ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

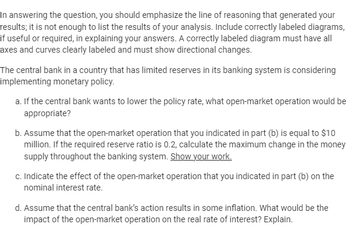

Transcribed Image Text:In answering the question, you should emphasize the line of reasoning that generated your

results; it is not enough to list the results of your analysis. Include correctly labeled diagrams,

if useful or required, in explaining your answers. A correctly labeled diagram must have all

axes and curves clearly labeled and must show directional changes.

The central bank in a country that has limited reserves in its banking system is considering

implementing monetary policy.

a. If the central bank wants to lower the policy rate, what open-market operation would be

appropriate?

b. Assume that the open-market operation that you indicated in part (b) is equal to $10

million. If the required reserve ratio is 0.2, calculate the maximum change in the money

supply throughout the banking system. Show your work.

c. Indicate the effect of the open-market operation that you indicated in part (b) on the

nominal interest rate.

d. Assume that the central bank's action results in some inflation. What would be the

impact of the open-market operation on the real rate of interest? Explain.

Expert Solution

arrow_forward

Step 1

A central bank is a financial institution that manages a country's monetary policy and oversees its banking system. Central banks typically have a mandate to ensure price stability and support economic growth. They are responsible for regulating the money supply, setting interest rates, and supervising commercial banks.

Central banks play a crucial role in ensuring the stability of the financial system and promoting economic growth. Their policies can have a significant impact on inflation, employment, and economic growth. As a result, central banks are closely watched by governments, financial markets, and the public.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the president of the central bank in this economy is convinced that there is no need for any monetary policy actions for the economy recover from the pandemic. If his/her opinion is followed, explain whether you think the president’s opinion is good for the citizens of this economy?arrow_forwardAnswer this for me mate. Much appreciated.arrow_forwardThe Federal Open Market Committee can buy and sell government securities/bonds. Which of the following tools of monetary policy does this describe?arrow_forward

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education