FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

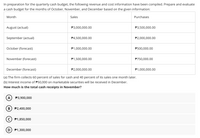

Transcribed Image Text:In preparation for the quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate

a cash budget for the months of October, November, and December based on the given information:

Month

Sales

Purchases

August (actual)

P3,000,000.00

P3,500,000.00

September (actual)

P4,500,000.00

P2,000,000.00

October (forecast)

P1,000,000.00

P500,000.00

November (forecast)

P1,500,000.00

P750,000.00

December (forecast)

P2,000,000.00

P1,000,000.00

(a) The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

(b) Interest income of P50,000 on marketable securities will be received in December.

How much is the total cash receipts in November?

A

P3,900,000

B) P2,400,000

c) P1,850,000

D) P1,300,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Evergreen Furniture, a retailing company, is preparing the cash budget for August. The following inventory information available: Estimated payments in August for purchases in August Estimated purchases for August Estimated cost of goods sold for August Estimated payments in August for purchases in July Estimated payments in August for purchases prior to July Inventories at beginning of August Required: What are the estimated cash disbursements in August? Estimated cash disbursements 70% $ 2,444,000 2,600,000 696,000 176,000 674,000arrow_forwardMecca 4 Company, a retailer of specialty wall-papers, prepares a monthly master budget. Data for the September master budget are given below: a. The August 31st balance sheet (Actual): cash accounts receivable inventory building and equipment (net) $25,000 133,000 32,813 203,500 e. accounts payable August-Actual September-Projected October-Projected November-Projected capital stock retained earnings b. Actual sales for August and budgeted sales for September, October, and November are given below: $62,016 $190,000 375,000 405,000 310,000 295,372 36,925 C. Sales are 30% for cash and 70% on credit. All credit sales are collected in the month following the sale. There are no bad debts. d. The gross margin percentage is 65% of sales. The desired ending inventory is equal to 25% of the following month's COGS. One fourth of the purchases are paid for in the month of the purchase and the remaining 75% are purchased on account and paid in full the following month. The monthly operating…arrow_forwardThe budgeted units for sales in January, February and March are 25,000, 55,000 and 35,000 andselling price is $ 12, 15 and 20 per unit respectively. Please determine the total budgeted sales in unitsand dollars for the quarter ended March 31, 2021.arrow_forward

- Evergreen Furniture, a retailing company, is preparing the cash budget for August. The following inventory information is available: Estimated payments in August for purchases in August Estimated purchases for August Estimated cost of goods sold for August Estimated payments in August for purchases in July Estimated payments in August for purchases prior to July Inventories at beginning of August Required: What are the estimated cash disbursements in August? Estimated cash disbursements 70% $ 2,428,000 2,560,000 672,000 160,000 658,000arrow_forwardIn May 2022, the budget committee of Blue Spruce, Inc. assembles the following data in preparation of budgeted merchandise purchases for the month of June. 1. Expected sales: June $725,000, July $970,000. 2. Cost of goods sold is expected to be 80% of sales. 3. Desired ending merchandise inventory is 30% of the following month's cost of goods sold. 4. The beginning inventory at June 1 will be the desired amount. (a) Compute the budgeted merchandise purchases for June. BLUE SPRUCE, INC. Merchandise Purchases Budget $arrow_forwardMitchell Company had the following budgeted sales for the first half of next year: The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled: Assume that the accounts recelvable balance on January 1 was $76,000. Of this amount, $60,000 represented uncollected December sales and $16,000 represented uncollected November sales. Glven these data, the total cash collected during January would be: Multiple Choice $138.000 $100,000 $196,000 $197,000arrow_forward

- Use the following information to prepare the September cash budget for PTO Company. Ignore the "Loan activity" section of the budget. a. Beginning cash balance, September 1, $44,000. b. Budgeted cash receipts from September sales, $261,000. c. Direct materials are purchased on credit. Purchase amounts are August (actual), $78,000; and September (budgeted), $106,000. Payments for direct materials follow: 65% in the month of purchase and 35% in the first month after purchase. d. Budgeted cash payments for direct labor in September, $34,000. e. Budgeted depreciation expense for September, $3,300. f. Budgeted cash payment for dividends in September, $54,000. g. Budgeted cash payment for income taxes in September, $10,200. h. Budgeted cash payment for loan interest in September, $1,200. PTO COMPANY Cash Budget September Beginning cash balance Total cash available 0 Total cash payments 0 Ending cash balance $ 0arrow_forwardCook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2022. Sales: quarter 1, 40,000 bags; quarter 2, 56,000 bags. Selling price is $60 per bag. Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.8 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: 1. 2. Type of Inventory January 1 Snare (bags) 8,000 Gumm (pounds) 9,000 10,000 13,000 Tarr (pounds) 14,000 20,000 25,000 4. 5. 6. 7. April 1 15,000 July 1 18,000 Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. Selling and administrative expenses are expected to be 15% of sales plus $175,000 per quarter. Interest expense is $100,000. Income taxes are expected to be 20% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and…arrow_forwardGiving questions, Prepare a cash budget for the January and February for the year 2020arrow_forward

- Rolling Financial Forecasts You are given the following budgeted and actual data for the GreyCompany for each of the months January through June of the current year.In December of the prior year, sales were forecasted as follows: January, 100 units; February, 95units; March, 100 units; April, 110 units; May, 120 units; June, 125 units. In January of the currentyear, sales for the months February through June were re-forecasted as follows: February, 90 units;March, 100 units; April, 105 units; May, 110 units; June, 120 units. In February of the current year,sales for the months March through June were reforecasted as follows: March, 95 units; April, 105units; May, 105 units; June, 120 units. In March of the current year, sales for the months Aprilthrough June were reforecasted as follows: April, 105 units; May, 100 units; June, 110 units. In Aprilof the current year, sales for the months May and June were reforecasted as follows: May, 90 units;June, 105 units. In May of the current…arrow_forward31arrow_forwardDetermine the anticipated total cash receipts for the month of January for Madison Co. in preparing a Cash Budget, given the following info: Accounts Receivable balance as of January 1 $296,000.00 Budgeted Sales for January = $860,000.00 Madison Co. assumes all monthly sales are on account. And that 75% of the sales on account will be collected in the month of the sale, and that the remainder will be collected the following month. $688,000.00 $812,000.00 $941,000.00 O $468,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education