FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

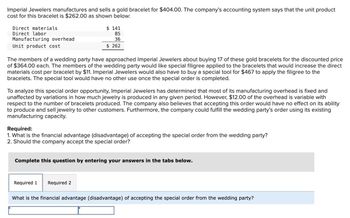

Transcribed Image Text:Imperial Jewelers manufactures and sells a gold bracelet for $404.00. The company's accounting system says that the unit product

cost for this bracelet is $262.00 as shown below:

Direct materials

Direct labor

Manufacturing overhead

Unit product cost

$141

85

36

$ 262

The members of a wedding party have approached Imperial Jewelers about buying 17 of these gold bracelets for the discounted price

of $364.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct

materials cost per bracelet by $11. Imperial Jewelers would also have to buy a special tool for $467 to apply the filigree to the

bracelets. The special tool would have no other use once the special order is completed.

To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and

unaffected by variations in how much jewelry is produced in any given period. However, $12.00 of the overhead is variable with

respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability

to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing

manufacturing capacity.

Required:

1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

2. Should the company accept the special order?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Imperial Jewelers manufactures and sells a gold bracelet for $408.00. The company's accounting system says that the unit product cost for this bracelet is $270.00 as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost The members of a wedding party have approached Imperial Jewelers about buying 12 of these gold bracelets for the discounted price of $368.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $7. Imperial Jewelers would also have to buy a special tool for $460 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $8.00 of the overhead is variable with respect to…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $405.00. The company's accounting system says the unit product cost for this bracelet is $266.00, as shown below: Direct materials $ 149 82 Direct labor Manufacturing overhead Unit product cost 35 $ 266 es A wedding party has approached Imperial Jewelers about buying 27 gold bracelets for the discounted price of $365.00 each. The wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $7. Imperial Jewelers would have to buy a special tool for $457 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order, Imperial Jewelers determined most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $8.00 of the overhead is variable with respect to the number of bracelets produced. The company also…arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,200 helmets, using 2,048 kilograms of plastic. The plastic cost the company $13,517. According to the standard cost card, each helmet should require 0.58 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,200 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,200 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forward

- Imperial Jewelers manufactures and sells a gold bracelet for $409.00. The company’s accounting system says that the unit product cost for this bracelet is $272.00 as shown below: Direct materials $ 148 Direct labor 84 Manufacturing overhead 40 Unit product cost $ 272 The members of a wedding party have approached Imperial Jewelers about buying 22 of these gold bracelets for the discounted price of $369.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $4. Imperial Jewelers would also have to buy a special tool for $468 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $5.00 of the…arrow_forwardRag Swag Inc. manufactures various styles of men’s casual wear. Shirts are cut and assembled by a workforce that is paid by piece rate. This means that they are paid according to the amount of work completed during a period of time. To illustrate, if the piece rate is $0.10 per sleeve assembled, and the worker assembles 800 sleeves during the day, then the worker would be paid $80 (800 × $0.10) for the day’s work. The company is considering adopting a lean manufacturing philosophy by organizing work cells around various types of products and employing pull manufacturing. However, no change is expected in the compensation policy. On this point, the manufacturing manager stated the following: “Piecework compensation provides an incentive to work fast. Without it, the workers will just goof off and expect a full day’s pay. We can’t pay straight hourly wages—at least not in this industry.” A garment company was following piece rate system for its employees and suddenly lean manufacturing…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $408.00. The company's accounting system says that the unit product cost for this bracelet is $267.00 as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost The members of a wedding party have approached Imperial Jewelers about buying 28 of these gold bracelets for the discounted price of $368.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $11. Imperial Jewelers would also have to buy a special tool for $454 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. $ 145 84 38 $ 267 To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $12.00 of the overhead is…arrow_forward

- Solve both parts with proper explanationarrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $403.00. The company's accounting system says the unit product cost fo this bracelet is $267.00, as shown below: 41 es Direct materials Direct labor Manufacturing overhead Unit product cost $ 146 82 39 $ 267 A wedding party has approached Imperial Jewelers about buying 25 gold bracelets for the discounted price of $363.00 each. The wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $5. Imperial Jewelers would have to buy a special tool for $453 to apply the filigree to the bracelets. The special tool would have no othe use once the special order is completed. To analyze this special order, Imperial Jewelers determined most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $6.00 of the overhead is variable with respect to the number of bracelet produced. The company also…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $409.00. The company’s accounting system says that the unit product cost for this bracelet is $272.00 as shown below: Direct materials $ 148 Direct labor 85 Manufacturing overhead 39 Unit product cost $ 272 The members of a wedding party have approached Imperial Jewelers about buying 14 of these gold bracelets for the discounted price of $369.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $5. Imperial Jewelers would also have to buy a special tool for $457 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $6.00 of the…arrow_forward

- Imperial Jewelers manufactures and sells a gold bracelet for $406.00. The company's accounting system says that the unit product cost for this bracelet is $265.00 as shown below: Direct materials Direct labor Manufacturing overhead Unit product cost $ 144 85 36 $ 265 The members of a wedding party have approached Imperial Jewelers about buying 17 of these gold bracelets for the discounted price of $366.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $7. Imperial Jewelers would also have to buy a special tool for $465 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $8.00 of the overhead is variable…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $405.00. The company's accounting system says that the unit product cost for this bracelet is $267.00 as shown below: Direct materials $ 143 Direct labor 85 Manufacturing overhead 39 Unit product cost $ 267 The members of a wedding party have approached Imperial Jewelers about buying 20 of these gold bracelets for the discounted price of $365.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $10. Imperial Jewelers would also have to buy a special tool for $466 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $11.00 of the overhead is…arrow_forwardImperial Jewelers manufactures and sells a gold bracelet for $400.00. The company's accounting system says that the unit product cost for this bracelet is $275.00 as shown below: Direct materials $ 148 Direct labor 88 Manufacturing overhead 39 Unit product cost $ 275 The members of a wedding party have approached Imperial Jewelers about buying 17 of these gold bracelets for the discounted price of $360.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $11. Imperial Jewelers would also have to buy a special tool for $466 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $12.00 of the overhead is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education