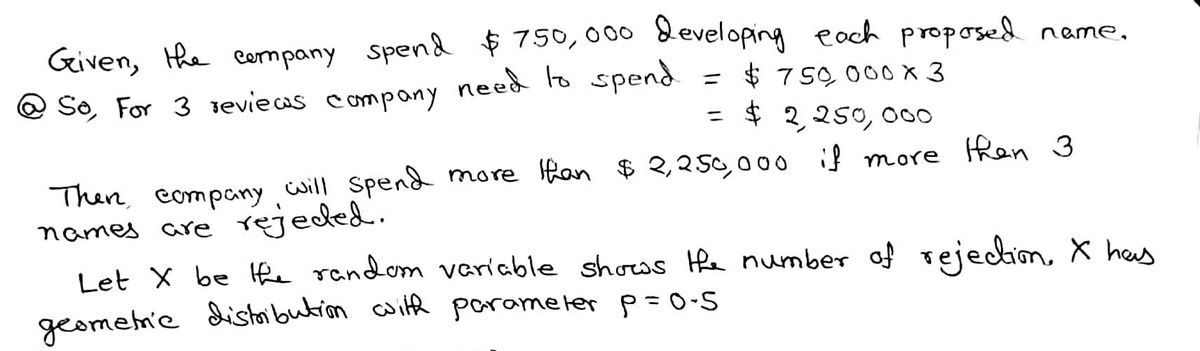

In one country, there exists a food and drug administration that has veto power over the choice of drug names. Last year, it used this power regularly, rejecting K 32% of the names proposed by companies for reasons such as sounding too much like another product. Suppose that a company spends $750,000 developing each proposed name, but there's a 50-50 chance of a name being rejected. Complete parts (a) and (b) below. (a) If the review of names occurs independently, what is the probability that the company will spend more than $2,250,000 developing a name? The probability is (Round to two decimal places as needed.) (b) What is the expected value of developing a name? [Hint: For 0≤p≤ 1, p(1+2(1-p) + 3(1-p)² + ...) = 1/p.] The expected value is $ (Round to the nearest dollar as needed.)

In one country, there exists a food and drug administration that has veto power over the choice of drug names. Last year, it used this power regularly, rejecting K 32% of the names proposed by companies for reasons such as sounding too much like another product. Suppose that a company spends $750,000 developing each proposed name, but there's a 50-50 chance of a name being rejected. Complete parts (a) and (b) below. (a) If the review of names occurs independently, what is the probability that the company will spend more than $2,250,000 developing a name? The probability is (Round to two decimal places as needed.) (b) What is the expected value of developing a name? [Hint: For 0≤p≤ 1, p(1+2(1-p) + 3(1-p)² + ...) = 1/p.] The expected value is $ (Round to the nearest dollar as needed.)

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 10CYU

Related questions

Question

![K

In one country, there exists a food and drug administration that has veto power over the choice of drug names. Last year, it used this power regularly, rejecting

32% of the names proposed by companies for reasons such as sounding too much like another product. Suppose that a company spends $750,000

developing each proposed name, but there's a 50-50 chance of a name being rejected. Complete parts (a) and (b) below.

(a) If the review of names occurs independently, what is the probability that the company will spend more than $2,250,000 developing a name?

The probability is

(Round to two decimal places as needed.)

(b) What is the expected value of developing a name? [Hint: For 0 ≤p ≤ 1, p(1+2(1-p) + 3(1-p)2 + ...) = 1/p.]

The expected value is $

(Round to the nearest dollar as needed.).](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb854e95b-6f91-4ea9-9e99-ab6ba7352139%2F630b85f5-6a30-4f54-a244-45a8844b3369%2F2qtw98_processed.jpeg&w=3840&q=75)

Transcribed Image Text:K

In one country, there exists a food and drug administration that has veto power over the choice of drug names. Last year, it used this power regularly, rejecting

32% of the names proposed by companies for reasons such as sounding too much like another product. Suppose that a company spends $750,000

developing each proposed name, but there's a 50-50 chance of a name being rejected. Complete parts (a) and (b) below.

(a) If the review of names occurs independently, what is the probability that the company will spend more than $2,250,000 developing a name?

The probability is

(Round to two decimal places as needed.)

(b) What is the expected value of developing a name? [Hint: For 0 ≤p ≤ 1, p(1+2(1-p) + 3(1-p)2 + ...) = 1/p.]

The expected value is $

(Round to the nearest dollar as needed.).

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage