Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

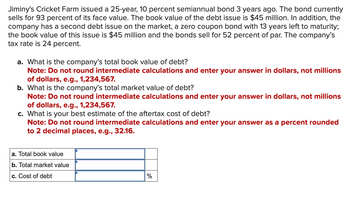

Transcribed Image Text:**Jiminy's Cricket Farm Debt Analysis**

Jiminy's Cricket Farm issued a 25-year, 10 percent semiannual bond 3 years ago. The bond currently sells for 93 percent of its face value. The book value of the debt issue is $45 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 13 years left to maturity; the book value of this issue is $45 million and the bonds sell for 52 percent of par. The company’s tax rate is 24 percent.

### Questions:

a. What is the company’s total book value of debt?

**Note:** Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.

b. What is the company’s total market value of debt?

**Note:** Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.

c. What is your best estimate of the aftertax cost of debt?

**Note:** Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

### Calculation Table:

| | |

|--------|---------|

| a. Total book value | |

| b. Total market value | |

| c. Cost of debt | % |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Similar questions

- Jiminy's Cricket Farm issued a 30-year, 5.2 percent semiannual bond 4 years ago. The bond currently sells for 104 percent of its face value. The book value of the debt issue is $60 million. In addition, the company has a second debt issue on the market a zero coupon bond with 11 years left to maturity; the book value of this issue is $50 million, and the bonds sell for 54 percent of par. The company's tax rate is 22 percent. a. What is the company's total book value of debt? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1.234,567) b. What is the company's total market value of debt? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, eg, 1,234,567,) c. What is your best estimate of the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 3 2.16)arrow_forwardWeismann Company issued 15-year bonds a year ago at a coupon rate of 12 percent. The bonds make semiannual payments and have a par value of $1,000. If the YTM on these bonds is 8 percent, what is the current bond price? Multiple Choice $593.35 $1,227.37 $1,670.52 $1,333.26 $ 1,343.26arrow_forwardFive years ago Tosev Inc. issued 30-year, $1,000 par value, semi-annual coupon bonds with a coupon rate of 9.10 percent. The bonds originally sold at a price of $1,010.32 per bond. Currently, those bonds have a market price of $1,118.15 per bond. The Chief Financial Officer of Tosev is currently considering issuing new bonds. These bonds will have a par value of $1,000, semi-annual coupon payments, a term of 25 years and a coupon rate of 8 percent. Due to differences in the legal provisions of the bonds, the Chief Financial Officer estimates that the yield to maturity on the new bonds will be one percent higher than the current yield to maturity on the old bonds. Based on the Chief Financial Officer's estimate, what would be the price per bond of the new bonds today? $1,000.00 $896.67 None of the answers in this list is within $0.25 of the correct answer. $1,118.15 $817.44 $901.19 10 fs % f6 hp f7 8arrow_forward

- Red Frog Brewery has $1,000-par-value bonds outstanding with the following characteristics: currently selling at par; 5 years until final maturity; and a 9 percent coupon rate (with interest paid semiannually). Interestingly, Old Chicago Brewery has a very similar bond issue outstanding. In fact, every bond feature is the same as for the Red Frog bonds, except that Old Chicago’s bonds mature in exactly 15 years. Now, assume that the market’s nominal annual required rate of return for both bond issues suddenly fell from 9 percent to 8 percent. a. Which brewery’s bonds would show the greatest price change? Why? b. At the market’s new, lower required rate of return for these bonds, determine the per bond price for each brewery’s bonds. Which bond’s price increased the most, and by how much?arrow_forwardWest Corporation issued 12-year bonds 2 years ago at a coupon rate of 9.2 percent. The bonds make semiannual payments. If these bonds currently sell for 104 percent of par value, what is the YTM? Multiple Choice O 10.31% 7.74% 8.60% 4.30% 9,46%arrow_forwardOn January 2, Year 3, JRCorp purchases a 5-year $100,000 face value, 4 percent fixed coupon bond paying annual interest when market rates at issuance for comparable bonds are 5 percent. The bond cost $95,671 at purchase and one year later, the market price was $94,742. Market rates most likely: Decreased by 0.5 percent. Increased by 0.5 percent. OC. Increased by 5.5 percent. O D. Decreased by 5.5 percent. A. OB. What is the calculations to derived at an increase of 5% for market rates.arrow_forward

- Jiminy's Cricket Farm issued a 20-year, 4 percent semiannual coupon bond 6 years ago. The bond currently sells for 95 percent of its face value. The company's tax rate is 25 percent. The book value of the debt issue is $50 million. In addition, the company has a second debt issue, a zero coupon bond with 7 years left to maturity; the book value of this issue is $35 million, and the bonds sell for 74 percent of par. a. What is the company's total book value of debt? (Enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) b. What is the company's total market value of debt? (Enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) c. What is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Total book value b. Total market value C. Cost of debt 85,000,000 73,400,000 %arrow_forwardPearce's Cricket Farm issued a 10-year, 8% semiannual bond 3 years ago. The bond currently sells for 96% of its face value. The company's tax rate is 35%. Suppose the book value of the debt issue is $50 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 10 years left to maturity; the book value of this issue is $30 million and the bonds sell for 55% of par. Assume the par value of the bond is $1,000. What is the company's total book value of debt? (Enter the answer in dollars. Omit $ sign in your response.) Total book value $ 8000000 What is the company's total market value of debt? (Enter the answer in dollars. Omit $ sign in your response.) Total market value $ 6450000 What is your best estimate of the after-tax cost of debt? (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) Cost of debtarrow_forwardThe bonds issued by United Corp. bear a coupon of 5 percent, payable semiannually. The bond matures in 17 years and has a $1,000 face value. Currently, the bond sells at $952. The yield to maturity (YTM) is ________%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education