Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

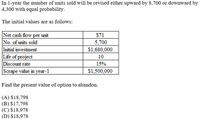

Transcribed Image Text:In l-year the number of units sold will be revised either upward by 8,700 or downward by

4,300 with equal probability.

The initial values are as follows:

Net cash flow per unit

S71

No. of units sold

5,700

$1,680,000

Initial investment

Life of project

Discount rate

Scrape value in year-1

10

15%

$1,500,000

Find the present value of option to abandon.

(A) $18,798

(B) $17,798

(C) $18,978

(D) $18,978

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. Show complete solution pleasearrow_forwardNonearrow_forwardA $350,000 capital investment proposal has an estimated life of four years and no residual value. The estimated net cash flows are as follows: Year Net Cash Flow 1 $150,000 2 130,000 3 104,000 4 90,000 The minimum desired rate of return for net present value analysis is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively. Determine the net present value.$fill in the blank 1arrow_forward

- Harrow_forwardCompute the discounted payback statistic for Project C if the appropriate cost of capital is 8 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project C Time: 1 3 4 Cash flow: -$1,900 $840 $750 $790 $480 $280 Discounted payback period years Should the project be accepted or rejected?arrow_forwardFind the Annual Equivalent Worth AEW for the indefinite project described by (jo» ND-), G, Nc-l»? Assume a MARR of 12% for the project. For the defender, the AEC are described below on the left side. For the challenger, the AEC are described on the right side. 5400 N=1 5100 5350 N=2 4900 5200 N=3 4800 5300 N=4 5300 5500 N=5 5900arrow_forward

- Compute the discounted payback statistic for Project C if the appropriate cost of capital is 6 percent and the maximum allowable discounted payback period is three years. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Project C 0 1 2 3 Time: Cash flow: -$3,000 $1,280 $ 1,080 $ 1,120 Discounted payback period years Should the project be accepted or rejected? 4 $ 700 5 $ 500arrow_forwardyear payback period criteria and a required return of 12 percent. |Year Cash flow |(OMR) -26,000 18,000 10,000 7,000 -15,000 9,000 2 3 4 11. What is the net present value for the project? 12. What is the payback period for the project? 13. What is the discounted payback period for the project? 14. What is the profitability index for the project? 15. Given your analysis, should the fim accept or reject the projeet?arrow_forwardCompute the discounted payback statistic for Project C if the appropriate cost of capital is 6 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project C Time: 0 1 2 3 4 5 Cash flow: −$2,800 $1,200 $1,020 $1,060 $660 $460 Should the project be accepted or rejected?multiple choice accepted rejectedarrow_forward

- 1otal Investment in the Project ration : A project requires an investment of 7.20.000 and a scrap value of 20,000 after five years. It is expected to yield profits after depreciation & taxes during five years amounting to 65,000; 25.000: 80.000, 3 70,000 and 90,000. Calculate the average rate of return on the investment. tion:arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 9 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$2,100 $790 $810 $740 $520 $320 Payback: ? Yearsarrow_forwardCompute the discounted payback statistic for Project C if the appropriate cost of capital is 7 percent and the maximum allowable discounted payback period is three years. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Project C Time: 2 Cash flow: -$ 2,600 $ 1,120 $ 960 3 $ 1,000 4 5 $ 620 $ 420 Discounted payback period years Should the project be accepted or rejected? (Click to select)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education