A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

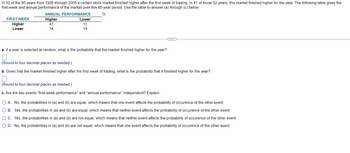

Transcribed Image Text:In 52 of the 80 years from 1926 through 2005 a certain stock market finished higher after the first week of trading. In 41 of those 52 years, this market finished higher for the year. The following table gives the

first-week and annual performance of the market over this 80-year period. Use the table to answer (a) through (c) below.

D

FIRST WEEK

Higher

Lower

ANNUAL PERFORMANCE

Higher

41

14

Lower

11

14

a. If a year is selected at random, what is the probability that the market finished higher for the year?

(Round to four decimal places as needed.)

b. Given that the market finished higher after the first week of trading, what is the probability that it finished higher for the year?

(Round to four decimal places as needed.)

c. Are the two events "first-week performance" and "annual performance" independent? Explain.

O A. No, the probabilities in (a) and (b) are equal, which means that one event affects the probability of occurence of the other event.

O B. Yes, the probabilities in (a) and (b) are equal, which means that neither event affects the probability of occurence of the other event.

O C. Yes, the probabilities in (a) and (b) are not equal, which means that neither event affects the probability of occurence of the other event.

O D. No, the probabilities in (a) and (b) are not equal, which means that one event affects the probability of occurence of the other event.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The owner of a dry cleaning business studied the number of dry-cleaned items that were returned for rework per day for a 4-week period (Mon-Sat). The results are given below. Complete (a) through (c). Time Items Returned Items Returned 1 6 Time 13 Items Returned 10 4 16- 2 10 12 Time AMANY 3 4 14 15 16 17 5 10 6 4 5 가더 24 5 9 6 10 18 9 7 5 19 20 10 10 a. Construct a c chart for the items per day that are returned for rework. Do you think that the process is in a state of statistical control? Choose the correct chart below. O A. O Items Returned B. 8 6 16- 0 9 8 21 5 Full data set 10 11 12 6 5 7 22 23 24 9 9 12 12 Time ² 24 O C. Items Returned 16- wwwww 12 Time 24arrow_forwardSuppose that Fred, a United States politician from a large western state, wants to create a new law that would require children under the age of 16 to be accompanied by an adult at all times in public places. Based on previous voting records, Fred believes that he could gain the support of 2525% of likely voters. To test his hypothesis, Fred conducts a random survey of 12001200 likely voters and asks if they would support his proposition. Let ?X denote the number of likely voters in Fred's sample that pledge their support, assuming that Fred's belief that 25%25% of likely voters would support his proposal. Which of the following statements are true about the sampling distribution of ?X? -The sampling distribution of ?X is approximately binomial with ?=1200n=1200 and ?=0.25p=0.25. -The sampling distribution of ?X is exactly normal with ?=0.5μ=0.5 and ?=0.0125σ=0.0125. -The sampling distribution of ?X is exactly binomial with ?=1200n=1200 and ?=0.25p=0.25. -The sampling…arrow_forwardA certain affects virus 0.8% of the population. A test used to detect the virus in a person is positive 88% of the time if the person has the virus (true positive) and 13% of the time if the person does not have the virus (false postive). Fill out the remainder of the following table and use it to answer the two questions below. (enter answer with no commas, i.e. as 1000 not 1,000.) Infected Not Infected Total Positive Test [a] [b] [c] Negative Test [d] [e] [f] Total 800 99,200 100,000 i) Find the probability that a person has the virus given that they have tested positive. (Round your answer to the nearest tenth of a percent and do not include a percent sign.)[g]_______ % ii) Find the probability that a person does not have the virus given that they test negative. (Round your answer to the nearest tenth of a percent and do not include a percent sign.)[h]________ %arrow_forward

- 3899 you're a data analyst for an insurance company. You want to make sure that your employer is not over-paying for car repairs. To investigate this, you bring 38 different cars to two different garages, Bubba's Hubcap Heaven and Repair, and Merle's Motor Shop. Some of the cars need lots of repairs. Some of the cars need very few. By taking each car to both shops, we can directly compare the two sets of prices. Before running your analysis, be sure to look at the data file and verify that each car requires a different amount of repairs, and that prices in one shop are correlated with prices at the other shop. That is, they're in the same ballpark. The question is whether one tends to charge more, on average, than the other. Your task is to use Excel to test the research hypothesis that prices are different in the two shops; the null hypothesis is that prices are equal between the two shops. You test at the alpha = 0.01 significance level. What do you conclude? Are prices the same?…arrow_forwardIn a recent study, 50 males used a new weight-loss supplement, and 37 of them experienced weight loss after two weeks. In the same study, 25 females used the same supplement, and 16 of them experienced weight loss after two weeks. Fill in the blanks below to make the most reasonable statement possible The new weight-loss supplement was more effective on males or females in the study. That is because _______% only failed to lose weight after two weeks, whereas, _______ % of males or females failed to lose weight after two weeksarrow_forwardSuppose a researcher is interested in examining the relationship between a person's gender and whether he or she likes the taste of Vegemite (a dark- brown food paste, made from yeast, that is popular in Australia). She collects a sample of n = 10 people and asks them whether they like the taste of Vegemite. The following table summarizes the results. Male Female Does Not Like the Taste of Vegemite 4 1 Likes the Taste of Vegemite 2 3 The researcher wants to calculate the correlation between a person's gender and whether he or she likes the taste of Vegemite. To do so, the researcher first creates a table of the data by converting each variable to a numerical value. She assigns 0 to "male" and 1 to "female." She then assigns 0 to "does not like the taste of Vegemite" and 1 to "likes the taste of Vegemite."arrow_forward

- Suppose 25% of workers in a market are willing to work for $55.000 and 75% of workers are willing to work for $63,000. The expected benetit of searching (interviewing) another worker equals Sarrow_forwardB7arrow_forwardA particular gambling game pays 4 to 1 and has a 20% chance to win. Someone will bet $10, 125 times, and keep track of the total amount won or lost. Which of the following boxes will produce the right answers? Check ALL answers that apply. Group of answer choices 1 ticket labeled 1 and 4 tickets labeled 0 20 tickets labeled 1 and 80 tickets labeled 0 1 ticket labeled $40 and 4 tickets labeled -$10 1 ticket labeled $10 and 4 tickets labeled -$10 20 tickets labeled $10 and 80 tickets labeled -$10 20 tickets labeled $40 and 80 tickets labeled -$10arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON