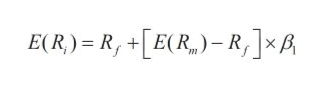

Illustrate the formula for portfolio beta and portfolio expected return.

Portfolio refers to a set of financial investments owned by the investor. The portfolio of investments includes debentures, stocks, bonds, and mutual funds.

Portfolio beta coefficient refers to the systematic risk of a portfolio in relation to the average risky asset in the market. It is the sum of the products of beta coefficients of each asset in the portfolio and their respective weights.

The formula to calculate the portfolio beta:

βP refers to the portfolio beta coefficient

“x1 to xn” refers to the weight of each asset from 1 to “n” in the portfolio

“β1 to βn” refers to the beta coefficient of each asset from 1 to “n” in the portfolio.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Organica Ltd. generates $350,000 cash flow each year. The cost of equity capital is 18% and the company has no debt outstanding. Organica would like to buy back $ 950,000 of its equity by borrowing the same amount at 12% per year. Assume that the debt will continue for an indefinite period and Modigliani and Miller proposition 1 holds, what is the cost of equity capital after the change in capital structure?