FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

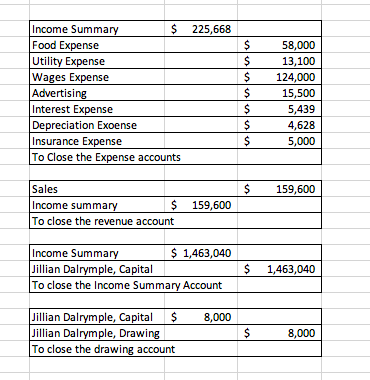

If I already have my closing entries for Capital and Drawing, how do I close them in a T-account? My textbook shows a closing T-account for Expenses and Revenue but not for Capital and Drawing.

Transcribed Image Text:Income Summary

Food Expense

Utility Expense

Wages Expense

Advertising

Interest Expense

Depreciation Exoense

Insurance Expense

To Close the Expense accounts

$ 225,668

58,000

13,100

124,000

15,500

5,439

4,628

5,000

Sales

159,600

Income summary

2$

159,600

To close the revenue account

Income Summary

Jillian Dalrymple, Capital

To close the Income Summary Account

$ 1,463,040

1,463,040

Jillian Dalrymple, Capital

Jillian Dalrymple, Drawing

To close the drawing account

8,000

8,000

%24

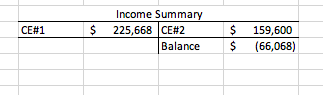

Transcribed Image Text:Income Summary

159,600

(66,068)

CE#1

225,668 CE#2

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assess the truth of this statement: The first closing entry requires a debit to the revenue account(s) for its balance, a debit to the capital account of each partner for his/her share of the net income, and a credit to the expense account(s) for the sum of the debits. Group of answer choices This statement is true. This statement is false. There is not enough information to determine whether this statement is true or false. There are no closing entries required for a partnership.arrow_forwardWhich of the following accounts could be part of a regular journal entry, an adjusting entry, a closing entry, and a reversing entry? interest revenue account receivable depreciation expense unearned revenue prepaid insurancearrow_forwardThe balance in the Income Summary account before it is closed will be equal to Question 1 options: A) the ending balance in the Owner's Capital account B) zero C) the beginning balance in the Owner's Capital account D) the Net Income or Net Loss on the Income Statementarrow_forward

- Which of the following entries closes the owner's drawing account at the end of the period? Group of answer choices debit the drawing account, credit cash debit the owner's equity account, credit the drawing account debit accounts receivable, credit the drawing account debit the drawing account, credit the owner's equity accountarrow_forwardI need help with the items in red. I am trying to complete my adjusting entries sheet.arrow_forwardWhen all expense accounts are closed, what account is debited? Each expense Income Summary Owners Withdrawal account Owners Capital accountarrow_forward

- 1- Please explain what closing entries are and why they are necessary. 2 -Please give an example of a closing entry and include a description. 3- please give an example two accounts that do not require a closing entry and why.arrow_forwardAll of the information needed to record the closing entries is found in the Income Statement section of the work sheet. Select one: True Falsearrow_forwardIdentify the type of account (Asset, Liability, Equity, Revenue, Expense), normal balance (Debit, Credit), financial statement (Balance Sheet, Income Statement), and whether the account is closed at the end of the period (Yes, No) by selecting the letter that best describes those attributes. If an account is a contra or adjunct account, the answer will show the account type in parentheses. Answer items may be used once, more than once, or not at all. Retained Earnings 1. Equity, Credit, Balance Sheet, No 2. Freight-Out Liability, Credit, Balance Sheet, No V Loss on Impairment of Intangible Assets 3. Expense, Debit, Income Statement, Yes 4. Gain on Acquisition of Business (Equity), Debit, Balance Sheet, No 5. Amortization of Copyrights Asset, Debit, Income Statement, Yes Allowance for Doubtful Accounts 6. Expense or Loss, Credit, Income Statement, Yes Land 7. Revenue or Gain, Credit, Income Statement, Yes Federal Income Tax Withheld 8. (Revenue or Gain), Debit, Income Statement, Yes…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education