ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please answer parts C and D:

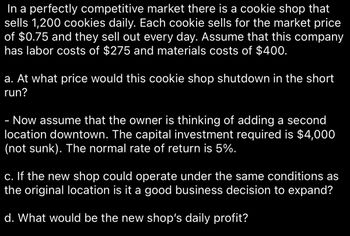

Transcribed Image Text:In a perfectly competitive market, there is a cookie shop that sells 1,200 cookies daily. Each cookie sells for the market price of $0.75, and they sell out every day. Assume that this company has labor costs of $275 and materials costs of $400.

**a. At what price would this cookie shop shut down in the short run?**

- Now assume that the owner is thinking of adding a second location downtown. The capital investment required is $4,000 (not sunk). The normal rate of return is 5%.

**c. If the new shop could operate under the same conditions as the original location is it a good business decision to expand?**

**d. What would be the new shop’s daily profit?**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer All parts show stepsarrow_forwardJenni has decided to start knitting during quarantine. She decides to open an etsy shop where she can sellknitted hats. Each hat costs $4.50 in materials to produce, in addition to the fee of $150 to license her shop.She plans on selling each hat for $24.50. (a) Write the cost, revenue, and profit equations for Jenni’s hat buisness. (b) Determine the profit if 13 hats are sold.(c) Determine thebreak-evenpoint.arrow_forwardPLS HELP ASAP ON BOTHarrow_forward

- PROBLEM: Orange Line Metro Train The Orange Line Metro Train is an automated rapid transit system in Lahore, Punjab, Pakistan. It will be Pakistan's first metro and first of the three proposed colored rail lines for the Lahore Metro Train Project. The line will span 27.1 km with 25.4 km elevated and 1.72 km underground. Consisting of 26 stations and is expected to handle 250,000 passengers daily. It also encompasses as a part of the wider China Pakistan Economic Corridor. It is expected to be operational in early 2020. Lahore Metrobus System Inaugurated on February 11, 2014, the Lahore Metrobus System currently operates with a fleet of 66 buses. The buses run on a single 28.7 km long Ferozepur Road corridor. Following the initiation ceremony, use of the system was to be free during the first month. However, following a week of chaos and overcrowding, a fare of Rs. 20 was imposed irrespective of the QCarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education