Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Based on the income statement given calculate and explain the :

profitability ratio

a. Gross profit ratio = gross profit/net sales

b. Operating margin ratio =operating income/net sales

c. Asset Turnover ratio = net sales / total assets

d.

Leverage ratio

a. interest coverage ratio =operating income / interest expenses

b. Debt service ratio=operating income/debt service

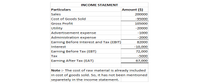

Transcribed Image Text:INCOME STAEMENT

Particulars

Amount ($)

Sales

200000

Cost of Goods Sold

-95000

Gross Profit

105000

Utility

-20000

Advertisement expense

-1000

Administration expense

-2000

Earning Before Interest and Tax (EBIT)

82000

Interest

-10,000

Earning Before Tax (EBT)

72,000

Тах

-5000

Earning After Tax (EAT)

67,000

Note :- The cost of raw material is already included

in cost of goods sold. So, it has not been mentioned

separetely in the income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Which of the following ratios helps in measuring the long term solvency of the company? Current ratio Debt equity ratio Net profit margin ratio Quick ratioarrow_forwardQuestion: Which financial ratio measures the proportion of net income generated per dollar of revenue? A) Return on Investment ( ROI) B) Operating Profit Margin C) Return on Sales (ROS) D) Earnings per Share (EPS)arrow_forwardThe following condensed information is reported by Sporting Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % The amount of dividends paid Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) times % 2021 $10,440,000 6,827,760 360,000 2. Determine the amount of dividends paid to shareholders in 2021. 2020 $8,400,000 5,900,000 248,000 $ 1,600,000 2,200,000 $ 3,800,000 $ 1,200,000 1,500,000 800,000 $ 900,000 1,500,000 800,000 300,000 200,000 $ 3,800,000 $3,400,000 $1,500,000 1,900,000 $3,400,000arrow_forward

- Business ratios of financial statements are generally categorized as one of the following areas, EXCEPT Select one: a. Leverage b. Profitability c. Net Present Value d. Liquidity e. Efficiency (or Activity)arrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.arrow_forwardReturn on equity (ROE) using the traditional DuPont formula equals to A. (net profit margin) (interest component) (solvency ratio) B. (net profit margin) (interest component) (liquidity ratio) C. (net profit margin) (total asset turnover) (quick ratio) D. (net profit margin) (total asset turnover) (solvency ratio)arrow_forward

- 1. Which of the following is referred to as the Accounting Equation? Assets Liabilities + Equity Equity Liabilities + Assets Liabilities Assets + Equity Assets = Liabilities - Equity = 2. Which of the following make up the Finance Equation? (select all that apply) Revenues = Price x Volume Costs = Fixed + Variable Profit Revenues-Costs Income Sales - COGSarrow_forwardWhich of the following is a solvency ratio? a. Times interest earned. b. Inventory turnover ratio. c. Profit margin. d. Price-earnings ratio.arrow_forward26. Given the following financial data for Alpha Company, calculate the ratios listed below the data. (Compute all ratios and percents to 2 decimal points.) Sales (all on credit) Cost of Goods Sold $650,000 422,500 Income before 78,000 Income Taxes Net Income 54,600 Ending Beginning Balances Balances Cash $19,500 $15,000 Accounts Receivable 65,000 59,800 (net) Merchandise 71,500 66,300 Inventory Plant and Equipment (net) 195,000 183,900 Total Assets $351,000 $325,000 Current $74,100 $100,200 Liabilities Long-Term Notes Payable 97,500 100,000 Stockholders' 179,400 124,800 Equity Total Liabilities and Stockholders' $351,000 $325,000 Equityarrow_forward

- 12. Which two ratios multiplied by each other equal Return on Total Assets? (A) Profit Margin (B) Return on Equity (C) Current Ratio (D) Price Earnings Ratio (E) Total Asset Turnoverarrow_forwardAccounting: type question:,,,,,, While calculating purchase price, the following values of assets are considered A. Book value B. New values fixed C. Averagevalues D. Market valuesarrow_forward5. Know the calculations for all of the following ratios (see ratio sheet that can be used on the exam) and know the category (listed in Question 4) they fall in: Formula Category/Use Ratio Working Capital Current Assets - Current Liabilities Net credit sales/Average Accounts Receivable Turnover accounts receivable Asset Turnover Net sales/Average total assets Net income/Average total stockholders' equity Total liabilities/Total stockholders equity Net income/Net sales Return on Equity (ROE) Debt to equity Return on Sales (ROS) (also known as Net Margin Current Assets/Current Liabilities Cost of goods sold/Average inventory Quick assets/Current Current Ratio Inventory Turnover Quick Ratio liabilities Dividend Yield Dividends per share/Market price per share Net earnings available for common stock/Number of outstanding common shares Net income/Average total Earnings per Share (EPS) Return on Investment (ROI) assets Price Earnings Ratio (P/E) Market price per share/Earnings per share…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education