FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

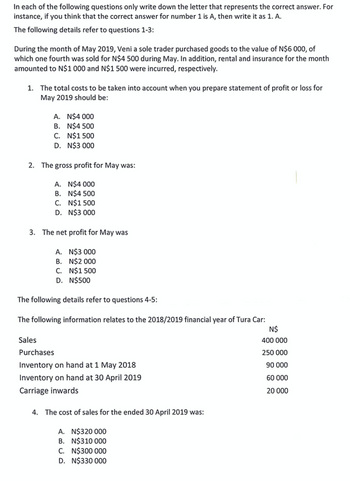

Transcribed Image Text:In each of the following questions only write down the letter that represents the correct answer. For

instance, if you think that the correct answer for number 1 is A, then write it as 1. A.

The following details refer to questions 1-3:

During the month of May 2019, Veni a sole trader purchased goods to the value of N$6 000, of

which one fourth was sold for N$4 500 during May. In addition, rental and insurance for the month

amounted to N$1 000 and N$1 500 were incurred, respectively.

1. The total costs to be taken into account when you prepare statement of profit or loss for

May 2019 should be:

A. N$4 000

B. N$4500

C. N$1500

D. N$3 000

2. The gross profit for May was:

A. N$4 000

B. N$4500

C. N$1500

D. N$3 000

3. The net profit for May was

A. N$3 000

B. N$2 000

C. N$1 500

D. N$500

The following details refer to questions 4-5:

The following information relates to the 2018/2019 financial year of Tura Car:

N$

400 000

250 000

90 000

60 000

20 000

Sales

Purchases

Inventory on hand at 1 May 2018

Inventory on hand at 30 April 2019

Carriage inwards

4. The cost of sales for the ended 30 April 2019 was:

A. N$320 000

B. N$310 000

C. N$300 000

D. N$330 000

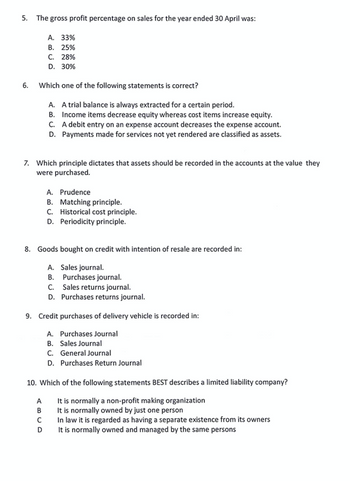

Transcribed Image Text:5. The gross profit percentage on sales for the year ended 30 April was:

6.

Which one of the following statements is correct?

A. A trial balance is always extracted for a certain period.

B. Income items decrease equity whereas cost items increase equity.

C. A debit entry on an expense account decreases the expense account.

D. Payments made for services not yet rendered are classified as assets.

A. 33%

B. 25%

C. 28%

D. 30%

7. Which principle dictates that assets should be recorded in the accounts at the value they

were purchased.

8. Goods bought on credit with intention of resale are recorded in:

A. Sales journal.

B. Purchases journal.

C.

Sales returns journal.

D. Purchases returns journal.

A. Prudence

B. Matching principle.

C. Historical cost principle.

D. Periodicity principle.

9. Credit purchases of delivery vehicle is recorded in:

A. Purchases Journal

B. Sales Journal

C. General Journal

D. Purchases Return Journal

A

B

10. Which of the following statements BEST describes a limited liability company?

It is normally a non-profit making organization

It is normally owned by just one person

In law it is regarded as having a separate existence from its owners

It is normally owned and managed by the same persons

с

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Derry Co. is a company in the industry of selling and installing laundry systems, Derry choose financial period ending by December 31. The following were selected from among the transactions completed during 2020. 2019 Oct 10 Sold merchandise to Edin, and received $6,000 cash. The cost of the merchandise sold was $3,800. Nov 13 Sold $25,000 merchandise to Flora, receive $12,000 in cash this day and the rest would follow Derry’s credit policy of 1/15, n/30. The cost of merchandise sold was $15,300. Dec 31 During 2019, Derry Co. offered sales of 30,000 laundry devices with one-year warranty-on-part policy. A provision was made by Derry Co., based on the management’s experience, 900 units (3%) will be defective and that warranty repair costs will average $4 per unit. Journalize this provision. Dec 31 Based on an analysis of the $92,000 of accounts receivable, it was estimated that $9,848 will be uncollectible, given the balance of the account Allowance for doubtful accounts…arrow_forwardSharleen purchased merchandise with a list price of $27,985. She receives a 2% cash discount and a 21/18/12 trade discount. What is Sharleen’s outstanding balance if she makes a $4000 partial payment within the discount period?arrow_forwardAssuming that a Retail Merchandise business purchased 500 numbers of HP three in one printer for OMR 40 each on 1st December 2020 under the credit terms of 5/20, n/60. On 3rd December 2020 the business discovers that 100 numbers of HP three in one Printer are HP two in one. Therefore, the business returned the goods to supplier. On 5th December 2020, the business settles full cash. Which of the following journal entry is correct on 3rd December 2020 assumes that the business uses periodic inventory system? a. Debit Accounts payable OMR 16,000 Credit Cash OMR 15,200 Credit Discount OMR 800 b. Debit Purchase OMR 20,000 Credit Accounts payable OMR 20,000 c. Debit Accounts payable OMR 4000 Credit Purchase return and allowances OMR 4000 d. Debit Accounts payable OMR 20,000 Credit Merchandise Inventory OMR 20,000arrow_forward

- On July 10, 2020, Cheyenne Music sold CDs to retailers on account and recorded sales revenue of $658,000 (cost $506, 660). Cheyenne grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2020, retailers returned CDs to Cheyenne and were granted credit of $80,000. Prepare Cheyenne's journal entries to record (a) the sale on July 10, 2020, and (b) $80,000 of returns on October 11, 2020, and on October 31, 2020. Assume that Cheyenne prepares financial statement on October 31, 2020. (To record sales) (To record cost of goods) (To record sales returns) (To record cost of goods returned)arrow_forwardHello can you please help with the attached question, thanks much.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education