-to-equity ratio of 0.76, current stock price of $74, estimated dividend growth rate of 7% and will pay a dividend of $3.2 next year. What is the company’s WACC A. 8 percent. B. 9 percent. C. 10 percent. D. 11 percent.arrow_forwardAn analyst is trying to estimate the intrinsic value of VN Co. that has a weighted average cost of capital at 10%. The estimated free cash flows for the company for the following years are: · Year 1 P3,000 · Year 2 P4,000 · Year 3 P5,000 The analyst estimates that after three years, free cash flow will grow at a constant annual percentage of 6%. What is the total intrinsic value of the company’s common stock if combined debt and preferred stock has a P25,000 market value? A. 98,556 B. 109,339 C. 78,310 D. 84,339arrow_forward

- Please provide a written out by hand solution for the above example.?arrow_forwardUse the following information to compute the weighted average cost of capital (WACC) of GoGo Inc. ▪ Debt information: The beta of GoGo Inc. stock is 1.5 . Risk-free rate is 4% • Market return is 15% • GoGo's capital structure is 65% equity and 35% debt. The tax rate is 21%. 14.62% Bonds will mature in 9 years. The maturity value is $1,000. GoGo's WACC is.. 15.47% The coupon rate is 8%, with semiannual payments. The current bond price is $1,015. 12.20% 13.32%arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common�� stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…arrow_forwardReingaart Systems is expected to pay a $4.2 dividend at year end (D1 = $4.2), the dividend is expected to grow at a constant rate of 4.1% a year, and the common stock currently sells for $62 a share. The before-tax cost of debt is 8.4%, and the tax rate is 24%. The target capital structure consists of 75% debt and 25% common equity. What is the company's WACC if all equity is from retained earnings? 8.41% O 7.51% 8.11% O 7.81% O 8.71%arrow_forwardA company is financed with equity of $4.5 million and a bank loan of $2.5 million with an interest rate of 8.6% per annum. The EBIT is $1.12 million. The applicable tax rate is 19%. Use the above information to calculate the following: a) change in the return on equity and the degree of financial leverage given a 15% increase in EBIT next year, b) change in the return on equity and the degree of financial leverage given a 5% decrease in EBIT in the following year (the year following the year in which EBIT grew by 15%).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT