ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

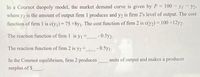

Transcribed Image Text:In a Cournot duopoly model, the market demand curve is given by P

100 - yI - y2-

!!

where y, is the amount of output firm 1 produces and y2 is firm 2's level of output. The cost

function of firm 1 is c(y1) 75 +8y1. The cost function of firm 2 is c(y2) = 100 +12y2.

%3D

The reaction function of firm 1 is y1 = -0.5y2-

The reaction function of firm 2 is y2 = -0.5y1-

In the Cournot equilibrium, firm 2 produces

units of output and makes a producer

surplus of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose two firms, A and B, have a cost function of ?(??) = 30??, for ? = ?, ?. The inverse demand for the market is given by ? = 120 − ?, where Q represents the total quantity in the market, ? = ?? + ??. 1. Solve for the firms’ outputs in a Nash Equilibrium of the Cournot Model. 2. Let Firm A be the first mover, and Firm B be the second mover. Solve for the firms’ outputs in a SPNE of the Stackelberg Model.arrow_forwardConsider the Bertrand model and answer the question below related to the content. Assume that each firm in the Bertrand Duopoly model can only choose non-negative integer quantities: 0, 1, 2, ... . Assume the demand is Q(P)=10-P and the marginal cost is 0 for each firm. Given this information, which of the following is FALSE? [Hint: Check values of profit functions.] A. If firm 2 sets price equal to 1, then the best response of firm 1 to this price is 1 B. If firm 2 sets price equal to 4, then the best response of firm 1 to this price is 4 C. If firm 2 sets price equal to 2, then the best response of firm 1 to this price is 1arrow_forwardConsider a Cournot Duopoly model. The inverse demand for their products is given byP = 200 − 6Q, where Q is the total quantity supplied in the market (that is, Q = Q1 + Q2). Each firm has an identical cost function, given byT Ci = 2Qi, for i = 1, 2.(a) In the Cournot model, what does each firm choose?(b) What is the timing of each firm’s decision?(c) Find the Nash equilibrium quantities (Q∗1, Q∗2)?(d) What is the equilibrium price? Just help with c and d here pleasearrow_forward

- A duopoly faces an inverse market demand of P(Q) = 150−Q.Firm 1 has a constant marginal cost of MC1 (q1) = $30.Firm 2's constant marginal cost is MC2 (q2) = $60.Assume fixed costs are negligible for both firms. Calculate the output of each firm, market output, and price if there is (A) a collusive equilibrium or (B) a Cournot equilibrium. (A) Collusive equilibrium (Enter your responses rounded to two decimal places) The collusive equilibrium occurs where q1 equals ?and q2 equals ? Market output is ? The collusive equilibrium price is ? (B) Cournot equilibrium (Enter your responses using rounded to two decimal places) The Nash-Cournot equilibrium occurs where q1 equals ? and q2 equals ? Market output is ? The equilibrium occurs at a price of ? arrow_forwardConsider an industry with N firms that compete by setting the quantities of an identical product simultaneously. The resulting market price is given by: p = 1000 − 4Q. The total cost function of each firm is C(qi) = 50 + 20qi . (a) Derive the output reaction of firm i to the belief that its rivals are jointly producing a total output of Q-i . Assuming that every firm produces the same quantity in equilibrium, use your answer to compute that quantity. (b) Suppose firms would enter (exit) this industry if the existing firms were making a profit (loss). Write down a mathematical equation, the solution to which would give you the equilibrium number of firms in this industry. You don’t have to solve this equation.arrow_forwardA duopoly faces a market demand of p= 120 - Q. Firm 1 has a constant marginal cost of MC' =S10. Firm 2's constant marginal cost is MC = S20. Calculate the output of each firm, market output, and price if there is (a) a collusive equilibrium or (b) a Cournot equilibrium. The collusive equilibrium occurs where q, equals and q, equals (Enter numeric responses using real numbers rounded to two decimal places) Market output is The collusive equilibrium price is S The Cournot-Nash equilibrium occurs where q, equals and q2 equals Market output is Furthermore, the Cournot equilibrium price is Sarrow_forward

- Consider a duopoly market, where two firms sell differentiated products, which are imperfect substitutes. The market can be modelled as a static price competition game, similar to a linear city model. The two firms choose prices p, and p2 simultaneously. The derived demand functions for the two firms are: D1 (P1, P2) = SG+P1)and D2 (P1, P2)= S(;+-P2), where S > 0 and the parameter t > 0 measures the 2t 2t degree of product differentiation. Both firms have constant marginal cost c> 0 for production. (a) Derive the Nash equilibrium of this game, including the prices, outputs and profit of the two firms. (b) From the demand functions, qi= D¡ (p; , p¡ )= SG+P), derive the residual inverse demand functions: p; = P; (qi , p¡) (work out: P; (qi , P;)). Show that for t > 0, P;(qi , P;) is downward 2t aPi (qi ,Pj) . sloping, i.e., c, i.e., firm į has market power. %3D (c) Calculate the limits of the equilibrium prices and profit as t → 0 ? What is P; (qi , p;) as t → 0? Is it downward sloping?…arrow_forwardDetermine the reaction function for firm 1 in a Cournot duopoly with an inverse demand curve given by: P = 12 - (Q1+ Q2) and zero costs.arrow_forwardSuppose the iceberg lettuce industry is a Cournot duopoly with two firms: Xtra Leafy (a) and Yummy Farms (y). Xtra Leafy produces q units of output and Yummy Farms produces qy units of output. Aggregate market output is Q = x + y. The (inverse) market demand schedule is: p = 176 - 2Q Both firms have identical cost structures: MC = MC₁ = ATC₂ = ATC₁ = $12 Find Xtra Leafy's Cournot reaction function of the form: 9x = a + bay Where "a" is the reaction function's intercept and "b" is its slope. Note: Please review the formatting instructions above. If any value is negative, be sure to include its negative sign. a. a= b. b = Hint: One of your answers will be negative. Think about why.arrow_forward

- The graph below presents the Short Run Aggregate Supply Curve and the Aggregate Demand Curve for Sanaton in 2001. Based on this graph, answer the questions: What is equilibrium output (Real GDP)? What is equilibrium price level?arrow_forward(4) Firm l's cost function is C1(q1) = q1 and firm 2's cost function is C2(q2) = 2q2. Consider a duopoly selling in a market with inverse demand function p = 12 q. (a) Assume firms choose output simultaneously (Cournot model). Compute the equilibrium quantities and the market price in a Nash equilibrium. (b) Now assume that firm 1 is a leader and chooses its output q1 first. Then, firm 2 chooses its output q2 after observing q1 (Stackelberg model). Find a subgame-perfect Nash equilibrium of this game. Carefully specify the strategies for firm 1 and firm 2. What quantities are produced in equilibrium and what is the market price in equilibrium?arrow_forwardcost function is c(y) An industry has two firms. Firm 1's cost function is c(y) = 3y + 200 and firm 2's 3y + 100. The demand curve for the output of this industry is a downward-sloping straight line. In a Cournot equilibrium, where both firms produce positive amounts of output: = The firm with higher fixed costs produces more. Both firms produce the same amount of output. There is less output than there would be if the firms colluded to maximize joint profits. It is not possible to tell because the demand function is not specified. The firm with lower fixed costs produces more.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education