FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

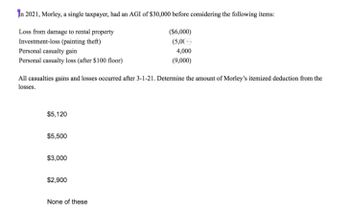

Transcribed Image Text:In 2021, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:

Loss from damage to rental property

(S6,000)

(5,00-)

Investment-loss (painting theft)

Personal casualty gain

Personal casualty loss (after $100 floor)

4,000

(9,000)

All casualties gains and losses occurred after 3-1-21. Determine the amount of Morley's itemized deduction from the

losses.

$5,120

$5,500

$3,000

$2,900

None of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For calendar year 2020, Jon and Betty Hansen (ages 49 and 50) file a joint return reflecting total income (NOT AGI) of $130,000 before the following potential deductions. They incur the following expenditures: Medical expenses net of reimbursements $12,000 Personal casualty loss (not covered by insurance) before $100 and AGI floors, Federally declared disaster area 10,000 Interest on home mortgage, balance of mortgage < $750,000 8,000 Interest on credit cards 1,000 Student loan interest 2,600 Property taxes on home 6,000 State income tax 5,000 State sales tax 3,000 Charitable contributions 14,000 Gambling losses incurred (gambling winnings reported $5,000) 5,500 Betty’s contribution to her Health Savings Account 1,500 Roth IRA contribution 4,000 a. Show the calculation of AGI starting with the total income shown above of $130,000. List and label each deduction FOR AGI that you are using to compute…arrow_forwardSubject:arrow_forwardBritta incurred the following capital gains and losses in 2019: Short-term capital gain $12,000 Short term capital loss ($19,000) Long term capital gain (28%) $5,000 Long term capital gain (25%) $12,000 Long term capital gain (0%/15%/20%) $17,000 Long term capital loss (0%/15%/20%) ($20,000) What is the net gain or loss Britta must recognize in 2019? Specify the character and tax rate that applies to the gain or loss. Please show your work.arrow_forward

- Aram's taxable income before considering capital gains and losses is $71,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Required: Aram sold a capital asset that he owned for more than one year for a $5,220 gain, a capital asset that he owned for more than one year for a $610 loss, a capital asset that he owned for six months for a $1,420 gain, and a capital asset he owned for two months for a $1,010 loss. Aram sold a capital asset that he owned for more than one year for a $2,110 gain, a capital asset that he owned for more than one year for a $2,720 loss, a capital asset that he owned for six months for a $310 gain, and a capital asset he owned for two months for a $2,120 loss. Aram sold a capital asset that he owned for more than one year for a $2,610 loss, a capital asset that he owned for six months for a $4,420 gain, and a capital asset he…arrow_forwardA has AGI of $400,000 in 2022 and has medical expenses of $65,000 in 2022. In 2023, A’s insurance company reimburses him for $40,000 of those expenses. How much of the $40,000 does A have to include in computing its taxable income for 2023?arrow_forwardArturo, a calendar year taxpayer, paid $20,300 in medical expenses and sustained a $24,360 casualty loss in 2018 (the loss occurred in a Federally declared disaster area). He expects $14,210 of the medical expenses and $17,052 of the casualty loss to be reimbursed by insurance companies in 2019. How much can Arturo include in determining his itemized deductions for 2018? Disregard %-of-AGI limitations or casualty loss floor in determining your answers. Before considering any limitations (or reductions) on deductions, Arturo can include $____ of the medical expenses and$ ____of the casualty loss when determining his itemized deductions in 2018.arrow_forward

- In 2021, Avi, a single taxpayer, had taxable income of $110,000. This amount included short-term capital losses of $2,000 and long-term capital losses of $12,000. He had no other capital transations in prior years. What is Avi's capital loss carryover to 2022? - $0 - $9,000 - $11,000 - $14,000arrow_forwardDuring the tax year, Monica incurred one personal casualty loss due to a federally declared disaster. The amount of the loss after reimbursements is $8,025. Monica will not be replacing any of the damaged property. Monica's adjusted gross income is $50,000. What is the amount of the casualty loss deduction to report on Schedule A (Form 1040)? $2,925 $3,025 $7,925 $8,025arrow_forwardAreaBurt purchased an apartment building on January 1, 2010, for $345,000. The building has been depreciated over the appropriate recovery period using the straight-line method. On December 31, 2022, the building was sold for $420,000, when the accumulated depreciation was $126,500. On his 2022 tax return, what should Burt report?a. Section 1231 gain of $75,000 and ordinary income of $126,500b. Section 1231 gain of $75,000 and unrecaptured depreciation of $126,500c. Ordinary income of $201,500d. Section 1231 gain of $126,500 and ordinary income of $75,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education