FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

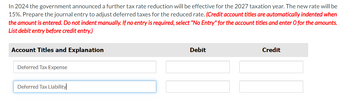

Transcribed Image Text:In 2024 the government announced a further tax rate reduction will be effective for the 2027 taxation year. The new rate will be

15%. Prepare the journal entry to adjust deferred taxes for the reduced rate. (Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.

List debit entry before credit entry.)

Account Titles and Explanation

Deferred Tax Expense

Debit

Credit

Deferred Tax Liability

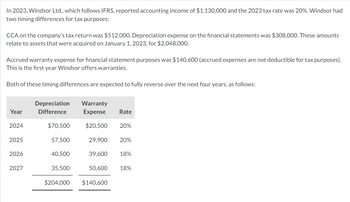

Transcribed Image Text:In 2023, Windsor Ltd., which follows IFRS, reported accounting income of $1,130,000 and the 2023 tax rate was 20%. Windsor had

two timing differences for tax purposes:

CCA on the company's tax return was $512,000. Depreciation expense on the financial statements was $308,000. These amounts

relate to assets that were acquired on January 1, 2023, for $2,048,000.

Accrued warranty expense for financial statement purposes was $140,600 (accrued expenses are not deductible for tax purposes).

This is the first year Windsor offers warranties.

Both of these timing differences are expected to fully reverse over the next four years, as follows:

Year

Depreciation

Difference

Warranty

Expense Rate

2024

$70,500

$20,500

20%

2025

57,500

29,900

20%

2026

40,500

39,600

18%

2027

35,500

50,600

18%

$204,000

$140,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (b) In 2023, Martinez receives the raw materials and pays the required $1,700,000. The raw materials now have a market value of $1,360,000. Prepare the entry to record the purchase. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Dec. 31, 2023 Debit Creditarrow_forwardWindsor Company borrowed $49,200 on November 1, 2025, by signing a $49,200, 10%, 3-month note. Prepare Windsor's November 1,2025, entry; the December 31, 2025, annual adjusting entry; and the February 1, 2026, entry. (If no entry is required, select "No Entry for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardplease help...need help finding noncash assetsarrow_forward

- Find the amount of accounts receivables written off in 2019.arrow_forwardRequired: Use the following information to complete Rhonda Hill's federal income tax return. If any information is missing, use reasonable assumption to fill in the gaps. Prepare this return for the year ending December 31, 2021 You may use any tax software program to complete the return, or you can do them manually by downloading fillable forms from the IRS website (www.irs.gov). The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: 1. Rhonda Hill (unmarried) is employed as an office manager at the main office of Carter & Associates CPA firm. Rhonda lives in a home she purchased 20 years ago. Rhonda's older cousin Mabel Wright lives with Rhonda in her home. Mabel is retired and receives $2,400 of Social Security payments each year. Mabel is able to save this money because Rhonda provides all of Mabel's support. Rhonda also provided the following information. Rhonda does not want to…arrow_forwardDescribe the advantages and disdvantages of the payroll tax deferral. Explain what is positive or negative; about who benefits or does not benefit. What problems might this create? Think about it in terms of timing, tax rate structures, income levels, payroll systems, administration. Hint: In August, President Trump issued a Memorandum regarding deferring payroll tax for certain taxpayers during from September 1 - December 31, 2020. The fact that payroll tax is deferred for the next 4 months for certain taxpayers.arrow_forward

- At the end of 2019, ABC has a balance in accounts receivable of $250,500. Of this amount, it is estimated that $4,500 would prove uncollectible. A reserve for tax purposes is deducted for this amount. During 2020, $7,500 of accounts receivable are written off. At the end of 2020, accounts receivable total $333,200, with $8,100 of this amount expected to be uncollectible. Required: Calculate the net impact on the business income of ABC given the above information with respect to bad debts?arrow_forwardSarasota Company borrowed $34,800 on November 1, 2025, by signing a $34,800, 9%, 3-month note. Prepare Sarasota's November 1, 2025, entry; the December 31, 2025, annual adjusting entry; and the February 1, 2026, entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardSaharrow_forward

- At the end of 2023, Novak Corporation owns a licence with a carrying amount of $508,000. Novak expects undiscounted future cash flows from this licence to total $512,500. The licence's fair value is $404,000 and disposal costs are estimated to be nil. The licence's discounted cash flows (that is, value in use) are estimated to be $458,000. Assume that the licence was granted in perpetuity and has an indefinite life, and that Novak prepares financial statements in accordance with ASPE. Assume that the licence was granted in perpetuity and has an indefinite life. Determine if the licence is impaired at the end of 2023. The licence Prepare any related entry that is necessary. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) at the end of 2023. Account Titles and Explanation eTextbook and Media List of…arrow_forwardAt the end of 2020, Bonita Company has accounts receivable of $960,000 and an allowance for doubtful accounts of $48,000. On January 16, 2021, Bonita Company determined that its receivable from Ramirez Company of $7,200 will not be collected, and management authorized its write-off. What is the net amount expected to be collected of Bonita Company’s accounts receivable after the write-off of the Ramirez receivable? Net amount expected to be collected $arrow_forwardINVOICE issued date 05/05/2020 as below: You have received an invoice from one of our suppliers and you are required to prepare: (i) Double entry for the invoice you have received base on the account and supplier number provided. (ii) Base on tax point of view, specify each item whether it is Capital or Revenue expenditure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education