Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Important Instruction:

Use GUFSA (given, unknown, formula, solution, answer) method and strictly use/choose from the given formula.

1. Fernan borrows money to buy a motorcycle. He will repay the loan by making monthly payments of P1,500 for 24 months at an interest rate of 9% per year Compounded monthly How much did Fernan borrow?

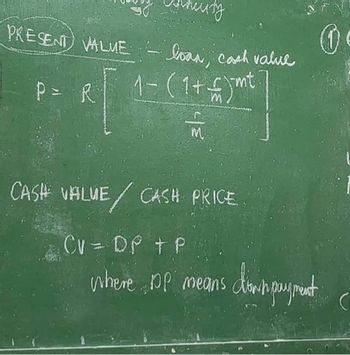

Transcribed Image Text:PRESENT VALME - loan, cash value

1- (1 + £ 5mt.

P = R

M

CASH VALUE CASH PRICE

CV = DP + P

Where DP means

(0)

domain pouy meant

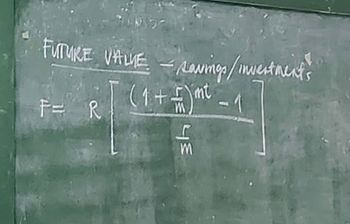

Transcribed Image Text:FUTURE VALUE - Rawings/invertnment's

(1 + =) m² - 1

mt

F= R

니트 니트

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Derek plans to buy a $29,486.00 car. The dealership offers zero percent financing for 52.00 months with the first payment due at signing (today). Derek would be willing to pay for the car in full today if the dealership offers him $ cash back. He can borrow money from his bank at an interest rate of 4.72%. Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardPlease don't give image format and not chatgpt answerarrow_forwardA man uses a loan program for small businesses to obtain a loan to help expand his vending machine business. The man borrows $25,000 for 2 years with a simple interest rate of 1.3%. Determine the amount of money the man must repay after 2 years.arrow_forward

- Problem:Answer the following questions completely. Show all computations. Round off only the final answers to two decimal places.On June 26, 2019, Naomi obtained a loan of P150,000 from a local businessman. The interest rate on the loan was 7.75% and it is to be paid on November 15, 2020.1. What is the exact time from June 26, 2019, to November 15, 2020? 2. What is the approximate time from June 26, 2019, to November 15, 2020? 3. What is the Ordinary simple interest using exact time? 4. What is the Ordinary simple interest using approximate time? 5. What is the Exact simple interest using exact time? 6. What is the Exact simple interest using approximate time? 7. If Naomi was given the option to choose the type of interest to use, which should she had chosen? Explain why in one sentence.arrow_forwardDesmond plans to purchase a new car. He qualifies for a loan at an annual interest rate of 5.2%, compounded monthly for 8 yr. He is willing to pay up to $300 per month. What is the largest loan he can afford? What is the correct formula for this situation? *** A. P OC. A= nt r n <-1 Desmond can afford a loan up to $ (Round to the nearest cent as needed.) OB. OD. A= r n nt -1 r narrow_forwardA borrower has two alternatives for a loan: (1) issue a $570,000, 90-day, 7% note or (2) issue a $570,000, 90-day note that the creditor discounts at 7%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet a. Compute the amount of the interest expense for each option. Round your answer to the nearest dollar. for each alternative. b. Determine the proceeds received by the borrower in each situation. Round your answers to the nearest dollar. (1) $570,000, 90-day, 7% interest-bearing note: $ (2) $570,000, 90-day note discounted at 7%: $ c. Alternative is more favorable to the borrower because the borrowerarrow_forward

- Repaying a Loan While Mary Corens was a student at the University of Tennessee, she borrowed $9,000 in student loans at an annual interest rate of 10%. If Mary repays $1,300 per year, then how long (to the nearest year) will it take her to repay the loan? Do not round intermediate calculations. Round your answer to the nearest whole number.arrow_forwardQ2.6: Anika received a loan of $9,000 at 4.72% compounded semi-annually from a credit union to use as working capital for his business. He had to make semi-annual payments for a period of 5 years to settle the loan. a. Calculate the size of his payments. b. What was the total interest paid during the period? c. What was the interest portion of payment number 3? Kindly keep all the decimals for all the preocedures, DO NOT ROUNDarrow_forwardProblem #1. Jason's uncle loaned him $26,560 to help start a landscaping business. They agreed that Jason would pay off the entire loan plus 3.24% annually compounded interest in 4 years, and that in the meantime he would make monthly deposits into a bank account to make sure that he has the amount needed when the loan comes due. The bank will pay 2.09%. (a) Find the total amount Jason will need to repay the loan. Show your work. (b) How much should each of his monthly deposits be? Show your work.arrow_forward

- Kindly solve it completely& correctly. Also, please provide your own solution. Thanks. 5. Ahmed bought a Machinery for RO46500. He made a down payment of RO15000and paid RO500 monthly for 65 months. i. Compute the total amount financed by Ahmed? ii. Compute the finance Charged to Ahmed? iii. Compute the deferred payment price paid by Ahmed?arrow_forwardStefanie takes out a five year car loan and agrees to pay $500 every month. This scenario shows how money functions as a OA. store of value. B. standard of deferred payment. O c. unit of accounting. D. medium of exchange. Aarrow_forwardIII. Assume compound interest is used to solve the following problems. 1. Stanley borrowed $4500.00 from his credit union to do some home renovations. The loan has an annual interest rate of 5.75% and an amortization period of 3 years. a. What is Stanley's monthly payment? b. Calculate the total amount he will pay over 3 years. G Calculate the finance charge on the loan. 2. Adele wants to buy a used car that costs $2900.00. She has $1100.00 saved up for a down payment. a. How much will Adele have to borrow to buy the car? b. She can get a loan at 6.50% per annum with an amortization period of 2 years. What will be her monthly payment? c. What will be the total she pays for the loan? d. How much will the car cost? 3. Calculate the monthly payment, the total amount paid, and the finance charge for the following loans: a $2000.00 at 8.00% per annum for 3 years; b. $10 000.00 at 6.25% per annum for 5 years; and c. $1500.00 at 3.75% per annum for 2 years. 4. Harley used her credit card to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education