Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I don't need

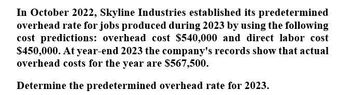

Transcribed Image Text:In October 2022, Skyline Industries established its predetermined

overhead rate for jobs produced during 2023 by using the following

cost predictions: overhead cost $540,000 and direct labor cost

$450,000. At year-end 2023 the company's records show that actual

overhead costs for the year are $567,500.

Determine the predetermined overhead rate for 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determine the predetermined overhead rate for 2024. Accountingarrow_forwardDetermine the predetermined overhead ratearrow_forwardIn December 2019, Solar Systems Inc. management establishes the 2020 predetermined overhead rate based on direct labor cost. The information used in setting this rate includes estimates that the company will incur $920,000 of overhead costs and $600,000 of direct labor cost in year 2020. During March 2020, Solar Systems began and completed Job No. 20-78. What is the predetermined overhead rate for year 2020?arrow_forward

- What is the predetermined overhead rate?arrow_forwardAssume you made the following two predictions for 2022 for one of your production facilities: Total manufacturing overhead for the year $15,000,000Total direct labor hours for the year 800,000 Actual results for July 2022 were as follows: Manufacturing overhead $1,238,500Direct labor hours 98,500 Calculate the predetermine overhead rate per direct labor hour for 2022.arrow_forwardSimPle Tech Corporation bases its predetermined overhead rate on the estimatedmachine-hours for the upcoming year.At the beginning of 2020, the Corporation estimated the machine-hours for the upcoming year at 10,000 machine-hours. The estimated variable manufacturing overhead was $6.82 per machine-hour and the estimated total fixed manufacturing overhead was $230,200. The predetermined overhead rate for 2020 is estimated at _____________.A. $29.84 per machine hourB. $23.15 per machine hourC. $23.02 per machine hourD. $6.82 per machine hour Give workings for your answerarrow_forward

- Determine the predetermined overhead rate for the year 2021?arrow_forwardGeneral Accountingarrow_forwardDrew Company’s predetermined overhead rate for 2022 is $12.00 per direct labor hour. Drew’s actual overhead costs in July 2022 were $1,250,000, and actual direct labor hours were 100,000. Calculate the amount of any overapplied or underapplied overhead in July. (If underapplied, enter your answer as a negative number by typing a minus “–” sign in front of your answer. Do not include a $ sign.)arrow_forward

- Calculate the predetermined overhead rate for 2017, assuming Lott Company estimates total manufacturing overhead costs of $907,200, direct labor costs of $756,000, and direct labor hours of 21,600 for the year. (Round answer to the nearest whole percent, e.g. 25%.) Predetermined overhead ratearrow_forwardMidwest Corporation has provided the following data concerning manufacturing overhead for 2020: Estimated manufacturing overhead for the year $ 30,000 Estimated direct labor hours for the year 2,000 Two jobs were worked on during the year: Job A-101 and Job A-102. The number of direct labor-hours spent on Job A-101 and Job A-102 were 1,200 and 1,000, respectively. The actual manufacturing overhead was $37,000.What was the amount of manufacturing overhead applied to Job A-101? $24,000. $44,000. $18,000. $16,000.arrow_forwardMichael Scott Paper Co. uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required.At the beginning of 2020, the company expected to incur the following:Michael Scott Paper Co.Beginning of 2020 Manufacturing overhead costs $1,001,910 Direct labor costs $1,512,800 Number of Machine hours to be used 73,400 At the end of 2020, the company had actually incurred:Michael Scott Paper Co.End of 2020 Direct labor costs $1,219,700 Depreciation on manufacturing plant equipment $596,400 Property taxes on plant $39,600 Sales Salaries $28,400 Delivery drivers wages $25,600 Plant janitor's wages $17,100 Number of Machine hours actually used 65,700 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rate. Total estimated overhead cost ? Total estimated quantity of the overhead allocation base =…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College