FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

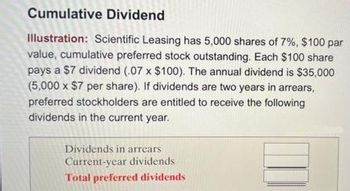

Transcribed Image Text:Cumulative Dividend

Illustration: Scientific Leasing has 5,000 shares of 7%, $100 par

value, cumulative preferred stock outstanding. Each $100 share

pays a $7 dividend (.07 x $100). The annual dividend is $35,000

(5,000 x $7 per share). If dividends are two years in arrears,

preferred stockholders are entitled to receive the following

dividends in the current year.

Dividends in arrears

Current-year dividends

Total preferred dividends

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Windborn Company has 30,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $30 par common stock. The following amounts were distributed as dividends: 20Y1 $75,000 20Y2 15,000 20Y3 90,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'.arrow_forwardFamily Foods, Inc. has a preferred stock issue outstanding that has a par value per share of $75.00. This preferred stock pays an annual divided that is 10% of its par value. Calculate the annual dividend paid per share on this preferred stock.arrow_forwardWookie Inc. has the following shareholders equity information at the beginning of the year: 1000 shares-$5 par value, issued and outstanding: $5,000 Additional Paid-In Capital: $45,000 Retained Earnings: $15,000 Instead of a stock split, a 5% stock dividend is declared. What would the above amounts be after the stock dividend?arrow_forward

- A share of stock in Bodah Corporation pays an annual dividend of $5. The current market price is $75. From the list of individuals below, identify who is likely to be a buyer or a seller of this stock. (Each person currently owns 100 shares) Individual Kate Keith Kyle Required Return -5% 8% 15% Expected Growth in Dividends 0% 0% 0% Buy or Sell? Buy Sell Sellarrow_forwardKin Corp. has preferred stock that was issued 3 years ago. It currently sells for $33.50 and offers a rate of 4.7%. What is the dividend paid by the preferred stock? O $1.57 O $4.72 O $3.52 O $4.01arrow_forwardPrestige Investments had the following preferred stock outstanding at the end of a recent year: $25 par, 10% 6,000 shares $42 par, 8%, cumulative 11,000 shares $50 par, 12%, cumulative, convertible 2,000 shares $80 par, 11%, nonparticipating 15,000 shares Required: 1. Determine the amount of annual dividends on each issue of preferred stock and the total annual dividend on all four issue Issue 1 ($25 par, 10%) of preferred stock Issue 2 ($42 par, 8%, cumulative) of preferred stock Issue 3 ($50 par, 12%, cumulative, convertible) of preferred stock Issue 4 ($80 par, 11%, nonparticipating) of preferred stock Total annual dividend 2. Calculate what the amount of dividends in arrears would be if the dividends were omitted for 1 year.arrow_forward

- Every Flavour Confection Co. Series A Cumulative Preferred shares have a par value of $100, a dividend rate of 9% and are currently trading for $26.50. The series A preferred shares pay dividends annually on January 1. Today is Dec 31, 20X1. The company announced today that it has suspended dividends for January 1, 20X2 and 20X3 but plans to resume dividend payments in 20X4. What is the amount of dividend the company pay in 20X4? Round your answer to two decimals.arrow_forwardDuring the current year, Zenith Corp. generated $250,000 of net income from $4,000,000 of revenue. Zenith's stock price is $80 per share, with 20,000 shares of stock outstanding, and a book value of equity equal to $1,500,000. Compute Zenith's Price/Earnings ratio. Question 50 options: 16.0 6.4 31.3 2.5arrow_forwardTaylor Systems has just issued preferred stock. The stock has a 9% annual dividend and a $120 par value and was sold at $126.00 per share. In addition, flotation costs of $9.60 per share were paid. Calculate the cost of the preferred stock.arrow_forward

- Zion has 165 shares of company LMN stock. LMN issued dividend payments every quarter that totaled $1.71 per share for the entire year. The current price for LMN stock is $34.56 per share. What is the current dividend yield for LMN stock? Round your answer to the hundredth of a percent. Input just the number. Do not input the percent sign. Do not use a comma. Example: 3.27arrow_forwardIllumination Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year Budgeted costs of operating the plant for 2,000 to 3,000 hours: Fixed operating costs per year Variable operating costs Budgeted long-run usage per year Flashlight Division Night Light Division Practical capacity $500,000 OA. $500,000 B. $625.000 OC. $600,000 D. $650,000 $500 per hour 2,000 hours 1,000 hours 4,000 hours Assume that practical capacity is used to calculate the allocation rates Actual usage for the year by the Flashlight Division was 1,500 hours and by the Night Light Division was 800 hours If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?arrow_forwardThe Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below. Assets $ 38,000,000 101,000,000 $139,000,000 Current assets Net plant, property, and equipment Total assets Liabilities and Equity Accounts payable $ 10,000,000 9,000,000 $ 19,000,000 40,000,000 $ 59,000,000 Accruals Current liabilities Long-term debt (40,000 bonds, S1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 30,000,000 _50,000,000 _80,000,000 $139,000,000 The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education