FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

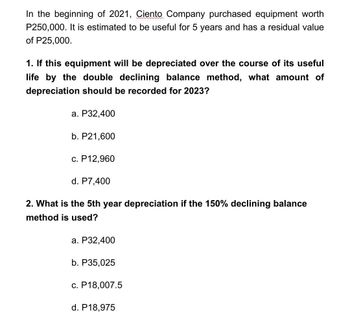

Transcribed Image Text:In the beginning of 2021, Ciento Company purchased equipment worth

P250,000. It is estimated to be useful for 5 years and has a residual value

of P25,000.

1. If this equipment will be depreciated over the course of its useful

life by the double declining balance method, what amount of

depreciation should be recorded for 2023?

a. P32,400

b. P21,600

c. P12,960

d. P7,400

2. What is the 5th year depreciation if the 150% declining balance

method is used?

a. P32,400

b. P35,025

c. P18,007.5

d. P18,975

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardOn march 10, 2023, Sweet Acacia limited sold equipment that it bought for 286800 on August 20, 2026. It was originally estimated that the equipment would have a useful life of 12 years and a residual value of 24000 at the end of that time and depreciation has been calculated on that basis. The company uses the straight line method of depreciation and prepares its financial statement under IFRS. Calculate the depreciation charges on this equipment for 2016 and 2023, and the total charge for the period from 2017 to 2022, inclusive under each of the following six assumptions for partial periods. Depreciation is calculated for the exact period of time during which the asset is owned. Depreciation is calculated for the full year on January 1 balance in the asset account. Depreciation is calculated for the full year on December 31 balance in the asset account Depreciation for a half year is charged on plant assets that are acquired or disposed of during the year. Depreciation is…arrow_forwardAt the beginning of May, The GAP's total assets totaled $400,000 . At the end of May, what is The GAP's new asset balance assuming the following transactions occurred in May? Paid S20,000 cash to to purchase new equipment for its stores. Prepaid rent for June for S6, 000. Sold $70,000 of clothes to customers who paid with cash. The inventory cost of the clothes sold was S20, 000.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education