FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

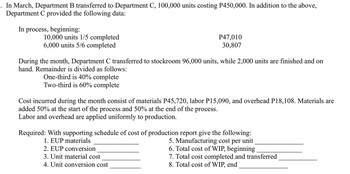

Transcribed Image Text:In March, Department B transferred to Department C, 100,000 units costing P450,000. In addition to the above,

Department C provided the following data:

In process, beginning:

10,000 units 1/5 completed

6,000 units 5/6 completed

P47,010

30,807

During the month, Department C transferred to stockroom 96,000 units, while 2,000 units are finished and on

hand. Remainder is divided as follows:

One-third is 40% complete

Two-third is 60% complete

Cost incurred during the month consist of materials P45,720, labor P15,090, and overhead P18,108. Materials are

added 50% at the start of the process and 50% at the end of the process.

Labor and overhead are applied uniformly to production.

Required: With supporting schedule of cost of production report give the following:

1. EUP materials

2. EUP conversion

3. Unit material cost

4. Unit conversion cost

5. Manufacturing cost per unit

6. Total cost of WIP, beginning

7. Total cost completed and transferred

8. Total cost of WIP, end

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Some answers are not correct. Can you provide me a solution aligned with the correct/key answer provided below?

- 99,000

- 100,600

- 0.46

- 0.33

- 0.79

- 84,467

- 507,667

- 88,308

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Some answers are not correct. Can you provide me a solution aligned with the correct/key answer provided below?

- 99,000

- 100,600

- 0.46

- 0.33

- 0.79

- 84,467

- 507,667

- 88,308

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3. The Assembly Department for Bright Company has the following production data for the current month. Beginning Work in Process Units transferred out Ending Work in Process -0- 20,000 10,000 Materials are entered at the beginning of the process. The ending work in process units are 70% complete as to conversion costs. Instructions: Compute the equivalent units of production for (a) materials and (b) conversion costs (2 marks) 4. Tien Group estimates that unit sales will be 20,000 in quarter 1, 24,000 in quarter 2, 27,000 in quarter 3 and 33,000 in quarter 4. Management desires to have an ending finished goods inventory equal to 20% of the next quarter's expected unit sales. Instructions: Prepare a production budget by quarters for the first 6 months of 2020. (*arrow_forwardSolve this question with steps please. The subject is fundamental of financial accounting.arrow_forwardTech Enterprise makes a single product in two departments. The production data for Department B for August 2019 follows: Quantities: In process, August 1 (40% complete) 4,000 units Received from Department A 30,000 units Completed and transferred 25,000 units In process, August 31 (60% complete) 6,000 units Production costs: August 1 August 31 Transferred in P48,900 P267,300 Materials 11,400 202,500 Conversion cost 5,820 243,000 Materials are added at the start of the process, and losses normally occur during the early stage of the operation. Cost of goods manufactured using FIFO method.arrow_forward

- 2. The Finishing Department started the month with 500 units in process, received 2,000 units from the Assembly Department, and transferred 2,100 units to the finished goods storage area. All direct materials are added at the beginning of the process. The units in process at the end of the month are 45% complete with respect to conversion costs. The department uses the weighted-average method. The Finishing Department incurred the following costs: Added this month Total $ 25,000 $ 31,250 2,000 2,500 5,590 6,840 $ 32,590 $ 40,590 Transferred In Direct Materials Conversion Costs Total Beginning WIP $ 6,250 500 1,250 $ 8,000 1). How many units are still in process at the end of the month? 2). Compute the equivalent units of production for the Finishing Department. 3). Determine the cost per equivalent unit for transferred in, direct materials, and conversion costs. 4). Determine the cost to be transferred to Finished Goods Inventory.arrow_forwardMuscat Painting Company has the following production data for March. Beginning work process 400,000 units (60% complete), started into production 370,000 units, completed and transferred out 706,000 units, and ending work in process 40,000 units (40% complete). the equivalent units of production for conversion costs will be: Select one: O a. 810,000. O b. 650,000. O c 770,000. O d. None of the answers are correct O e. 722,000.arrow_forwardUse this information about Department G to answer the question that follows. Department G had 3,600 units 25% completed at the beginning of the period, 11,000 units were completed during the period, 3,000 units were 20% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period: Work in process, beginning of period $40,000 Costs added during period: Direct materials (10,400 units at $8) 83,200 Direct labor 63,000 Factory overhead 25,000 All direct materials are added at the beginning of the process, and the first-in, first-out cost flow method is used. Determine the total cost of the inventory in process at the end of the period. Round the unit cost computation to the nearest cent. a. $21,432 b. $16,163 c. $28,932 d. $35,670arrow_forward

- Axel Ltd. began operations on October 1 of the current year. Its production requires that direct materials be added at the beginning of the process, and conversion costs are incurred uniformly. Direct materials costs for October were $380,000, and conversion costs were $1,750,000. There were 80,000 units started during the month. The ending inventory was 25,000 units, which were 60% complete. What was the cost per equivalent unit for conversion? Round to the nearest cent. OA. $70.00 OB. $25.00 OC. $21.88 O D. $16.67 OE. $116.67arrow_forwardBarney makes a single product in two Departments. The production data for Dept. 2 for Aug 2020 follows: Production Cost Transferred in Materials Conversion Quantities In Process, beginning (40% done) Received from Dept. 1 Completed and transferred In Process, end (60% done) O 70,000 O 111,600 Last Month This Month O 111,400 40,750 222,750 O 68,600 9,500 168,750 4,850 202,500 10,000 Materials are added at the start of the process, and losses normally occur continuously. 75,000 Using the weighted average method, how much is the cost of the work in process, ending? 62,500 15,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education