FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

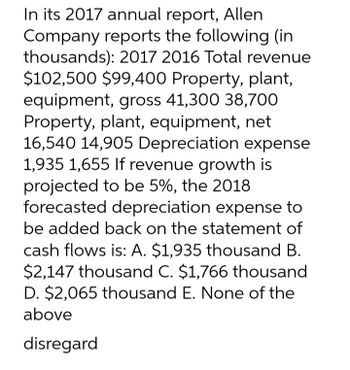

Transcribed Image Text:In its 2017 annual report, Allen

Company reports the following (in

thousands): 2017 2016 Total revenue

$102,500 $99,400 Property, plant,

equipment, gross 41,300 38,700

Property, plant, equipment, net

16,540 14,905 Depreciation expense

1,935 1,655 If revenue growth is

projected to be 5%, the 2018

forecasted depreciation expense to

be added back on the statement of

cash flows is: A. $1,935 thousand B.

$2,147 thousand C. $1,766 thousand

D. $2,065 thousand E. None of the

above

disregard

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2011 During 2011, its first yearof operations, Eli-Wallace Distributors reported pretax accounting income of $200 million which included thefollowing amounts: 1. Income (net) from installment sales of warehouses ni 2011 of$9 milion to be reported for tax purposes ni 2012 ($5 million) and 2013 ($4 milion). .2 Depreciation si reported by the straight-line method on na asset with afour-year useful life. On the tax return, deductions for depreciation will be more than straightline depreciation the first two years but less than straight-line depreciation the next two years (S in millions): 2011 2012 2013 2014 Income Statement $ 50 50 50 50 $ 2 0 0 T a x R e t u r n •66 88 30 16 $200 Difference $(16) (38) 20 34 0 3. Estimated warranty expense that wil be deductible on the taxreturn when actually paid during the next two years. Estimated deductionsare as follows $( ni millions): 2011 2012 2013 57 : $4 (4) (3) $0 income Statement Tax Return Difference 2012 During 2012, pretax accounting income…arrow_forwardPlease Solve this Questionarrow_forwardWallace Driving School’s 2020 balance sheet showed net fixed assets of $4.7 million, and the 2021 balance sheet showed net fixed assets of $5.3 million. The company’s 2021 income statement showed a depreciation expense of $405,000. What was net capital spending for 2021?arrow_forward

- ABC Ltd has the following land and buildings in its financial statements as of 30 June 2022: Residential land, at cost 2,553,800 Factory land, at valuation 2020 2,298,420 Buildings, at valuation 2020 2,043,040 Accumulated depreciation -255,380 At 30 June 2022, the balance of the revaluation surplus is $1,021,520, of which $766,140 relates to the factory land and $255,380 to the buildings. On this same date, independent valuations of the land and buildings are obtained. In relation to the above assets, the assessed fair values at 30 June 2022 are: Residential land, previously recorded at cost 2,809,180 Factory land, previously revalued in 2020 1,787,660 Buildings, previously revalued in 2020 2,298,420 Required: Provide the journal entries to account for the revaluation on 30 June 2022. ABC Ltd classifies the residential land and the factory land as different classes of assets.arrow_forwardPrescott Football Manufacturing had the following operating results for 2019: sales = $30,074; cost of goods sold = $21,704; depreciation expense = $3,498; interest expense = $534; dividends paid = $841. At the beginning of the year, n fixed assets were $19,988, current assets were $3,205, and current liabilities were $3,554. At the end of the year, net fixed assets were $23,047, current assets were $4,425, and current liabilities were $3,045. The tax rate for 2019 was 24 percent. A. What is net income for 2019? B. What is the operating cash flow for 2019? C. What is the cash flow from assets for 2019? D. Assume no new debt was issued during the year. What is the cash flow to creditors for 2019? F. Assume no new debt was issued during the year. What is the cash flow toarrow_forwardVinny's Overhead Construction had free cash flow during 2021 of $25.4 million. The change in gross fixed assets on Vinny's balance sheet during 2021 was $5.0 million and the change in net operating working capital was $6.0 million. Calculate the missing amounts on Vinny's income statement below. (Enter your answers in millions of dollars rounded to 2 decimal places.) Net sales VINNY'S OVERHEAD CONSTRUCTION, CORP. Income Statement for Year Ending December 31, 2021 (in millions of dollars) Less: Cost of goods sold 118.10 Gross profits $ 61.00 Less: Other operating expenses 14.40 Earnings before interest, taxes, depreciation, and amortization (EBITDA) $ 46.60 Less: Depreciation 12.60 Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income $ 15.54arrow_forward

- Computing Working capital changes Data for Research Enterprises follows: Compute the dollar amount of change and the percentage of Change in Research Enterprises’s working capital each year during 2019 and 2018. What do the calculated changes indicate?arrow_forwardEarnhardt Driving School's 2018 balance sheet showed net fixed assets of $5.5 million, and the 2019 balance sheet showed net fixed assets of $6.1 million. The company's 2019 income statement showed a depreciation expense of $360, 000. What was the company's net capital spending for 2019? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g .. 1,234,567.)arrow_forwardIn 2023, Amalgamated Industries' net fixed assets decreased from $380,000 to $260,000. depreciation expense for the period was $90,000. What was Net Capital Spending for 2023? $150,000 ($210,000) $170,000 ($30,000) $290,000arrow_forward

- Amount ($)e Description Year 2014 Cost of goods sold 300,000- Cash 35,000- Depreciation 65,000- Interest expense 15,000 Selling and administrative expenses 55,000- Accounts payable 60,000 Net fixed assets 325,000- Sales 500,000 Account receivable 30,000- Notes payable 25,000 Long-term debt 145,000- Inventory 60,000- Equity (at the beginning of 2014) 197,250- Additional information Tax rate 30% Dividends payout 50%- 1. What is the net income after tax for 2014? 2. What is the total dividends paid by the company in 2014?H 3. What is the total retained earnings for 2014?<' 4. What is the return on equity for 2014? 5. What is the debt to equity ratio for 2014?arrow_forwardArco Steel, Inc. generated total sales of $45,565,200 during fiscal 2010. Depreciation and amortization for the year totaled $2,278,260, and cost of goods sold was $27,339,120. Interest expense for the year was $9,641,300 and selling, general, and administrative expenses totaled $4,556,520 for the year. What is Arco’s EBIT for 2010? A) $9,641,300 B) $11,391,300 C) $13,275,030 D) $18,490,000arrow_forwardThe 2021 Income statement for Egyptian Nolse Blasters shows that depreciation expense is $80 million, NOPAT is $239 million. At the end of the year, the balance of gross fixed assets was $650 million. The change in net operating working capital during the year was $70 million. Egyptian's free cash flow for the year was $180 million. Calculate the beginning-of-year balance for gross fixed assets. (Enter your answer in millions of dollars.) Gross fixed assets millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education