FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer No. 22 and 23

The First Part of Question No. 23 is on the other Picture

Provide a complete solution. Thank You

Transcribed Image Text:(1 92,000)

2.JM

'n

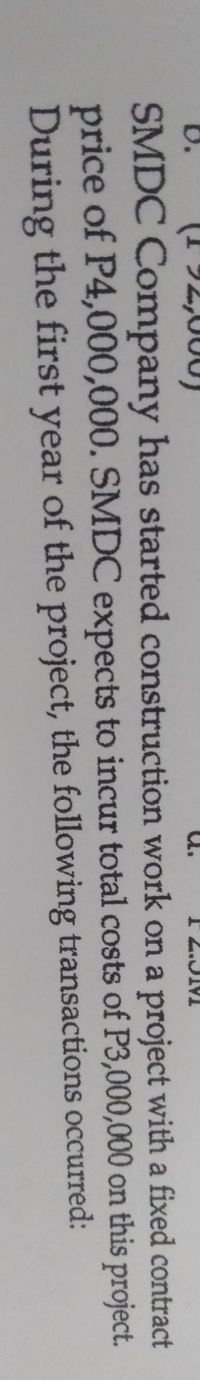

SMDC Company has started construction work on a project with a fixed contract

price of P4,000,000. SMDC expects to incur total costs of P3,000,000 on this project.

During the first year of the project, the following transactions occurred:

Transcribed Image Text:Chapter 8- Long Term Construction Contracts

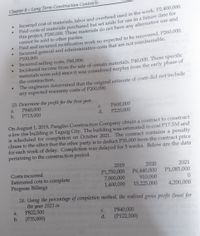

Incurred cost of materials, labor and overhead used in the work, P2,400,000.

Paid costs of materials purchased but set aside for use in a future date for

this project, P200,000. These materials do not have any alternative use and

cannot be sold to other parties.

Paid and incurred rectification work no expected to be recovered, P260,000.

Incurred general and administrative costs that are not reimbursable,

P100,000.

Incurred selling costs, P60,000.

Incidental income from the sale of certain materiałs, P40,000. These specific

materials were sold since it was considered surplus from the early phase of

the construction.

The engineers determined that the original estimate of costs did not include

any expected warranty costs of P200,000.

23. Determine the profit for the first year.

P600,000

P220,000

a.

P840,000

C.

b.

P715,000

d.

On August 1, 2019, Panglao Construction Company obtain a contract to construct

a low rise building in Taguig City. The building was estimated to cost P17.5M and

is scheduled for completion on October 2021. The contract contains a penalty

clause to the effect that the other party is to deduct P35,000 from the contract price

for each week of delay. Completion was delayed for 5 weeks. Below are the data

pertaining to the construction period.

2019

2020

2021

Costs incurred

Estimated cots to complete

Progress Billings

P1,750,000

7,000,000

1,400,000

P1,085,000

P6,440,000

910,000

15,225,000

4,200,000

24. Using the percentage of completion method, the realized gross profit (loss( for

the 2021 is:

year

P822,500

b. (P35,000)

a.

P840,000

C.

d.

(P122,500)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please solve questions 5-15 of the problem above. Thank you.arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education