FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

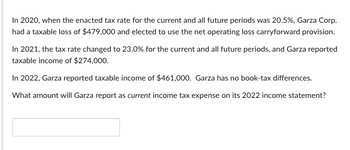

Transcribed Image Text:In 2020, when the enacted tax rate for the current and all future periods was 20.5%, Garza Corp.

had a taxable loss of $479,000 and elected to use the net operating loss carryforward provision.

In 2021, the tax rate changed to 23.0% for the current and all future periods, and Garza reported

taxable income of $274,000.

In 2022, Garza reported taxable income of $461,000. Garza has no book-tax differences.

What amount will Garza report as current income tax expense on its 2022 income statement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grouper Corp. has a deferred tax asset account with a balance of $71,600 at the end of 2019 due to a single cumulative temporary difference of $358,000. At the end of 2020, this same temporary difference has increased to a cumulative amount of $490,000. Taxable income for 2020 is $857,000. The tax rate is 20% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2019. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2020, assuming that it is more likely than not that the deferred tax asset will be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardAddison Co. has one temporary difference at the beginningof 2017 of $500,000. The deferred tax liabilityestablished for this amount is $150,000, based on a taxrate of 30%. The temporary difference will provide thefollowing taxable amounts: $100,000 in 2018, $200,000in 2019, and $200,000 in 2020. If a new tax rate for 2020of 20% is enacted into law at the end of 2017, what isthe journal entry necessary in 2017 (if any) to adjustdeferred taxes?arrow_forwardSunland Corporation has one temporary difference at the end of 2025 that will reverse and cause taxable amounts of $57,500 in 2026, $62,100 in 2027, and $66,600 in 2028. Sunland's pretax financial income for 2025 is $314,600, and the tax rate is 40% for all years. There are no deferred taxes at the beginning of 2025. (a) Compute taxable income and income taxes payable for 2025. Taxable income $ Income taxes payable $ +Aarrow_forward

- Sunland Corporation began operations in 2020 and reported pretax financial income of $212,000 for the year. Sunland’s tax depreciation exceeded its book depreciation by $33,000. Sunland’s tax rate for 2020 and years thereafter is 30%. Assume this is the only difference between Sunland’s pretax financial income and taxable income.Prepare the journal entry to record the income tax expense, deferred income taxes, and income taxes payable. Show how the deferred tax liability will be classified on the December 31, 2020, balance sheet. Deferred tax liability should be classified as a a) current asset b) current liability c) non current asset or d) non current liability on the December 31, 2020, balance sheet.arrow_forwardHurricane Ltd reports financial income of $100,000 for 2019. The following items cause taxable income to bedifferent than pre-tax financial income:1. Depreciation on the tax return is greater than depreciation on the income statement by $26,0002. Rent collected on the tax return is greater than rent earned on the income statement by $17,0003. Fines for pollution appear as an expense of $1,000 on the income statement. Hurricane Ltd tax rate is 30% for all years, and the company expects to report taxable income in allfuture years. There are no deferred taxes at the beginning of 2019. Required: According to IAS 12 Income Taxes 1. Prepare the journal entry to record income tax expense, deferred taxes and income taxes payable for2019. Clearly label them as deferred tax asset or liability.arrow_forwardCheyenne Corp. has a deferred tax asset account with a balance of $78,400 at the end of 2024 due to a single cumulative temporary difference of $392,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $482,500. Taxable income for 2025 is $791,900. The tax rate is 20% for all years. At the end of 2024, Cheyenne Corp. had a valuation account related to its deferred tax asset of $47,000. (a) Record income tax expense, deferred income taxes, and income taxes payable for 2025, assuming that it is more likely than not that the deferred tax asset will be realized in full. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To record income tax expense) (To adjust allowance account) Debit Creditarrow_forward

- Sandhill Corp. follows IFRS and began operations in 2023 and reported accounting income of $273,000 for the year. Sandhill's CCA exceeded its book depreciation by $39,200. Sandhill's tax rate for 2023 and years thereafter is 30%. Assume that the $39,200 difference is the only difference between Sandhill's accounting income and taxable income. Prepare the journal entries to record the current tax expense, deferred tax expense, income tax payable, and the deferred tax liability. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date December 31, 2023 December 31, 2023 Account Titles and Explanation (To record current tax expense) (To record deferred tax expense) II Debit Creditarrow_forwardIn 2025 Vaughn Corporation had pretax financial income of $185,000 and taxable income of $117,000. The difference is due to the use of different depreciation methods for tax and accounting purposes. The effective tax rate is 30%. Compute the amount to be reported as income taxes payable at December 31, 2025arrow_forwardAt the end of 2020, Payne Industries had a deferred tax asset account with a balance of $50 million attributable to a temporary book-tax difference of $200 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $144 million. Payne has no other temporary differences. Taxable income for 2021 is $360 million and the tax rate is 25%. Payne has a valuation allowance of $20 million for the deferred tax asset at the beginning of 2021. Required:1. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full.2. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized.arrow_forward

- Provita Fish feed has a regular taxable income of $120000 in December 31, 2020. The company had $1300 tax-exempt interest on certain "private activity bonds" and $1200 intangible drilling cost on that year. The AMT adjustment apart from the Adjusted Current Earning (ACE) is ($5000) and Provita Fish feed's ACE for its current tax year is $110000. On the other hand, Provita had tax losses equal to $150,000, of which $25,000 were attributable to tax preference items. As Provita is a corporation, a regular corporate AMT exemption is required for Provita. Moreover, Provita had Foreign and Investment Tax Credits of $1600 on 2020. If the regular tax liability of Provita is $11500, what was the AMT of Provita for 2020?arrow_forwardAt the end of 2020, Payne Industries had a deferred tax asset account with a balance of $100 million attributable to a temporary book-tax difference of $400 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $304 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2021 is $720 million and the tax rate is 25%. Required:1. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full. ( 1 Journal Entry for - 2021 income taxes. 1 Journal Entry for valuation allowance for the end of 2021.) 2. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized. ( 1 Journal Entry for - 2021 income taxes. 1 Journal Entry for valuation allowance for the end of 2021.)arrow_forwardAt the end of 2020, Payne Industries had a deferred tax asset account with a balance of $120 million attributable to a temporary book-tax difference of $480 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $368 million. Payne has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2021 is $864 million and the tax rate is 25%. Required:1. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full.2. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education