ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

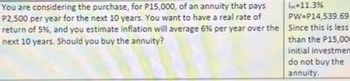

Transcribed Image Text:in-11.3%

PW-P14,539.69

You are considering the purchase, for P15,000, of an annuity that pays

P2,500 per year for the next 10 years. You want to have a real rate of

return of 5%, and you estimate inflation will average 6% per year over the Since this is less

next 10 years. Should you buy the annuity?

than the P15,000

initial investmem

do not buy the

annuity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- i got the perpetual eq. annual worth but i dont know how to find annual worth.please explain with steps and give the answer.arrow_forwardThe cost of a first-class postage in 1970 was $0.06 and in year 2013 was $0.46. Determine the average annual rate of increase in the price of postage stamps during the years 1970 to 2013. A. 18.47% B. 4.851% C. 6.63% D. 4.84%arrow_forwardQUESTION-2 Someone calculated the-future worth of his investment in term of today's dollars. The obtained result was $/945.89s, The life of the investment is expected to be 20 years. The average annual inflation rate along this period is 7%. If it is known that the investor earns 149% per year from this investment, what is the first cost of the investment?arrow_forward

- A machine cost P 20,000 today. If the inflation is 6% per year and interest is 10% per year, what will be the appropriate future value of the machine adjusted for inflation in 5 years? (don't use excel)arrow_forwardYour aunt Janet bought a land for $125,000 cash 12 years ago. The inflation rate has avearged 4% per year for the last 12 years. She wants to sell her property now, exactly 12 years after the property was purcahsed. She would like to have a 9% after-tax real rate of return. If capital gain tax rate is 15%, what should be her selling price.arrow_forwardE C € Question 5 Goods Good A Show answer choices Good B 15 Assuming that weights for Good A and Good B are 3 and 2 respectively, the CPI for Year 2 is A) 120 (8) 72 60 Price in Year 1 (D) 100 10 Price in Year 2 12 18 0/2 marrow_forward

- 4. land after 3 years for $160,000. Assume that your capital gains tax is 15%. What is the average inflation rate over this time period if your after-tax, inflation adjusted rate of return on this investment is 4%? You bought some land for $100,000 for investment purposes. You sold thearrow_forward8 years ago a machine cost $774000. Now, the same machine costs $1546000. The average rate of inflation per year is close to: 6.77% 13.55% 4.52% None of the given answers 9.03%arrow_forwardYou would like to buy carcar t is currently on themarket at $85,000, but you cannot afford it right now. However, you think that youwould be able to buy it after 4 years. If the expected inflation rate as applied to the priceof this car is 6% per year, what is its expected price after 4 years?arrow_forward

- 5arrow_forwardIf the inflation rate is 4.8% per year and themarket interest rate is known to be 10.2% per year,what is the implied real interest (inflation-free) ratein this inflationary economy?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education