Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

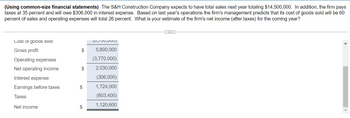

Transcribed Image Text:(Using common-size financial statements) The S&H Construction Company expects to have total sales next year totaling $14,500,000. In addition, the firm pays

taxes at 35 percent and will owe $306,000 in interest expense. Based on last year's operations the firm's management predicts that its cost of goods sold will be 60

percent of sales and operating expenses will total 26 percent. What is your estimate of the firm's net income (after taxes) for the coming year?

Cost of goods sola

Gross profit

Operating expenses

Net operating income

Interest expense

Earnings before taxes

Taxes

Net income

$

$

$

$

10,700,00u)

5,800,000

(3,770,000)

2,030,000

(306,000)

1,724,000

(603,400)

1,120,600

(...

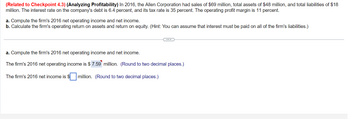

Transcribed Image Text:(Related to Checkpoint 4.3) (Analyzing Profitability) In 2016, the Allen Corporation had sales of $69 million, total assets of $48 million, and total liabilities of $18

million. The interest rate on the company's debt is 6.4 percent, and its tax rate is 35 percent. The operating profit margin is 11 percent.

a. Compute the firm's 2016 net operating income and net income.

b. Calculate the firm's operating return on assets and return on equity. (Hint: You can assume that interest must be paid on all of the firm's liabilities.)

a. Compute the firm's 2016 net operating income and net income.

The firm's 2016 net operating income is $ 7.59 million. (Round to two decimal places.)

The firm's 2016 net income is $ million. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- AEI Incorporated has $5 billion in assets, and its tax rate is 40%. Its basicearning power (BEP) ratio is 10%, and its return on assets (ROA) is 5%. What is AEI’s times interest-earned (TIE) ratio?arrow_forwardA company is financed with equity of $4.5 million and a bank loan of $2.5 million with an interest rate of 8.6% per annum. The EBIT is $1.12 million. The applicable tax rate is 19%. Use the above information to calculate the following: a) change in the return on equity and the degree of financial leverage given a 15% increase in EBIT next year, b) change in the return on equity and the degree of financial leverage given a 5% decrease in EBIT in the following year (the year following the year in which EBIT grew by 15%).arrow_forwardgive me answerarrow_forward

- (Using common-size financial statements) The S&H Construction Company expects to have total sales next year totaling $14,600,000. In addition, the firm pays taxes at 35 percent and will owe $315,000 in interest expense. Based on last year's operations the firm's management predicts that its cost of goods sold will be 59 percent of sales and operating expenses will total 26 percent. What is your estimate of the firm's net income (after taxes) for the coming year? Complete the pro-forma income statement below: (Round to the nearest dollar.) Pro-Forma Income Statement Sales Cost of goods sold Gross profit Operating expenses Net operating income Interest expense Earnings before taxes Taxes Net income $arrow_forwardMPI Incorporated has $6 billion in assets, and its tax rate is 35 %. Its basic earning power (BEP) ratio is 9 %, and its return on assets (ROA) is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is MPI's times - interest - earned (TIE) ratio? Round your answer to two decimal places.arrow_forwardBlue Sky Drone Company has a total asset turnover ratio of 6.00x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $1.75 million on which it pays a 7% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Blue Sky Drone's debt management ratios? Ratio Debt ratio Times-interest- earned ratio Value Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with low debt ratios.arrow_forward

- Ladders, Inc. has a net profit margin of 5.4% on sales of $49.3 million. It has book value of equity of $41.7 million and total book liabilities of $29.2 million. What is Ladders' ROE? ROA? Note: Assume the value of Interest Expense is equal to zero. What is Ladders' ROE? Ladders' ROE is%. (Round to two decimal places.)arrow_forwardTake It All Away has a cost of equity of 11.14 percent, a pretax cost of debt of 5.34 percent, and a tax rate of 21 percent. The company's capital structure consists of 66 percent debt on a book value basis, but debt is 32 percent of the company's value on a market value basis. What is the company's WACC?arrow_forwardTerry's Markets has sales of $684,000, costs of $437,000, interest paid of $13,800, total assets of $712,000, and depreciation of $109,400. The tax rate is 21 percent and the equity multiplier is 1.6. Please use the Dupont Identity to compute the return on equity.arrow_forward

- Take It All Away has a cost of equity of 10.57 percent, a pretax cost of debt of 5.29 percent, and a tax rate of 39 percent. The company's capital structure consists of 69 percent debt on a book value basis, but debt is 29 percent of the company's value on a market value basis. What is the company's WACC?arrow_forwardThe firm had sales of $33 million, operating expenses of $14 million, interest of $4 million and pays a tax rate of 20%. What is the firm’s earnings before interest and taxes?arrow_forwardPurple Panda Products Inc. has a total asset turnover ratio of 3.50x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On Its balance sheet and income statement, respectively, it reported total debt of $2.50 million on which It pays a 7% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding Information, what are the values for Purple Panda's debt management ratios? Ratio Debt ratio Times-interest-earned ratio Valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education