Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:O Monthly Payment on a $1,000 loan

Number of Years for the Loan

Annual Interest Rate

3

4

10

20

30

4%

$29.53

$22.58

$10.12

$6.06

$4.77

5%

29.97

23.03

10.61

6.60

5.37

6%

30.42

23.49

11.10

7.16

6.00

8%

31.34

24.41

12.13

8.36

7.34

10%

32.27

25.36

13.22

9.65

8.78

12%

33.21

26.33

14.35

11.01

10.29

Print

Done

part

remaining

Clear All

Check Answer

cript:doExercise(5);

Copyright © 2020 Pearson Education nc. All rights reservec

99+

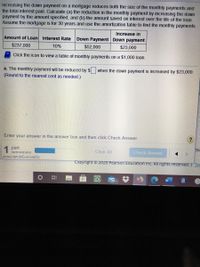

Transcribed Image Text:Increasing the down payment on a mortgage reduces both the size of the monthly payments and

the total interest paid. Calculate (a) the reduction in the monthly payment by increasing the down

payment by the amount specified, and (b) the amount saved on interest over the life of the loan.

Assume the mortgage is for 30 years and use the amortization table to find the monthly payments.

Increase in

Amount of Loan Interest Rate

Down Payment Down payment

$237,000

10%

$52,000

$23,000

Click the icon to view a table of monthly payments on a $1,000 loan.

a. The monthly payment will be reduced by $ when the down payment is increased by $23,000.

(Round to the nearest cent as needed.)

Enter your answer in the answer box and then click Check Answer.

1 part

remaining

Clear All

Check Answer

javascript:doExercise(5);

Copyright © 2020 Pearson Education Inc. All rights reserved. | Ter

99+

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardA homeowner can obtain a $250,000, 30-year fixed-rate mortgage at a rate of 6.0% with zero points or at a rate of 5.5% with 2.25 points. How long must the owner stay in the house to make it worthwhile to pay the points if the payment saving is invested monthly? A. 7.15 years B. 6.04 years C. 7.90 years D. 5.90 yearsarrow_forwardFind the monthly house payments nessary to amortize the following loan. Find total payments and total interest paid. 198000 at 6.94% for 30 years.arrow_forward

- I need help with this problemarrow_forwardA $305,000 mortgage at 5.00% compounded semi-annually was settled with monthly payments of $2,300. a. What is the amortization period for the mortgage? b. How much will the amortization period be shortened by if bi-weekly payments of $1,200 are made instead of the monthly payments?arrow_forward9) Mortgage Payment You take out a 20-year fixed mortgage. The annual interest rate is ? = 0.10 and the monthly payment is $4,000. a. What is the total amount of this Mortgage? E.g., What is the PV of this mortgage payment stream? b. If you make an additional payment of $4,000 in period t=1 and period t=2, how long will it take to repay the mortgage?arrow_forward

- 不 Increasing the down payment on a mortgage reduces both the size of the monthly payments and the total interest paid. Calculate the reduction in the monthly payment by increasing the down payment by the amount specified, and the amount saved on interest over the life of the loan. Assume the mortgage is for 20 years and use the table to find the monthly payments Click the icon to view the table for the monthly payment Amount of Loan $169,000 Interest Rate OA $77.20, $18.528.00 OB. 557.28, $13,747.20 OC. $58.72, $14,092.80 OD. $66.88, $16.051.20 8% Down Payment $33,000 Increase in Down Payment $8,000 Table Anal Interest Rate 5% 6% Monthly payments on a $1,000 loan. Number of Years for the Loan 8% 10% 126 10 20 30 $29.53 $22.58 $10.12 $6.06 $4.77 29.97 23.03 1061 6.60 5.37 30.42 23.49 11.10 7.16 6.00 3134 2441 12.13 X36 734 32.27 25.36 13.22 9.65 8.78 33.21 26.33 14.35 1101 10.29 Print Done Xarrow_forwardAssume we have a $500,000 mortgage at a 3.5% original interest rate, 30-year term, and monthly payments. The interest rate can be adjusted at the end of each year, and we assume the rate increases by 0.25% after the first year. What is the monthly payment for the 4th year of the loan? O 2,418,25 O 2,448,03 O 2,455,81 None of the given answers O2,481,25arrow_forwardPLEASE DO NOT ROUND THE ANSWERS Selling Price of Home Down Payment Rate of Interest Years $ 160,000.00 $ 20,000.00 3.50% 30 Required: Please use the above information to answer the below questions: (Use Table 15-1) How many total payments on this mortgage? What is the principal (loan)? What is the payment per $1,000? What is the monthly mortgage payment? TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Term in Years INTEREST 3½% 5% 5½% 6% 6½% 7% 7½% 8% 8½% 9% 9½% 10% 10½% 11% 10 9.89 10.61 10.86 11.11 11.36 11.62 11.88 12.14 12.40 12.67 12.94 13.22 13.50 13.78 12 8.52 9.25 9.51 9.76 10.02 10.29 10.56 10.83 11.11 11.39 11.67 11.96 12.25 12.54 15 7.15 7.91 8.18 8.44 8.72 8.99 9.28 9.56 9.85 10.15 10.45 10.75 11.06 11.37 17 6.52 7.29 7.56 7.84 8.12 8.40 8.69 8.99 9.29 9.59 9.90 10.22 10.54 10.86 20 5.80 6.60 6.88 7.17 7.46 7.76 8.06 8.37 8.68 9.00 9.33 9.66 9.99 10.33 22 5.44 6.20 6.51 6.82 7.13 7.44 7.75 8.07 8.39 8.72 9.05 9.39…arrow_forward

- Give typing answer with explanation and conclusionarrow_forwardConsider a 30-year, 6% loan for $240,000 with fixed monthly payments. a) What will be the remaining mortgage balance after the first 6 years? b) How much of interest is to be paid over the first 6 years? c) How much of principal reduction is to take place over the first 6 years?arrow_forward12. Amortized loans Mortgages and other amortized loans (meaning equal or blended payments) involve regular payments at fixed intervals. These are sometimes called reverse annuities, because you get a lump-sum amount as a loan in the beginning, and then you make the periodic payments (usually monthly or more frequently, depending on the agreement) to the lender. You've decided to buy a house that is valued at $1 million. You have $400,000 to use as a down payment on the house, and you take out a mortgage for the rest. Your bank has approved your mortgage for the balance amount of $600,000 and is offering you a 25-year mortgage with 12% fixed nominal interest rate (called the APR, or Annual Percentage Rate) compounded semiannually. According to this proposal, what will be your monthly mortgage payment? OOO $7,740 $6,192 $8,359 $9,598 Your friends suggest that you take a 15-year mortgage, because a 25-year mortgage is too long and you will lose a lot of money on interest. If your bank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education