Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

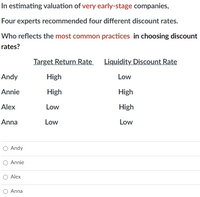

Transcribed Image Text:In estimating valuation of very early-stage companies,

Four experts recommended four different discount rates.

Who reflects the most common practices in choosing discount

rates?

Target Return Rate

Liquidity Discount Rate

Andy

High

Low

Annie

High

High

Alex

Low

High

Anna

Low

Low

O Andy

O Annie

Alex

Anna

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- -Based on the ratios calculated in Part 1, you will perform a ratio-based analysis. You should divide your discussion into four parts: liquidity, solvency, operational efficiency, and profitability. Ensure to choose the right ratios to discuss a specific part. -Find the relationships among ratios and trends over the three years compared. Also, compare these relationships and trends with those of Target. -In the last part of your discussion, you will show your investment decision: buy or not buy Walmart. You may want to split your investment between two companies. Tell me your rationale for your decision - Your discussion and final investment decision should solely be based on the ratio analysis, although investors also use various non financial information in their investment decision-making.arrow_forwardUse the following information to answer the questions that follow. A. Calculate the operating income percentage for each of the courses. Comment on how your analysis has changed for each course. B. Perform a vertical analysis for each course. Based on your analysis, what accounts would you want to investigate further? How might management utilize this information? C. Which method of analysis (using a dollar value or percentage) is most relevant and/or useful? Explainarrow_forward9. In a Balanced Scorecard, what perspective would a measure of the number of repeat orders be most likely to appear? (a) Market perspective (b) Customer perspective (c) Internal perspective (d) Financial perspectivearrow_forward

- Which of the following is NOT one of the uses of moving averages by technical analysts? A. To determine when trend line will be broken B. To determine trend C. To generate when to buy or sell D. To determine whether price action is extreme Based on the chart given below, identify the chart pattern and the best course of action: -37.00 - 36.00 - 35.00 -34.00 -33.00 - 32.00 -31.00 B-30.00 -29.00 truly Volume A. Mar May Jul Sep Nov Jan Mar 2013 sol, p May Jul 2014 Sep Nov Jan Mar May Jul 2015 B. overconfidence Double top; go short at point A as shares have violated an uptrend support line. C. c. framing D. mental accounting B. Head and shoulder top; wait for a close below point B to execute below the neckline. 28.00 27.00 - 26.00€ -25.00 -24.00 - 23.00 - 22.00 - 21.00 2000 Million C. Head and shoulder top; go long and use current pullback as shares are retesting an important support level at point B. D. Triple top; wait for a close below point C and execute shorts when prices are 2% below…arrow_forwardexplain the impact on financial statement using FIFO, weighted avverage and LIFO. When would the three methods give similar profit figures? when would they give indentical profit figure?arrow_forwardIn the price equation, incentives are subtracted from the list price and are added to it to determine the final price. Multiple Choice equity adjustments. О allowances. extra fees. discounts. quotas.arrow_forward

- Your Task… Using your assigned financial statements calculate the required ratios below Indicate if the change from year to year is favorable or unfavorable. All values should be accurate to at least two decimal places. The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer. All calculations are to be represented. Analysis of Profitability Gross Profit Ratio Operating Profit Ratio Net Profit Ratio Sales to Total Assets Ratio Return on Total Assets Return on Equity Earnings Per Sharearrow_forward1. Compute for the profitability ratios of both Elen and Melanie. Which of the two companies do you believe is more profitable? 2. Compute for the operational efficiency ratios of both Elen and Melanie. Which of the two companies do you believe is more efficient? 3. Compute for the financial health ratios of both Elen and Melanie. Which of the two companies do you believe is more financially healthy?arrow_forwardPlease take a look below at the two companies' financial ratios. Use the material your learned in the chapter to try and identify the industries these two companies operate in. You are going to be graded on the quality of your analysis and arguments (e.g. this ratio indicates that... and that ratio indicates the other,... and taken together these ratios indicate that.... (and so forth)) : Company A Company B P/E Ratio: 30 Price/Sales: 6 Price/Book Value of Equity: 7.5 Profit Margin: 20% Operating Margin: 25% Return on Assets (ROA): 6% Return On Equity (ROE): 25% Current Ratio: 3 P/E Ratio: 17 Price/Sales: 0.6 Price/Book Value of Equity: 3 Profit Margin: 3% Operating Margin: 5% Return on Assets (ROA): 7% Return On Equity (ROE): 15% Current Ratio: 1arrow_forward

- Give typing answer with explanation and conclusion Financial analysis is more meaningful if the ratios can be compared to an appropriate benchmark such as Select one: a. Industry averages b. Economic industry sector c. Changes over time d. All of the options are appropriate benchmarksarrow_forwardThe P/E ratio is most useful in .... : Comparing the premium that the market places on the total dollar value of earnings among competitors. Comparing the premium that the market places on the total dollar value of earnings per share among competitors. Comparing the return on earnings among competitors. Forecasting the future earnings of a company.arrow_forwardSuppose you a stock analyst are performing a ratio analysis and comparing a discount merchdiser with a high end merchandiser. Suppose further that both companies have identical ROE. IF You apply the dupont equation to both firms, would you expect the three components to be the same for both companies? If not, explain what balance balance sheet and income statements might lead to the differences in the Dupont equation components.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning