Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

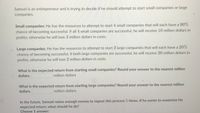

Transcribed Image Text:Samuel is an entrepreneur and is trying to decide if he should attempt to start small companies or large

companies.

Small companies: He has the resources to attempt to start 4 small companies that will each have a 90%

chance of becoming successful. If all 4 small companies are successful, he will receive 10 million dollars in

profits; otherwise he will lose 3 million dollars in costs.

Large companies: He has the resources to attempt to start 2 large companies that will each have a 20%

chance of becoming successful. If both large companies are successful, he will receive 20 million dollars in

profits; otherwise he will lose 2 million dollars in costs.

What is the expected return from starting small companies? Round your answer to the nearest million

dollars.

million dollars

What is the expected return from starting large companies? Round your answer to the nearest million

dollars.

million dollars

In the future, Samuel raises enough money to repeat this process 5 times. If he wants to maximize his

expected return, what should he do?

Choose 1 answer:

Transcribed Image Text:In the future, Samuel raises enough money to repeat this process 5 times. If he wants to maximize his

expected return, what should he do?

Choose 1 answer:

A

Start small companies all 5 times.

Start large companies all 5 times.

C

Start small companies 3 times and large companies 2 times.

D

Not start any companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Professional cuddling therapy is a growing industry. You think you might be really good at cuddling so you decide to open a cuddle therapy business. Setting up the business will cost $14,000. Your business will be an all cash business so net income will be equal to your cash flows. You expect to earn $3,000 in net income in your first year of business and $4,000 in net income in the second year. In your third year you will sell the business for $15,000. These are all the cash flows associated with your cuddling business. The cost of capital is 15%. What is the NPV of this project? What is the IRR?arrow_forward(Question #2) Dr. Pickens wants to buy a burger chain. He currently has $35,000. He needs to have $80,000 in 5 years. He can earn 12% compounded annually. If he saves money at the beginning of the year, how much must he save per year to meet his goal?arrow_forward4. A friend wants to retire in 30 years when he is 65. At age 35, he can invest $600/month that earns 6% each year. But he is thinking of waiting 15 years when he is age 50, and then investing $1,500/month to catch up, earning the same 6% per year. He feels that by investing over twice as much for half as many years (15 instead of 30 years) he will have more. A. What is the future value of each of these options at age 65, and under which scenario would he accumulate more money?Scenario A: $ _________, Scenario B: $___________ , Best:_________ B. He has decided he wants to save $1,000,000 before he retires. If he saves for 30 years, earning 6%, how much must he save each month to retire with a million dollars Monthly Savings $________ 5. TV’s R Yours is advertising a deal, in which you buy a flat screen TV/entertainment package for $1,205 (including tax) with one year before you need to pay (no interest is incurred if you pay by the end of the one year). How much would you need to…arrow_forward

- Carrie Haute buys a fast-food restaurant for $500,000. She is very successfuland sells the business 6 years later for $1,375,000. What is Carrie’s internalrate of return?arrow_forwardHow do I work this problem in excel? You have been offered $3,000 in 4 years for providing $2,000 today into a business venture with a friend. If interest rates are 10%, is this a good investment for you?arrow_forwardMarian owns Dolan's Handbags. The estimated value of this retail store today is $ 267,000. She expects her business to grow by 13% per year in the next 7 years. Find the Future Value of the business in 7 years. Group of answer choices $628, 155.56 $ 628, 154.86 $628, 145.66 $628, 154.66arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education