Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

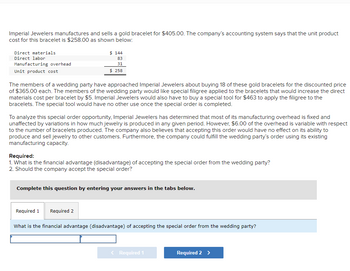

Transcribed Image Text:Imperial Jewelers manufactures and sells a gold bracelet for $405.00. The company's accounting system says that the unit product

cost for this bracelet is $258.00 as shown below:

Direct materials

Direct labor

Manufacturing overhead

Unit product cost

$ 144

83

31

$ 258

The members of a wedding party have approached Imperial Jewelers about buying 18 of these gold bracelets for the discounted price

of $365.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct

materials cost per bracelet by $5. Imperial Jewelers would also have to buy a special tool for $463 to apply the filigree to the

bracelets. The special tool would have no other use once the special order is completed.

To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and

unaffected by variations in how much jewelry is produced in any given period. However, $6.00 of the overhead is variable with respect

to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to

produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing

manufacturing capacity.

Required:

1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

2. Should the company accept the special order?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A credit card company offers an annual 2% cash-back rebate on all gasoline purchases. If a family spent $7250 on gasoline purchases over the course of a year, what was the family's rebate at the end of the year?arrow_forwardA manufacturer offers a 25/20 chain discount if the invoice subtotal is above $1,000. If the list price is $45 per item, what is the total price of the first invoice that activates the chain discount? A. $648.00 C. $569.25 Enternational Academy of Science. All Rights Reserved. Q Search B. $621.00 D. $594.00 DELL 19arrow_forwardJill Janzen's gross weekly pay is $298. Her earnings to date for the year total $14,900. What amount is deducted from her pay each week for Social Security, which is taxed at 6.2%? Select one: O a. $30.88 ОБ. $18.48 O c. $14.52 O d. $21.33arrow_forward

- Susan and Toby created a list of their monthly household expenses, as shown below. Mortgage: $1,960.00 Monthly Bills: $1,680.00 Entertainment and Food: $840.00 Savings: $1,120.00 Which hourly wage, working 40 hours a week for 4 weeks, meets these expenses? O A. $46.67 OB. $37.33 OC. $31.11 OD. $35.00arrow_forwardConsider a grocery bill containing the following costs for the items purchased: $3.07 $5.72 $7.29 $5.13 $8.73 $1.24 $7.42 a. Estimate the total cost by first rounding each to the nearest dollar. $ b. Estimate the total cost by first rounding each to the nearest fifty cents. $ c. What is the actual total cost? $ Show all work using the correct method on your handwritten work/answer sheet.arrow_forward2. The state sales tax in Kansas is 6.5%. If the state tax on a purchased item is $2.38, what is selling price of the item?arrow_forward

- Rose Garza's regular hourly wage rate is $12.00, and she receives a wage of 1½ times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Rose worked 42 hours. Her gross earnings prior to the current week were $5,000. Rose is married and claims three withholding allowances. Her only voluntary deduction is for group hospitalization insurance at $20 per week.arrow_forwardA car rental company is offering a contract to pay by-the-mile. The plan charges a flat rate of $50.55 each week. Every mile traveled during the week costs $2.2 each. a) How much would the bill be if in one week 177 miles were driven? b) How many miles were driven if the bill for one week was $1,557.55?arrow_forwardHappy Valley Homecare Suppliers, Incorporated (HVHS), had $19.8 million in sales in 2015. Its cost of goods sold was $7.92 million, and its average inventory balance was $1.83 million. a. Calculate the average number of days inventory outstanding ratios for HVHS. b. The average number of inventory days in the industry is 73 days. By how much must HVHS reduce its investment in inventory to improve its inventory days to meet the industry? (Hint: Use a 365-day year.) ... a. Calculate the number of days inventory outstanding ratios for HVHS. The number of inventory days outstanding is days. (Round to two demical places.) b. The average number of inventory days in the industry is 73 days. By how much must HVHS reduce its investment in inventory to improve its inventory days to meet the industry? To match the industry average number of inventory days, HVHS would reduce its inventory by $ million. (Round to three decimal place.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,