ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

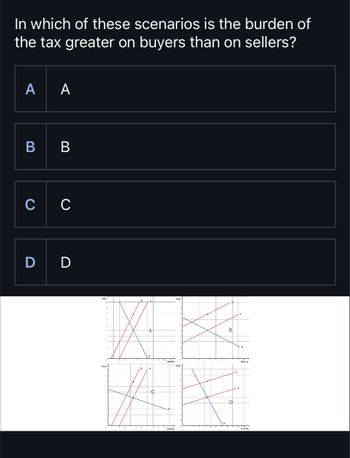

Transcribed Image Text:In which of these scenarios is the burden of

the tax greater on buyers than on sellers?

AA

BB

C C

DD

B

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Doyle and Samphantharak (2008) find that when a 5% gas tax is implemented, prices consumers pay for gas increase by about 4%. What role does demand elasticity play in determining the size of this price change? That is, under what demand elasticity cases would the price change be closer to 5%, or closer to 0%? Illustrate and explain using supply-and-demand graph(s)..arrow_forwardHELP ME WITH PART B PLEASE BY SHOWING IN A DIAGRAM a. The elasticity of demand for beer in country A is 1.8 and the elasticity ofdemand for beer in country B is 1.7. Suppose that the supply of beer isthe same in both countries and that both countries impose the same levelof tax on beer. Does the consumer in country A share more burden of tax?b. ii. Suppose the demand curve for sugar is Q = 60 − 3P and the supply curveis Q = 2P. Suppose the government announces a per-unit tax of 1 on theprice of sugar. What is the deadweight loss from the tax?arrow_forwardUse Exhibit to answer question a. A. b. C. c. B. d. B + C + E + F. Price e. C + F. 22 PB Po Ps I FIBI U O Size of tax per unit 'm/ F If a tax is placed on the product in this market, tax revenue paid by the sellers is the area Qo Supply Demand Quantityarrow_forward

- The table shows the market for chocolate bars Quantity demanded Quantity supplied (thousands per day) Price (dollars per chocolate bar) 1.10 1.20 1.30 1.40 1.50 50 5 40 10 30 15 20 20 10 25 A tax of $0.30 per chocolate bar is imposed on sellers What is the new price of a chocolate bar? Who pays the tax? The new price of a chocolate bar following the tax is $ The tax is A. paid totally by the buyer B. paid totally by the seller C. split between the buyer and the sellerarrow_forwardHow do the elasticities of supply and demand affectthe deadweight loss of a tax? Why do they have thiseffect?arrow_forwardOnly typed answer and please don't use chatgptarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education