FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

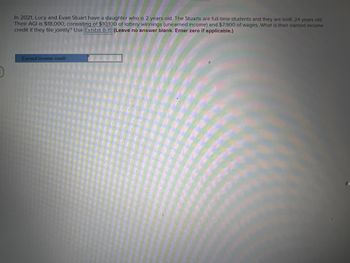

![EXHIBIT 8-11 2021 Earned Income Credit Table

(4)

(1)

(3)

Maximum Earned

Credit Phase-Out for

AGI (or earned income

Income Eligible

Maximum

Credit

Qualifying

Children

(2)

if greater) Over This

Amount

for Credit

Credit %

(1) × (2)

Married taxpayers filing joint returns

01100

11 LIS

0

$9,820

15.3%

$1.502

$14,820

1

10,640

34

3,618

25,470

15.98

2

14,950

40

5,980

25,470

21.06

3+

14.950

45

6.728

25,470

21.06

All taxpayers except married taxpayers filing joint returns

ORD CHIT EL

0

$9,820

15.3%

$ 11,610

$1.502

3,618

1

10,640

34

19,520

2

14.950

40

5,980

19,520

3+

14,950

45

6,728

19.520

Source: Internal Revenue Code. "Rev. Proc. 2020-45. " www.irs.gov.

SI DU

નવીura વ

(5)

Phase-Out

Percentage

15.3%

15.3%

15.98

21.06

21.06

No Credit When AGI

(or earned income if

greater) Equals or

Exceeds This Amount

(4) + [(3)/(5)]

$24,637

48,108

53,865

57,414

$21,427

42,158

47,915

51.464](https://content.bartleby.com/qna-images/question/e3f6c889-a75c-4371-a5c1-ff1949d4fdf5/8b836fd8-89ed-439a-a501-7dc3b71bed9e/y3gjee_thumbnail.jpeg)

Transcribed Image Text:EXHIBIT 8-11 2021 Earned Income Credit Table

(4)

(1)

(3)

Maximum Earned

Credit Phase-Out for

AGI (or earned income

Income Eligible

Maximum

Credit

Qualifying

Children

(2)

if greater) Over This

Amount

for Credit

Credit %

(1) × (2)

Married taxpayers filing joint returns

01100

11 LIS

0

$9,820

15.3%

$1.502

$14,820

1

10,640

34

3,618

25,470

15.98

2

14,950

40

5,980

25,470

21.06

3+

14.950

45

6.728

25,470

21.06

All taxpayers except married taxpayers filing joint returns

ORD CHIT EL

0

$9,820

15.3%

$ 11,610

$1.502

3,618

1

10,640

34

19,520

2

14.950

40

5,980

19,520

3+

14,950

45

6,728

19.520

Source: Internal Revenue Code. "Rev. Proc. 2020-45. " www.irs.gov.

SI DU

નવીura વ

(5)

Phase-Out

Percentage

15.3%

15.3%

15.98

21.06

21.06

No Credit When AGI

(or earned income if

greater) Equals or

Exceeds This Amount

(4) + [(3)/(5)]

$24,637

48,108

53,865

57,414

$21,427

42,158

47,915

51.464

Transcribed Image Text:In 2021, Lucy and Evan Stuart have a daughter who is 2 years old. The Stuarts are full-time students and they are both: 24 years old

Their AGI is $18,000, consisting of $10,100 of lottery winnings (unearned income) and $7,900 of wages. What is their earned income

credit if they file jointly? Use Exhibit 8-11 (Leave no answer blank. Enter zero if applicable.)

HAN

Earned Income credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bernie is a former executive who is retired. This year Bernie received $192,500 in pension payments and $19,600 of social security payments. What amount must Bernie include in his gross income? Multiple Choice 1. $192,500. 2. $202,300. 3. $209,160. 4. $212,100. 5. Zero.arrow_forwardPlease do not give solution in image format ?arrow_forwardI need answers for Question a,b,c,darrow_forward

- ! Required information [The following information applies to the questions displayed below.] Lewis and Laurie are married and jointly own a home valued at $265,000. They recently paid off the mortgage on their home. The couple borrowed money from the local credit union in January of 2021. How much interest may the couple deduct in each of the following alternative situations? (Assume they itemize deductions no matter the amount of interest.) (Leave no answer blank. Enter zero if applicable.) b. The couple borrows $160,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds to add a room to their home. The couple pays $6,450 interest on the loan during the year, and the couple files a joint return. Deductible interest expensearrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardaj.2arrow_forward

- S3.arrow_forward(please Solve quickly)arrow_forwardHarry is single and attends the University of Northeast law school. He pays $15,000 in tuition for 2023 His AGI for 2023 is $75,000. How much of a Lifetime Learning Credit can he claim in 2023? (a) $3,000 (b) $15,000 © $10,000 (d) $2,000arrow_forward

- Required information [The following information applies to the questions displayed below] In 2023, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10. Note: Leave no answer blank. Enter zero if applicable. Check my work c. Their AGI is $30,000, consisting of $23,000 of wages and $7,000 of lottery winnings (unearned income) Note: Round your intermediate calculations to the nearest whole dollar amount. Earned income creditarrow_forwardSusan and Derick finalized an adoption in 2020. Their adoption fees totaled $10,000. They have AGI of $238,520 for 2020. What is their adoption credit? a. $4,000 b. $10,000 c. $7,263 d. $14,300arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education