FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

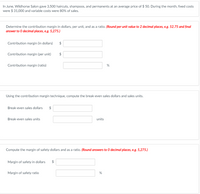

Transcribed Image Text:In June, Wildhorse Salon gave 3,500 haircuts, shampoos, and permanents at an average price of $ 50. During the month, fixed costs

were $ 31,000 and variable costs were 80% of sales.

Determine the contribution margin in dollars, per unit, and as a ratio. (Round per unit value to 2 decimal places, e.g. 52.75 and final

answer to 0 decimal places, e.g. 5,275.)

Contribution margin (in dollars)

2$

Contribution margin (per unit)

Contribution margin (ratio)

%

Using the contribution margin technique, compute the break-even sales dollars and sales units.

Break-even sales dollars

$

Break-even sales units

units

Compute the margin of safety dollars and as a ratio. (Round answers to 0 decimal places, e.g. 5,275.)

Margin of safety in dollars

$

Margin of safety ratio

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardFollowing is relevant information for Philly's Sandwich Shop, a small business that serves sandwiches: Total fixed cost per month Variable cost per sandwich $1,020.00 1.50 Sales price per sandwich 5.75 During the month of June, Philly's sold 580 sandwiches. Required: Complete the contribution margin income statement for the month of June. Note: Round your final answers to the nearest whole dollar. Philly's Sandwich Shop Contribution Margin Income Statement Month of June Contribution margin Net Operating incomearrow_forwardAjayarrow_forward

- Hydra Company has two locations, downtown and at a surburban mall. During March, the company reported total net income of $337,000 and sales of $1.2 million. The contribution margin in the downtown store was $320,000 (40% of sales). The contribution margin in the mall store is $200,000. Total fixed costs are $90,000 in the downtown store and $93,000 in the mall location. How much are sales at the mall. Show the work. A. $400,000 B. $800,000 C. $666,667 D. Not enough information is provided to answer.arrow_forwardAssume Hairy-Cairy Salon, a hair styling salon in Matthews, NC, provides cuts, perms, and hairstyling services. Annual fixed costs are $225,000, and variable costs are 40 percent of sales revenue. Sales revenue totaled $450,000. Determine the margin of safety in sales dollars.arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour $ 21,500 $ 15.00. $7.30 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Revenue Expenses: Administrative expenses $ 0.50 For example, wages and salaries should be $21,500 plus $15.00 per repair-hour. The company expected to work 3,000 repair-hours in May, but actually worked 2,900 repair-hours. The company expects its sales to be $54.00 per repair-hour. $ 2,760 $ 5,740 Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values.) Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent $ 4,630 $ 3,820 Jake's Roof Repair Activity Variances For the Month Ended May 31 Administrative expenses Total expense Net operating income $…arrow_forward

- Last month when Gifted by Design, Inc. sold 30,000 units, total sales were $600,000, total variable expenses were $300,000 and fixed expenses were $80,000. What is the company's contribution margin ratio? Please express as a number without the % emblem i.e. 15 not 15%arrow_forwardStandard Appliances obtains refrigerators for $1,640 less 27% and 6%. Standard's overhead is 18% of the selling price of $1,710. A scratched demonstrator unit from their floor display was cleared out for $1,365. a. What is the regular rate of markup on cost? %Round to two decimal places b. What is the rate of markdown on the demonstrator unit? %Round to two decimal places c. What is the operating profit or loss on the demostrator unit? Round to the nearest cent d. What is the rate of markup on cost that was actually realized? %Round to two decimal placesarrow_forwardHow many T-shirts must the company sell this year in order to earn $56,640 in net income? (Use the rounded contribution margin per unit calculated in the previous part to calculate Target Sales units. Round Target Sales units to 0 decimal places, e.g. 25,000.) W Promotions sells T-shirts imprinted with high school names and logos. Last year the shirts sold for $20.00 each, and variable costs were $8.50 per shirt. At this cost structure, the breakeven point was 24,600 shirts. However, the company actually earned $24,840 in net income.This year, the company is increasing its price to $22 per shirt. Variable costs per shirt will increase by 20%, and fixed expenses will increase by $30,980. The tax rate will remain at 40%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education