FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

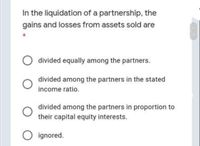

Transcribed Image Text:In the liquidation of a partnership, the

gains and losses from assets sold are

O divided equally among the partners.

divided among the partners in the stated

income ratio.

divided among the partners in proportion to

their capital equity interests.

O ignored.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In liquidation of LLP, for allocation of realization losses to partners, the journal entry includes: a. Debit each partner’s capital with his/her share in gains based final capital balances. b. Debit each partner’s capital with his/her share in gains based on income sharing ratios. c. Credit each partner’s capital with his/her share in gains based final capital balances. d. Credit each partner’s capital with his/her share in gains based on income sharing ratios.arrow_forwardWhen a partner withdraws from a partnership, why is the final distribution often based on the appraised value of the business rather than on the book value of the capital account balance?arrow_forwardNet income for a partnership has to be allocated based on stated ratios. Question 2 options: True Falsearrow_forward

- Tax Drill - Effect of Partnership Operations on Basis Indicate whether the following items "Increase" or "Decrease" a partner's basis in the partnership. a. A partner's proportionate share of nondeductible expenses. b. A partner's proportionate share of any increase in partnership liabilities. c. A partner's proportionate share of partnership income. d. A partner's proportionate share of any reduction in partnership liabilities.arrow_forwardHow do loans from partners affect the distribution of assets in a partnership liquidation?arrow_forwardHow does a newly formed partnership handle the contribution of previously depreciated assets?arrow_forward

- In the liquidating process, any uncollected cash becomes a loss to the partnership and is divided among the remaining partners' capital balances based on their income-sharing ratio. Group of answer choices True Falsearrow_forwardUnder the goodwill method, a. declines in asset values prior to new partner admission are recorded, but not asset appreciation. b. the total capital of the new partnership must approximate the fair value of the entity. c. a new partner’s capital balance may be less than his or her contribution. d. All of the above.arrow_forward1. What is KW Partnership’s ordinary business income (loss)? 2. Which of the following items are separately stated?arrow_forward

- There is a liquidation of assets of a partnership. Describe the order in which assets must be distributed upon liquidation of a partnership, and explain the "right-of-offset" concept.arrow_forwardAccounting type Question: As per the decision in the Garner vs Murray case, when the partner's capital accounts are fixed, any loss arising due to the capital deficiency in the insolvent partner's capital account is to be borne by solvent partners in the ratio of ..... A. profit sharing ratio B. last agreed capital ratio C. sacrificing ratio D. gaining ratioarrow_forwardEach partner's initial noncash investment in the partnership should be recorded at the a. carrying amount of the assets at the date of their transfer into the partnership. fair value of the assets at the date of their transfer into the business. c. original cost of the assets at the time they were purchased by the contributing partner. d. fair value of the assets at the date the partnership begins operations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education