FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

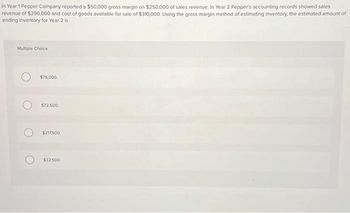

Transcribed Image Text:In Year 1 Pepper Company reported a $50,000 gross margin on $250,000 of sales revenue. In Year 2 Pepper's accounting records showed sales

revenue of $290,000 and cost of goods available for sale of $310,000. Using the gross margin method of estimating inventory, the estimated amount of

ending inventory for Year 2 is

Multiple Choice

$78,000,

$72,500

$217,500

$32.500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At May 31, Lily Company has net sales of $320,000 and cost of goods available for sale of $216,000.Compute the estimated cost of the ending inventory, assuming the gross profit rate is 35%. Estimated cost of ending inventory $________arrow_forwardSandhill Inc. reported inventory at the beginning of the current year of $320000 and at the end of the current year of $371000. If net sales for the current year are $4229200 and the corresponding cost of sales totaled $3126775, what is the inventory turnover for the current year?arrow_forwardDelta Apparel Inc. uses a perpetual inventory system. At the beginning of the year inventory amounted to $ 50,000. During the year, the company purchased merchandise for $ 230,000 and sold merchandise costing $ 245,000. A physical inventory taken at year-end indicated shrinkage losses of $4,000. Prior to the recording of these shrinkage losses, the year-end balance in the companys Inventory account was :- a. $ 31,000 b. $ 35,000 c. $ 50,000 d. $ 55,00arrow_forward

- Dhapaarrow_forwardGarrison Company uses the retail method of inventory costing. It started the year with an inventory that had a retail sales value of $36,200.During the year, Garrison purchased inventory with a retail sales value of $771,100. After performing a physical inventory, Garrison computed the inventory at retail to be $54,700. The markup is 100% of cost.What is the ending inventory at its estimated cost? A. $27,350 B. $136,750 C.$82,050arrow_forwardAt the beginning of the year, Snaplt had $10,000 of inventory. During the year, Snaplt purchased $35, 000 of merchandise and sold $30,000 of merchandise. A physical count of inventory at year-end shows $14,000 of inventory exists. Prepare the entry to record inventory shrinkage.arrow_forward

- A company has beginning inventory for the year of $14,500. During the year, the company purchases inventory for $190,000 and ends the year with $21,000 of inventory. The company will report cost of goods sold equal to: Multiple Choice $211,000. $190,000. $196,500. $183,500.arrow_forwardMarigold Inc. had beginning inventory of $9,600 at cost and $16,000 at retail. Net purchases were $96,000 at cost and $136,000 at retail. Net markups were $8,000, net markdowns were $5,600, and sales revenue was $117,600. Assume the price level increased from 100 at the beginning of the year to 115 at year-end. Compute ending inventory at cost using the dollar-value LIFO retail method. (Round ratios for computational purposes to 1 decimal place, e.g. 78.7% and final answer to 0 decimal places, e.g. 28,987.) Ending inventory using the dollar-value LIFO retail methodarrow_forwardCost of goods sold for Califant Industries was $949,420 for the year. If the beginning inventory at cost was $609,700 and the ending inventory at cost was $416,200, find the inventory turnover at cost. (Round your answer to the nearest tenth.) a. 1.9 times b. 2.0 times c. 2.4 times d. 3.2 timesarrow_forward

- During the year, TRC Corporation has the following inventory transactions. Date Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Weighted Average Cost Total Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Transaction Sales revenue Gross profit For the entire year, the company sells 450 units of inventory for $70 each. 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 2 decimal places and all other answers to the nearest whole number.) Number of Units 60 140 210 120 530 Cost of Goods Available for Sale # of units 60 140 210 120 530 Average Cost per unit Cost of Goods Available for Sale $ $ Unit Cost 3,120 $ 52 54 57 58 7,560 11,970 6.960 29,610 Total Cost $ 3,120 7,560 11,970 6,960 $29,610 Cost of Goods Sold - Weighted Average Cost of units Sold Average Cost of Cost per Unit Goods Sold Ending Inventory - Weighted Average Cost # of units in Ending Inventory…arrow_forwardA company had the following purchases during the current year: January: February: May: September: November: 10 units at $120 20 units at $125 15 units at $130 12 units at $135 10 units at $140 On December 31, there were 26 units remaining in ending inventory. Using the LIFO inventory valuation method, what is the cost of the ending inventory? ☐ $3,280. ○ $3,200. ○ $3,540. ☐ $3,445. ○ $3,640.arrow_forwardThe inventory accounting records for Lee Enterprises contained the following data: Beginning inventory 400 units at $13 each Purchase 1, Feb. 26 2,300 units at $14 each Sale 1, March 9 2,500 units at $27 each Purchase 2, June 14 2,200 units at $15 each Sale 2, Sept. 22 2,100 units at $29 each Required: Calculate the cost of ending inventory and the cost of goods sold using the FIFO, LIFO, and average cost methods. (Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) FIFO LIFO Average cost Cost of ending inventory Cost of goods soldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education